Our Research

Commonwealth conducts original qualitative and quantitative research with financially vulnerable people—including Black, Latinx, and women-led households who disproportionately experience financial insecurity. We also interview industry experts and academics. We take what we learn and translate findings into actionable insights and practical solutions designed to change systems to work better for financially vulnerable people. We work with community groups, employers, financial services firms, fintechs, policymakers, and workplace solution providers to design and test real-world, practical solutions that not only work for individuals and families, but are also scalable and address the business needs of our partners.

We share the results of our work to provide you with innovative ideas, practical insights, and the tools you need to act. Explore our publications below.

Commonwealth 2017 Accomplishments

In 2017, we developed new ideas, tested innovative solutions, and worked with partners to improve the lives of financially vulnerable Americans at scale. Here are just a few examples of the work we’re proud of from 2017.

Minimum Wage Survey Results

In 2017, Commonwealth conducted a national survey of minimum wage workers. Our goal was to better understand the unique perspectives and financial challenges of those workers. This infographic shows some of what we learned.

Addressing the Emergency Savings Challenge

In June 2017, Commonwealth and The Federal Reserve Bank of Boston (“the Boston Fed”) hosted a convening, “The Emergency Savings Innovation Challenge,” to invite banks, credit unions and key regulators in the region to discuss the financial insecurity crisis and…

Walmart MoneyCard Prize Savings: One Year Anniversary Brief

Innovative financial products can help financially vulnerable people save money. Walmart’s MoneyCard Prize Savings program, designed in partnership with Green Dot Bank and Commonwealth, is demonstrating that case. Prize Savings uses the chance to win cash prizes to make saving…

Ramp It Up: Executive Summary

Access to a college education is one of the key drivers of financial security, and financial aid (loans, grants, and scholarships) can make college a viable opportunity for many students. However, understanding how to access such aid requires financial capability…

Ramp It Up: Gamifying College Financial Readiness

Access to a college education is one of the key drivers of financial security, and financial aid (loans, grants, and scholarships) can make college a viable opportunity for many students. However, understanding how to access such aid requires financial capability…

Ramp It Up: Evaluation of a Gamified College Financial Readiness App

Access to a college education is one of the key drivers of financial security, and financial aid (loans, grants, and scholarships) can make college a viable opportunity for many students. However, understanding how to access such aid requires financial capability…

Product Spotlight: Neighborhood Credit Union’s Prize- Linked Savings Account

For over a decade, Neighborhood Credit Union in Dallas, Texas has offered a unique sweepstakesbased prize-linked savings (PLS) product called Prize Savings. This PLS product provides an example of how individual financial institutions can independently launch and manage innovative savings…

Rise with the Raise: Findings From Early Pilots

Nearly 19MM minimum wage workers across the country will receive annual raises of $61.5 billion by 2022. Commonwealth is partnering with employers to ensure as many of these workers as possible can use these raises to build their financial security.…

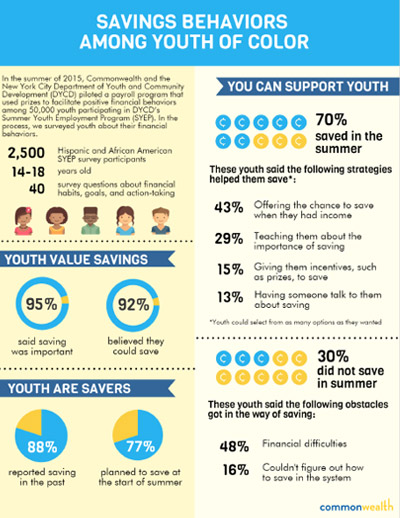

Savings Behaviors Among Youth of Color

In the summer of 2015, Commonwealth and the New York City Department of Youth and Community Development (DYCD) piloted a payroll program that used prizes to facilitate positive financial behaviors among 50,000 youth participating in DYCD’s Summer Youth Employment Program…