Our Research

Commonwealth conducts original qualitative and quantitative research with financially vulnerable people—including Black, Latinx, and women-led households who disproportionately experience financial insecurity. We also interview industry experts and academics. We take what we learn and translate findings into actionable insights and practical solutions designed to change systems to work better for financially vulnerable people. We work with community groups, employers, financial services firms, fintechs, policymakers, and workplace solution providers to design and test real-world, practical solutions that not only work for individuals and families, but are also scalable and address the business needs of our partners.

We share the results of our work to provide you with innovative ideas, practical insights, and the tools you need to act. Explore our publications below.

Rise with the Raise: California

Over the last six months, Commonwealth has sought to understand minimum wage workers’ and employers’ attitudes, knowledge, and beliefs about the minimum wage hikes and building financial security. We surveyed low wage workers, held focus groups, and met with leaders…

Five Years of SaveYourRefund

SaveYourRefund (SYR) completed its fifth successful year in 2017. Learn about how it has grown and the impact it has made on tax filers across the country.

SaveYourRefund 2017 Summary

At the end of its fifth year, SaveYourRefund continues to motivate saving at tax time. Learn more about its impact in 2017, and meet some of the winners who were motivated to save.

Prize-Linked Savings in Credit Unions: 2016

In 2016, Prize-Linked Savings (PLS) products expanded rapidly, doubling the number of states with PLS products from 6 to 12. Two new branded products – Lucky Savers (LS) in New York and WINcentive Savings Accounts (WSA) from the Minnesota Credit…

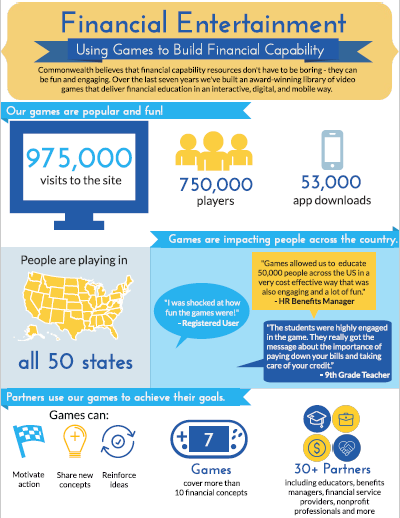

Financial Entertainment Infographic

Over the last seven years, we’ve developed our Financial Entertainment suite of games to cover a variety of financial topics, making financial education more fun and exciting. They’ve been popular among a wide range of people, and have helped our…

Rules of Thumb Presentation

You’ve probably heard that “an apple a day keeps the doctor away,” but why are there are so few simple, effective messages about your finances? Credit unions can build a better relationship with their members by offering these sorts of…

WINcentive Savings 2016 Report

This report analyzes the performance of WINcentive Savings accounts throughout 2016, as well as data from a Commonwealth survey administered to WINcentive account holders by their respective credit unions. With the WINcentive survey, Commonwealth aims to understand who holds WINcentive accounts,…

Prizes Facilitate Saving by Youth

In the summer of 2015, we worked with the New York City Department of Youth and Community Development (DYCD) to design and pilot a Payroll Savings Program for around 50,000 youth participating in their summer youth employment program. The goal…

Commonwealth 2016 Accomplishments

In 2016, we developed new ideas, tested innovative solutions, and worked with partners to improve the lives of financially vulnerable Americans at scale.

Building Financial Security Through Integrated Financial Solutions

People’s financial lives are more deeply interconnected than traditional financial products suggest: income impacts expenses; expenses impact savings; savings impacts borrowing; borrowing impacts expenses; and uncertainty impacts everything. Products that fail to acknowledge these interdependencies optimize one financial function at…