Financial AI for Good: Guide & Chatbot

Commonwealth’s Emerging Tech for All (ETA) initiative aims to ensure that the design of new financial technologies integrates the needs, wants, and aspirations of people living on low and moderate incomes (LMI). We are shedding light on these perspectives by partnering with who implement emerging technologies to research the needs and wants of customers living on LMI.

Guide Overview

This guide is intended to provide design guidance for financial institutions and other organizations that offer financial services to populations living on LMI using emerging technologies like conversational AI (chatbots) and automated financial management software. Recommendations included were based on two nationally representative surveys, field tests with financial institutions and chatbot providers, and focus groups with people living on LMI. The full reports and field tests briefs are in the Additional Resources section. The guide is organized around four primary goals for the provision of effective and accessible financial services for populations living on LMI, and includes a section on directions for future research, including the rise in use cases for generative AI technologies:

- Earn trust

- Drive engagement

- Increase value

- Improve accessibility

- Future directions

This guide will evolve as our research in this area progresses. Below, find insights into how we developed these goals based on existing barriers and ideas for effective design.

How to Use the Guide and Chatbot

Navigate through the guide using the linked table of contents or the search bar on the left. We have chatbot prompts throughout the guide, which are indicated with a blue icon. You can also ask your own questions using the chatbot in the lower right corner.

Our chatbot is built with ChatGPT 3.5, and source data includes Commonwealth’s website, research, and reports related to the Emerging Tech for All Initiative.

1. Earn Trust

Before users living on LMI are willing to engage with conversational AI, financial automation, or other emerging technologies, they need to feel that communications are secure and the information they receive is trustworthy. Earning the trust of users is especially important in light of financially vulnerable Americans’ history of exclusion from financial services and higher likelihood of experience with predatory alternative financial products.

Emphasize Data Security

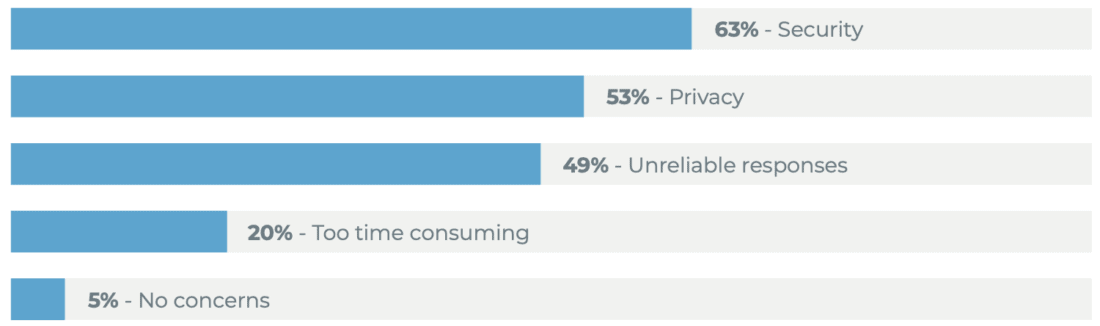

Threats to personal data privacy are at the top of many people’s minds, and the risks of identity theft and other security breaches are particularly significant in a financial context.1 When asked about their top concerns in using a chatbot, 63% of respondents said they were concerned about security in our national survey. When interviewing users about artificial intelligence tools specifically, some of these concerns were exacerbated by not understanding how the technology works.

- Include branding on chatbots or apps. Users are more likely to trust tools from companies they already have a relationship with and have interacted with positively in the past.

- Include upfront messaging about data security. During interviews, participants named the inherent data security risks of using chatbots but that this was not a dealbreaker for them. Instead, they shared a desire for their bank to inform them of the measures it is taking. Clearly reporting these measures before requesting personal information can communicate that organizations are aware of and proactive about data security.

- Give users control over what data is stored. Because the success of emerging financial technologies like chatbots often depends on sharing some personal information, addressing these concerns is an important trust-building strategy. Allowing users to choose what types of financial questions, such as questions about their financial goals, they answer can increase a sense of agency and security, thus building trust. Additionally, ensuring the chatbot only accesses the information their bank currently has, but no information beyond that (other accounts, total income, etc) and allows users to input additional financial information beyond what the bank may have (income data, total debt, etc) could provide more transparency about data.

Clarify the Source of Guidance

Top user concerns when considering asking a chatbot for guidance were that the chatbot would push products they didn’t need, that the information would be inaccurate, or that the guidance given by chatbots would not address their needs.2

- Include clear messaging explaining that customers are interacting with a chatbot and not a human. Our research indicates that banking customers are often unsure if they are chatting with a human agent or a chatbot. This uncertainty can set chatbot interactions up for failure if a user believes they are interacting with a live agent.

- When making product recommendations, consider connecting to real customer reviews or action steps taken by other customers. Helping clients connect recommendations to other real clients in similar financial situations may help build trust with clients who would otherwise feel like the chatbot is simply pushing a product.3

- Clearly state the source of any information given. During interviews, participants reported that knowing where information was coming from was a determining factor in whether they trusted the chatbot. Citing sources such as areas on the website that an answer is being sourced from, or links to reputable organizations may build trust.

Provide a Human Connection

While use of and comfort with chatbots have increased significantly since the pandemic, users retain a strong preference for interacting with a real person—especially for more complicated issues.

- Make it easy to connect to a human agent. Making it easy to move from a chatbot conversation to a live agent can improve openness to financial chatbots by creating a pathway to solutions rather than a potential dead end. This potential for human connection may play an important role in the applications of various customer-facing technologies. Knowing that humans are available as an alternative if they run into issues with new technology makes them more willing to give these novel pathways a shot. In the boost.ai field test, 70% of customers preferred a chatbot over a human to find information about their bank (routing numbers, hours, information on a website). However, in contrast, 80% of customers preferred engaging with a human over a chatbot to receive financial advice.

Offer Low-Risk Opportunities to Engage with New Technologies

Many concerns about chatbots and AI tools are rooted in a lack of familiarity with these technologies. While user trust and comfort take time to develop, financial institutions and organizations may be able to accelerate this process by exposing users to new technologies in low-risk ways.

- Give users examples of potential chatbot interactions. In one-on-one interviews with Commonwealth, users had reservations about AI and chatbots when speaking in abstract terms but could identify specific use cases relevant to them when presented with examples. Offering users access to demos or examples to familiarize themselves with new technologies may help build a foundation of trust before situations that are more urgent or require sharing sensitive information.

2. Drive Engagement

Ensuring that users living on LMI get the most out of chatbots and other emerging financial technologies means working to create an engaging experience in which users feel like they understand what these tools can do for them and when.

Create Clarity Around Functions

When asked about their priorities for chatbot features, users most often named an ability to understand a wide variety of questions, the option to connect to a live agent, and an ability for a chatbot to connect to accounts and real-time financial data.

- Put function first to rebuild trust in the reliability of chatbots. In Commonwealth’s research, participants consistently selected a chatbot’s ability to connect to a live agent, its ability to understand a wide range of questions, and the ability to connect to real-time financial data among their top priorities.

- Integrate financial data into chatbot responses. In interviews, participants highlighted the information about their finances that a bank or credit union already has access to and thought a chatbot should be able to use that to provide insights. Financial data could be used to provide recommendations based on finances or to recommend applicable products. For example, interview participants suggested the chatbot could recommend savings accounts based on their saving and spending habits, small actions they could take to improve their credit score, or recommendations if they are in the market for a new home or car.

- Give clarity on what the chatbot can and cannot accomplish. Users expressed the most frustration when they felt continuously redirected by the chatbot experience without arriving at the information they needed. Chatbot designers can avoid this by providing examples of topics the chatbot can help with and designing clear flows that end redirection loops. Interview participants were also uncertain whether a chatbot would have the authority to make decisions. A chatbot could include messaging that explains more about what it has the ability to authorize or be programmed to quickly escalate to a live agent when a request requiring authorization is being made.

Pursue Intelligent Proactivity

Without any proactive engagement, it is easy for customers to overlook the existence of chatbots that might be able to assist them effectively. At the same time, pushy chatbots that are too aggressive in making their presence known can feel “spammy” and turn users off. Intelligent proactivity is about designing consumer-facing technologies that can recognize the moments when users might benefit from assistance and make suggestions in a way that invites engagement.

- Have chatbots pop up on specific webpages where actions can be taken. When chatbots pop up immediately before they are needed, users are more likely to disregard them later on when they could be useful.

- Avoid chatbot messaging that immediately suggests a specific product or service. Instead, consider opening with information about the different ways a chatbot can help. Chatbots that are perceived as vehicles for advertising or other offers can turn users off.

- Use customers’ financial data to prompt them about opportunities that may be relevant to them. Participants in interviews saw the potential for their bank to be able to prompt them about opportunities that were customized to them. For example, participants were open to being notified about changes in interest rates on their accounts or cards they qualify for, seasonal opportunities like opening a new savings account in the leadup to holidays, or products that they may use to improve their financial standing based on their spending/savings data.

Users expressed the most frustration when they felt continuously redirected by the chatbot experience without arriving at the information they needed.

Create personalized experiences

When it comes to making financial decisions, users are looking for advice that not only draws on industry best practices, but also on their personal values and goals. When asked what types of personal information users would be willing to share with a chatbot, users were open to sharing about their personal financial goals or values. Offering ways for users to share information can increase engagement and build trust.

- Connect with customers’ values. When given the opportunity to set goals within a financial tool, participating users set an average of five goals. Connecting with users on a personal level and incorporating their individual values and preferences into financial recommendations not only allows for higher quality recommendations, but can also increase user comfort with sharing information generally.

Example:

For more insights into connecting with customers’ values, see Commonwealth’s Actionable Insights for Inclusive Product Design

- Provide personalized recommendations that customers can research further. Some respondents to Commonwealth’s research named that they had lower trust in chatbots because it wasn’t personalized to them or didn’t understand their financial standing. Participants were particularly open to sharing more about their financial standing with the chatbot if it could provide more complex and helpful information that they could research further on their own.

Some respondents had lower trust in chatbots because the technology wasn’t personalized to them or didn’t understand their financial standing.

3. Increase Value

Designing emerging technologies in an inclusive way means working to understand the financial needs of customers living on low and moderate incomes and incorporating those needs into design choices to maximize value.

Anticipate the Financial Needs of Users Living on LMI

Customers living on LMI represent a large and diverse group that cannot be reduced to a single shared set of needs or preferences. Delivering value through the design of tech products ultimately depends on understanding the alignment between technological capabilities and the needs of specific audiences. At the same time, there are common economic barriers and situations that should be kept in mind which may be relevant for the design of emerging technologies.

AI-driven apps seemed well suited to assist because they could provide data-based judgment-free information.

- Customers living on LMI have limited local branch access. Decreased access to physical banking branches in lower-income communities creates an opportunity for chatbots and other financial technologies to fulfill a broader range of banking needs. Customers in these situations are looking for chatbots and online tools to be able to complete small actions they may have had to go to a bank for, such as requesting new checks or credit/debit cards, answering questions about financial products, or resolving disputes quickly.

- Customers living on LMI have limited time. Users often feel that chatbots are a waste of time that lead them to dead ends or around in circles. Ensuring that chatbots can either provide action-oriented guidance quickly or recognize the need to transfer to a human agent is key to building stronger associations between chatbots and quick solutions.

- Customers are looking for support with budgeting. Commonwealth surveyed credit union users on their preferences for automated financial tools, and the results indicated that assistance with budgeting was where users felt automation could add the most value. This is an area AI-driven apps are well suited to assist with because of the need to continuously adapt budgets to changes in income and expenses.

- Customers are looking for support with credit building. Many participants in the interviews said they needed help with credit building. This area was where chatbots or AI-driven apps seemed well suited to assist because they could provide data-based judgment-free information around an area that may feel overwhelming or sensitive to customers. A chatbot could add value to users by recommending credit-building products, suggesting small actions a customer can take to improve credit, or linking to reputable credit building resources.

Create Action-Oriented Chatbots

Although chatbots are perhaps most commonly thought of as sources of information that can provide guidance or recommendations, our research suggests that the ability to complete basic transactions through a chatbot interface has significant appeal.4

- Support online banking services like sending payments through a chatbot. Digital payments are an essential financial service, particularly for households living on low to moderate incomes. More action-oriented chatbots that can facilitate easy payments provide an opportunity to design technology to match the needs of this group.

- Give users confirmations of completed actions through chatbots. Action-oriented chatbots that report back to users when a payment dispute has been resolved, a transfer has been made, or a credit card has been turned off or on can increase the usefulness of these tools for users.

Balance Automation and Control

Automated features can make it easier for customers to reach their financial goals with lower effort and time commitments. Simultaneously, users with lower incomes may have more fears about automating their financial lives when margins are small and errors can create significant setbacks. One way to increase engagement with automated financial tools is to allow users to have control over how much automation is used or to put guardrails in place to ensure they don’t overdraft any accounts.

- Allow users to turn automated finance features on and off. Users may have volatile financial situations or anticipate future changes in their income and expenses. Allowing users to easily turn features on and off can help them engage with automated finance, while still knowing that they can update their preferences quickly should the need arise. Even if the technology involved is capable of adapting to these changes, allowing customers to turn it off will increase trust and demonstrate that they are still in control.

- Include “safety net” features that pause automated movement of money if their balance is below a certain threshold. When credit union users were surveyed about potential features in an automated finance app, 89% of respondents expressed interest in a feature that would pause savings deposits automatically based on account balances. Many financially vulnerable Americans have experienced getting charged an unexpected overdraft fee and are wary of any tool that may unintentionally lead to overdrafted accounts.

- Give users the final say. In interviews, participants desired chatbots or online tools to present them with options for managing their finances but give them the final say on whether or not to act on the recommendations. Most participants expressed a desire to be able to check the information the chatbot provided them against other sources of information outside of their bank or credit union before making a decision.

- Provide multiple options or pathways in conversation. Multiple participants in Commonwealth research appreciated chatbots that gave them multiple potential answers to a query and invited them to choose which one was most relevant. Even though these features made the chatbot feel less conversational or human-like, participants preferred this to being given irrelevant information or getting caught in loops with the chatbot.

89% of respondents expressed interest in a feature that would pause savings deposits automatically based on account balances

4. Improve Accessibility

People living on LMI may face unique barriers not only in banking or managing finances, but also in accessing the tools and resources they need in the first place. Financial institutions can pay attention to how customers most often bank or would prefer to bank and invest in these areas.

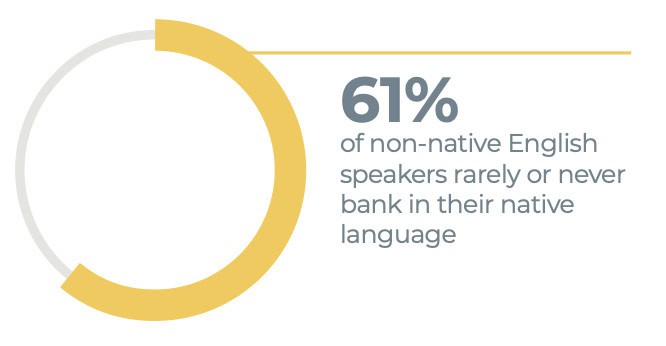

Offer Multilingual Guidance

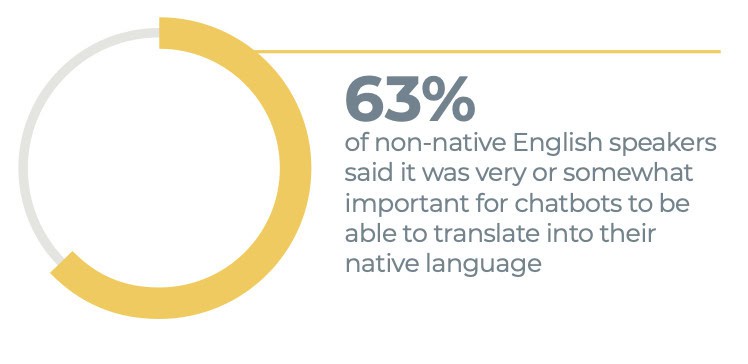

One in 5 Americans speak a language other than English at home. Offering multilingual support for customers through chatbots can increase trust of financial institutions and customer comfort levels when it comes to banking. In Commonwealth’s national survey, 63% of respondents whose first language was not English said that it would be important to them that a chatbot be able to translate its responses into their native language.

- Offer languages that match existing customer bases. Financial institutions can research languages most commonly spoken by customers or within their geographic area to understand what languages to focus on providing services in. The top 5 languages spoken in the US by people with limited English proficiency are Spanish (63%), Chinese (7%), Vietnamese (3%), Arabic (2%), and Tagalog (2%).5

- Ensure translated chatbot responses are legally compliant. A financial institution hoping to offer translated chatbot services can look at guidance provided by the CFPB and regulatory agencies to ensure that translated materials or answers meet compliance standards. According to federal consumer financial laws, financial institutions must provide accurate, straightforward answers and deal fairly with customers. Chatbot responses run the risk of providing inaccurate information and violating a consumer’s federal rights.6

- Check translated answers against English chatbot responses. Especially if using generative AI technologies for translation, it is possible that a translated message may convey a different meaning or give a different answer than its English counterpart to the same question. In focus groups with credit union members, members shared that they would check to see if the guidance given in English matched what was available in other languages. Ensuring that it does can help build trust in the chatbot and in the translation tools.

Focus on Mobile-Friendly Features

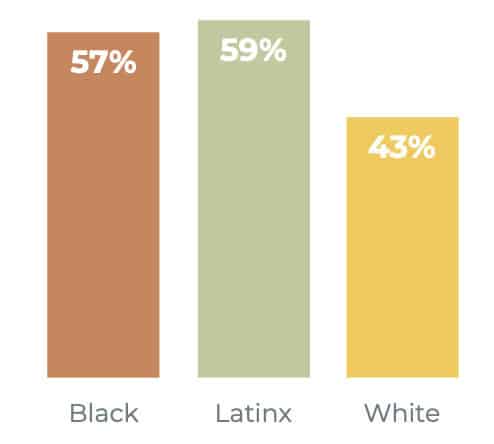

The rise in popularity of online-only neobanks has shown that more and more Americans are comfortable banking completely online. In Commonwealth’s national survey, 40% of respondents had used an online-only bank and over half of all respondents preferred to access their banking through their mobile phone. This preference was even stronger for Black and Latinx respondents.

- Invest in mobile app functionality. In Commonwealth’s field tests, mobile apps were overwhelmingly the preferred method of access for online banking compared to logging on a computer or using a mobile-friendly website. Participants named their constant access to their phone and the app’s quick identity verification and login process as reasons for preferring the app.

- Streamline onboarding processes and lower barriers to banking. The rise in usage of neobanks by people living on LMI can inform our understanding of what types of features and functionality customers are looking for. Namely, neobanks have simple onboarding processes that can be completed in minutes and do not require paper forms or travel to a physical bank location. These accounts also do not typically have minimum balance requirements or overdraft fees.

- Make key features accessible through mobile. In interviews with credit union customers, participants named making transfers between accounts, being able to check account balances, and being able to quickly review transactions as their most common uses of the mobile app. Ensuring that these features are easy to access and offer a quality experience through mobile app can drive value for customers.

5. Looking Toward the Future

Commonwealth’s research on emerging technologies in finance has provided valuable insights into the needs and wants of banking customers living on LMI, highlighting their banking preferences, concerns, and desires for expanded tool capabilities. It provides a foundation for thinking through broader applications of AI in finance to best support the financial health of this population. As this next generation of technologies develops, Commonwealth is working to provide industry actors with research that facilitates inclusive design of these technologies, leveraging their potential to positively impact the financial health of households living on LMI. In this section, we provide an overview of some of the key future directions at the intersection of emerging tech and financial health.

Generative AI

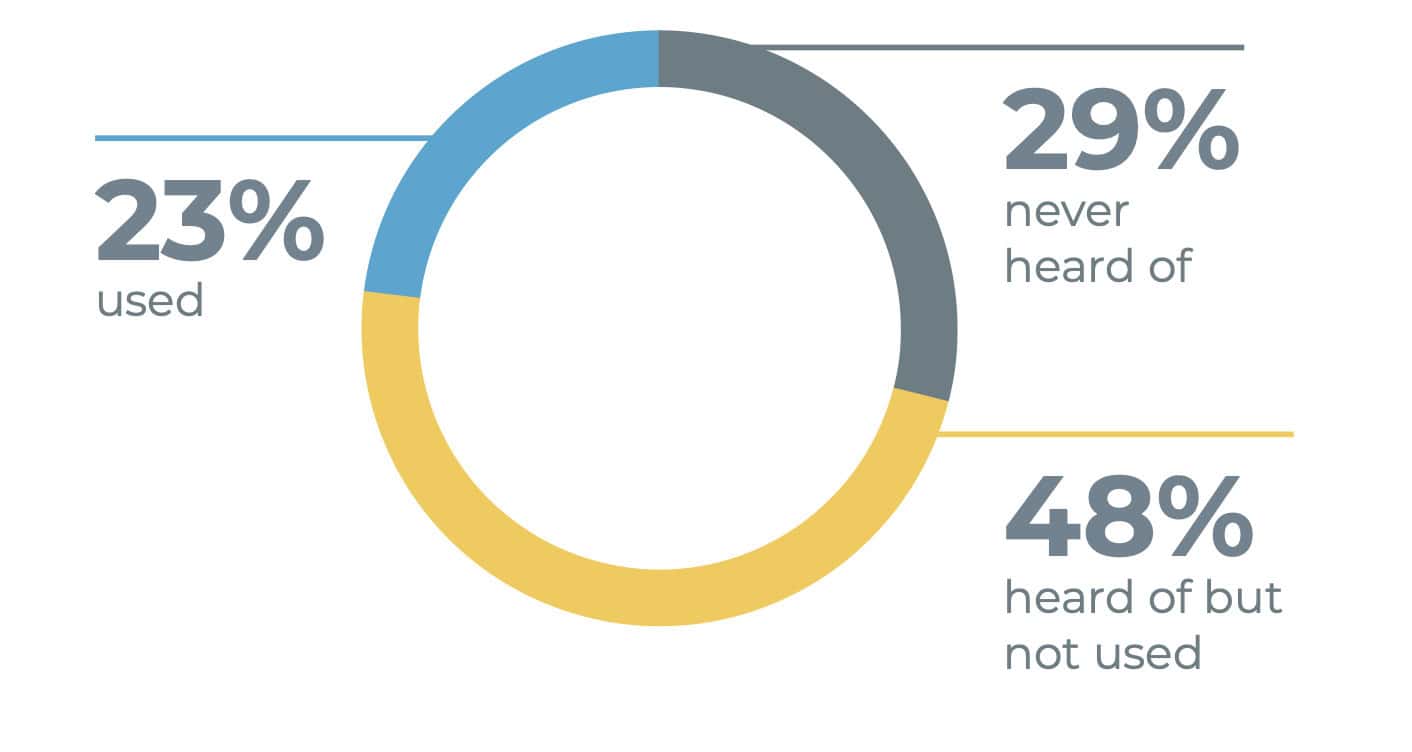

Generative AI represents the next evolution in conversational AI support, allowing for personalized and context-sensitive engagement at a level that much more closely approximates human support than the decision-tree structure of most financial chatbots today. About three-quarters of people living in the US have heard of generative AI applications like ChatGPT, and 23% have tried the technology. Initial applications of generative AI in finance have focused primarily on back-office applications, where there is an opportunity to support customer service agents. But identifying how generative AI can provide personalized support at scale in a financial context is one of the key opportunities that will drive development in this sector.

Much of the work on trust-building that has developed as a part of Commonwealth’s research will be particularly critical for broader adoption of generative AI, which participants in our field tests and focus groups remain more skeptical of than traditional chatbots. The potential benefits of providing this more advanced level of support across financial service applications make generative AI the most exciting technology to watch in the financial sector. First movers in this space who are able to develop trusted and reliable generative AI support will be at the frontier of this new era of customer relationship building at scale.

Co-pilots and Personal Assistants

One of the critical advances that generative conversational AI can provide is comprehensive financial guidance, using customer data to identify opportunities for them to build financial security and wealth along with answering questions with relevant and timely guidance aligned with their goals. Co-pilots complement generative AI chatbots; they often can streamline operations and complete basic tasks. These co-pilots would provide users with access to a broad range of relevant financial information tailored to their individual needs, equipping millions of people with a personal financial coach for the first time. We are beginning to see enough trust in generative AI to support customer-facing applications like this. For example, Public.com has recently rolled out their generative AI co-pilot Alpha, who can provide investors with real-time support and information regarding any investing questions they have. We expect to see a significant increase in the number of AI co-pilots available in the near future, providing a new set of tools for providers to build relationships with and support the financial health of their customers.

Public Benefits

Public benefits play an essential role in helping Americans navigate financial challenges, but most major programs fall short of reaching full participation. As much as $140 billion in government aid never reaches the people it’s intended to help. A major reason is that benefits systems are complex and disjointed. Americans may not be able to tell what benefits they are eligible for and means-testing processes can be burdensome for both applicants and administrators. New technologies have the potential to overcome these barriers and improve access.

Workplace Benefits

In addition to supporting access to public benefits, advances in conversational AI can provide scalable initiatives to support learning about and using workplace benefit programs. The inability to receive prompt and accurate information can serve as a major barrier to workers’ adoption of available benefits, including things like retirement account benefits and emergency savings tools. Immediate access to a personalized chatbot that can access company records and provide employees with timely, personalized guidance about using workplace benefits can play a valuable role in promoting workers’ financial health.

Back Office Support

In addition to the customer-facing applications of generative AI that have gained the most public attention, there are also opportunities for generative AI to play a supporting role in back-office applications by acting as a tool for customer service agents and other employees rather than interfacing directly with customers. This strategy has been taken by some early generative AI adopters in the financial industry, who control for the unpredictability of generative responses by keeping a human agent in the mix to interpret outputs. In addition to customer service, back office generative AI can provide valuable training functions, and be able to respond to employees’ queries about their work. This is likely to be the entry point for a number of financial providers, allowing them to explore the business applications of this technology without letting it interact directly with customers.

Resources

Key Publications

Designing Conversational AI for People Living on Low to Moderate Incomes

Field tests and research that contributed to this guide:

- Generative AI and Emerging Technology

- Provider Interviews Indicate Opportunity to Build Products Aimed at People Earning Low and Moderate Income

- Perspectives on Emerging Technologies and Inclusive Design

- Designing Conversational AI for People Living on Low to Moderate Incomes

- Closing the Fintech Inclusion Gap

- Digital Payments and the New Opportunity to Increase Savings

- Machine Learning and Financial Security

Additional Commonwealth research on inclusive design

Additional relevant research from other sources

- Financial Decision Making Processes of Low-Income Individuals: Harvard Joint Center for Housing Studies

- Trust and Digital Privacy: Willingness to Disclose Personal Information to Banking Chatbot Services: Journal of Financial Services Marketing

- Do I Desire Chatbots to be like Humans? Exploring Factors for Adoption of Chatbots for Financial Services: Journal of International Technology and Information Management

- Emergency Savings: Building Pathways to Financial Health and Economic Opportunity

Organizations promoting financial security and ethical and inclusive AI

This research and associated work was completed with the support of JPMorgan Chase & Co. The views and opinions expressed in this guide are those of the authors and do not necessarily reflect the views and opinions of these supporters or their affiliates.

Footnotes

1 In a survey of households living on low incomes conducted by Harvard University’s Joint Center for Housing Studies on where households felt most comfortable cashing their checks, the most important element was that their information was kept confidential.

2 In an FDIC survey, 59.4% of households without bank accounts reported that they do not trust banks, and cited feeling like banks were more focused on getting them to borrow money than on helping them save. In Commonwealth’s research, only 41% of respondents expected chatbots to provide correct answers, and only 28% believed a chatbot could give effective solutions to their financial issues.

3 In the sphere of online shopping, 91% of respondents to a 2019 survey said that they read reviews before making a purchasing decision.

4 While only 8% of respondents preferred a chatbot to a human for resolving a banking-related issue and 13% preferred a chatbot for receiving financial advice, 36% of respondents said they would rather talk to a chatbot than a human to send payments or complete banking transactions.

5 KFF.org

6 CFPB