Financial Security: A Foundation for Worker Wellbeing

Meeting This Moment: An Unprecedented Need & Opportunity for Employers to Act

- Emotional wellbeing depends on financial security.

- Employers can help; prioritize the financial “Swiss army knife” (Emergency Savings).

- Solve for how workers are AND how they feel.

Download Timothy Flacke, Co-Founder and Executive Director of Commonwealth slide presentation from Human Resources Leadership Forum.

Learn More

Data

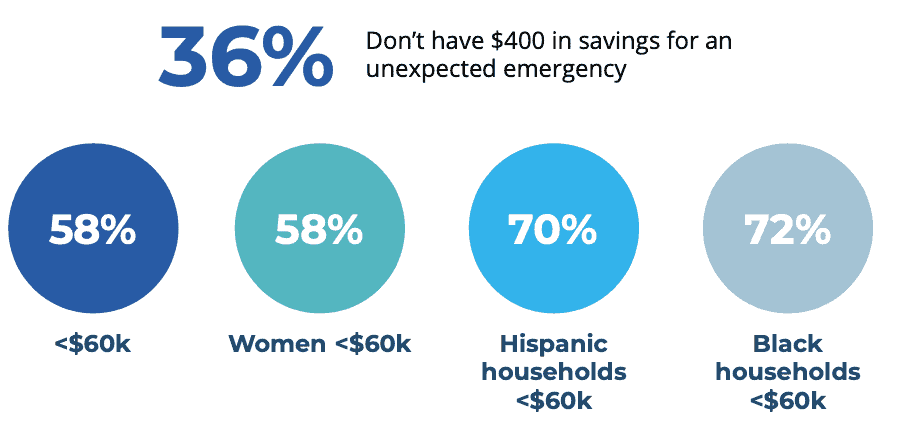

The $400 Problem

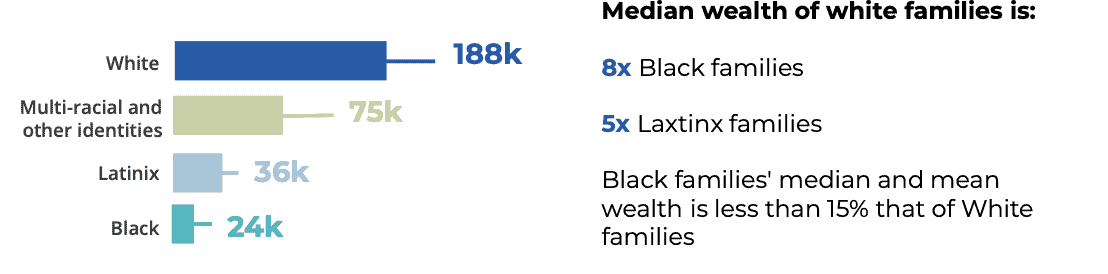

Financial Insecurity: Widely-Recognized Problem

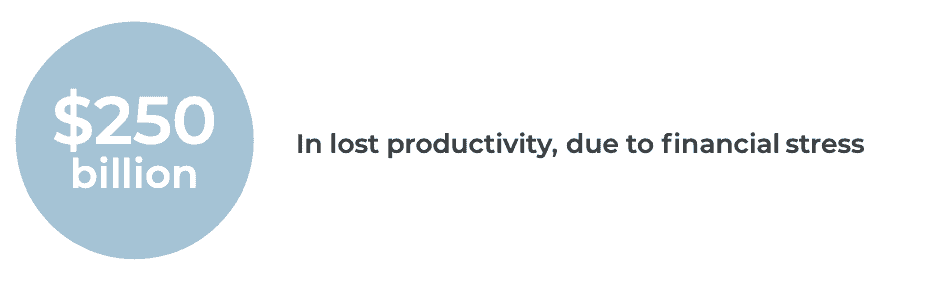

Impact of Financial Insecurity on Corporations

Financial Insecurity: Widely-Recognized Problem

About Commonwealth

Commonwealth is a national nonprofit building financial security and opportunity for financially vulnerable people through innovation and partnerships. Black, Latinx and Women-led households disproportionately experience financial insecurity due in large part to longstanding, systemic racism and gender discrimination. Addressing these issues is critical to Commonwealth’s work of making wealth possible for all.