Our Research

Commonwealth conducts original qualitative and quantitative research with financially vulnerable people—including Black, Latinx, and women-led households who disproportionately experience financial insecurity. We also interview industry experts and academics. We take what we learn and translate findings into actionable insights and practical solutions designed to change systems to work better for financially vulnerable people. We work with community groups, employers, financial services firms, fintechs, policymakers, and workplace solution providers to design and test real-world, practical solutions that not only work for individuals and families, but are also scalable and address the business needs of our partners.

We share the results of our work to provide you with innovative ideas, practical insights, and the tools you need to act. Explore our publications below.

Four Years of SaveYourRefund

SaveYourRefund (SYR) completed its fourth successful year in 2016. Learn about how it has grown and the impact it has made on tax filers across the country. “[SaveYourRefund saw] successful integration with Volunteer Income Tax Assistant programs.”“29% of savers purchased…

WINcentive Survey Results

This report is a summary of results from a Commonwealth survey of WINcentive account holders. The survey aims to understand who holds WINcentive accounts, what types of savers they are, and how WINcentive affects their impressions of credit unions. “[WINcentive] gives savers the thrill of…

SaveYourRefund 2016

The SaveYourRefund campaign had another successful tax season in 2016. SaveYourRefund, in its 4th year, is a national campaign encouraging savings at tax time, when households making less than $50,000 claim $100 billion in federal tax refunds. The campaign creates…

The Faces of Financial Vulnerability in Greensboro NC

Commonwealth undertook an in-depth research project with a small group of credit union account holders in Greensboro, NC in order to better understand the granularity of challenges faced by the financially vulnerable and the role prize-linked savings accounts can play in…

Save to Win 2015

In 2015, Save to Win accountholders in all participating states (MI, CT, VA, NC, WA) saved over $22 million. A total of 6,195 new accounts were opened during the same year, helping the program reach new heights. Since 2009, Save to…

Building the Innovation Pipeline: Workshopping Solutions for Financially Vulnerable Consumers

With support from the J. P. Morgan Chase Foundation and the Ford Foundation, Commonwealth tested an interactive design workshop on March 1, 2016, convening a select group of experts to ideate around a specific consumer challenge: How might we combine savings…

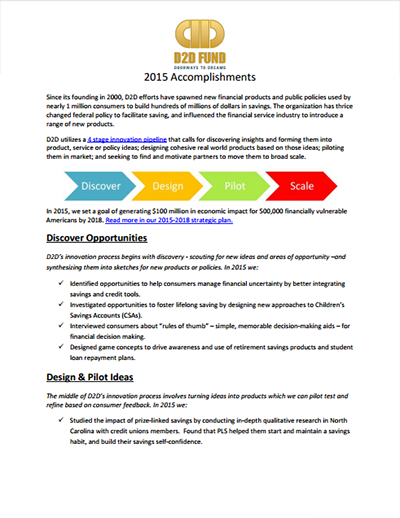

Commonwealth Innovation Pipeline

Commonwealth uses a four-step process to generate innovative solutions to build financial security. We discover ideas, pilot solutions and drive innovations to scale to impact millions of households. The attached publication provides more detail about each of the 4 stages of this process and describes a…

Behavior Changes and Prize-Linked Savings: Managing Financial Volatility

Consumers from across the income spectrum are faced with the challenge of uncertain income and expenses, but for low- and moderate-income consumers with limited access to financial products and services these challenges are magnified. Commonwealth undertook a year-long study with eight Greensboro…

Lessons from the Field: Prepaid Savings Features that Consumers Demand

As the prepaid card market continues to grow, consumers will continue to demand, and benefit from, product innovations that encourage savings. This publication discusses Commonwealth's work with the prepaid industry to identify the opportunities and challenges for creating engaging savings features that…

Commonwealth 2015 Accomplishments

This report describes Commonwealth's most notable accomplishments that occurred at every stage of the innovation pipeline – discover, design, pilot and scale – in 2015.