Our Research

Commonwealth conducts original qualitative and quantitative research with financially vulnerable people—including Black, Latinx, and women-led households who disproportionately experience financial insecurity. We also interview industry experts and academics. We take what we learn and translate findings into actionable insights and practical solutions designed to change systems to work better for financially vulnerable people. We work with community groups, employers, financial services firms, fintechs, policymakers, and workplace solution providers to design and test real-world, practical solutions that not only work for individuals and families, but are also scalable and address the business needs of our partners.

We share the results of our work to provide you with innovative ideas, practical insights, and the tools you need to act. Explore our publications below.

SaveYourRefund 2018

Learn more about the winners and savers from SaveYourRefund 2018.

Integrated Product Design to Build Savings

In December 2017, Commonwealth and The Federal Reserve Bank of Boston (Boston Fed) hosted a Savings Innovation convening focused on integrated product design. Twenty-one banks, credit unions, and nonprofits in the region gathered to discuss financial security challenges and approaches…

Six Years of SaveYourRefund

SaveYourRefund (SYR) completed its sixth successful year in 2018. Learn about how this Commonwealth project has grown and the impact it has made on tax filers across the country.

The Changing Nature of Work: Amplifying the Voice of the Financially Vulnerable Worker

For many people, the nature of work is in flux. All indications are that the Traditional full-time job with one employer will continue to become less common as other work arrangements flourish. Those Non-Traditional alternatives are themselves evolving rapidly. To…

The Case for a Well-Designed High-Deductible Health Plan

HDHPs are attractive because they provide short-term cost savings on premiums to both the employer and employee. However, unless they are well designed, HDHPs increase the risk of out-of-pocket healthcare expenses for employees. This can lead to medical debt, delayed…

Raise-Centered Financial Security Strategies: Findings From Rise with the Raise

Across the country, financially vulnerable workers are witnessing increases to their take-home pay as companies boost compensation and jurisdictions raise statutory minimum wages. Through pilot interventions and consumer research with hundreds of workers, Commonwealth has studied how wage hikes can be…

Financial Security in the Workplace

In America’s human resources community, the moment of “financial wellness” has arrived. In growing numbers, employers are concluding that benefits to support workers’ financial wellbeing should go well beyond retirement benefits. More and more firms believe that personal finance challenges…

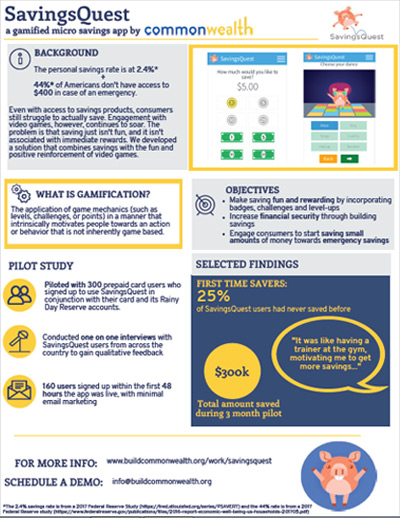

SavingsQuest: Gamification Brings Savings to the 21st Century

Commonwealth designed and tested a gamified savings app called SavingsQuest, a modern, accessible approach that facilitates microsaving and reinforces the principle that every contribution counts. As a gamified experience, the app makes engaging in savings behavior more interesting and desirable.…

SavingsQuest Infographic

Even with access to savings products, consumers still struggle to actually save. Engagement with video games, however, continues to soar. The problem is that saving just isn’t fun, and it isn’t associated with immediate rewards. Commonwealth developed a solution that…

Prize-Linked Savings in Credit Unions: 2017

In 2017, Prize-Linked Savings (PLS) products continued to expand and reach more people. All three of the PLS products highlighted in this piece saw growth, from the flagship Save to Win (STW) product to the two new products from 2016,…