Our Research

Commonwealth conducts original qualitative and quantitative research with financially vulnerable people—including Black, Latinx, and women-led households who disproportionately experience financial insecurity. We also interview industry experts and academics. We take what we learn and translate findings into actionable insights and practical solutions designed to change systems to work better for financially vulnerable people. We work with community groups, employers, financial services firms, fintechs, policymakers, and workplace solution providers to design and test real-world, practical solutions that not only work for individuals and families, but are also scalable and address the business needs of our partners.

We share the results of our work to provide you with innovative ideas, practical insights, and the tools you need to act. Explore our publications below.

Blockchain Technology and Financial Security

New and emerging technologies throughout history have transformed our lives, wellbeing, and day to day tasks. This is true in financial services as well: we use cash less and cards more, have access to banking services 24/7, and can perform…

Rise with the Raise

The Promise of Straightforward Employer Benefits for Building Lower-Wage Employee Financial Security Fostering financial security among employees is an increasingly high priority for employers. Employees who are more financially secure have been shown to be less stressed and more productive–characteristics…

Designing a High-Deductible Health Plan That Works

While high-deductible health plans (HDHPs) may seem like a great value due to lower premiums, they often result in high out-of-pocket costs. Health Savings Accounts (HSAs) offer tax-advantaged savings for health expenses to help get around the drawbacks of an…

SaveYourRefund 2019

The SaveYourRefund campaign had another successful tax season in 2019. SaveYourRefund, a national campaign in its 7th year, encourages savings at tax time, when households making less than $50,000 claim $100 billion in federal tax refunds. The campaign creates a…

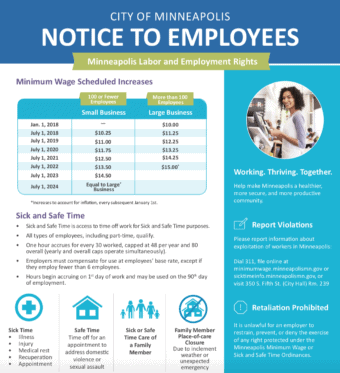

Minimum Wage Ordinances

Minimum wage ordinances are going into effect July 1 in many localities. In this webinar, CLASP and Commonwealth shared how innovative employer outreach and engagement approaches can improve compliance and relationships with the business community. We will also share how…

Ramp It Up Infographic

High cost and complicated financial aid processes limit access to higher education, especially for students from low- to moderate-income households. Ramp It Up aims to impart college financial readiness: the knowledge and ability to navigate the challenge of paying for higher…

Advancing Your Business Through Worker Financial Security Strategies

Employee financial insecurity is pervasive, intense, and distracting. Both employers and employees stand to benefit from financial security tools and strategies offered through the workplace.

Short-Term Financial Stability: A Foundation for Security and Well-Being

The Aspen Institute Financial Security Program convenes the Consumer Insights Collaborative, an effort across nine leading nonprofits (including Commonwealth) to collectively understand and amplify data for the public good, specifically about the financial lives of low- to moderate-income households. The…

Illuminating a Hidden Safety Net: Lessons from Research into Employee Hardship Funds

Financial insecurity is increasingly common among households in the United States (US). Over a quarter of families in the US report that it is difficult to get by, or they feel they are just getting by. In 2014, almost 60%…

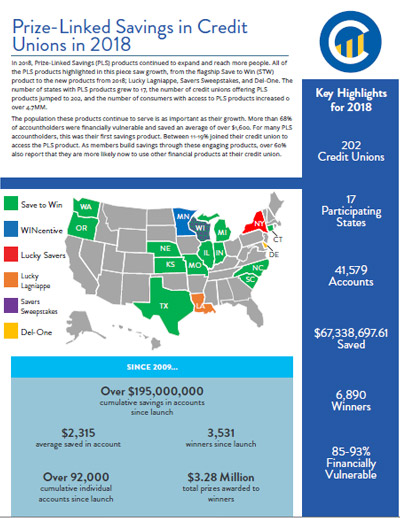

Prize-Linked Savings in Credit Unions: 2018

In 2018, Prize-Linked Savings (PLS) products continued to expand and reach more people. All of the PLS products highlighted in this piece saw growth, from the flagship Save to Win (STW) product to the new products from 2018; Lucky Lagniappe,…