Our Research

Commonwealth conducts original qualitative and quantitative research with financially vulnerable people—including Black, Latinx, and women-led households who disproportionately experience financial insecurity. We also interview industry experts and academics. We take what we learn and translate findings into actionable insights and practical solutions designed to change systems to work better for financially vulnerable people. We work with community groups, employers, financial services firms, fintechs, policymakers, and workplace solution providers to design and test real-world, practical solutions that not only work for individuals and families, but are also scalable and address the business needs of our partners.

We share the results of our work to provide you with innovative ideas, practical insights, and the tools you need to act. Explore our publications below.

Bringing Financial Entertainment to America

Millions of Americans struggle to engage with personal finance concepts, not because they are unimportant, but because doing so feels too tedious and dull to be worth the effort. But it doesn't have to be this way. This infographic looks…

Capital One Student Banking Program: Pilot Testing of Financial Entertainment

D2D (now Commonwealth) has released a report with the results of a pilot studying the role of Financial Entertainment in the classroom. Over 100 students and teachers participated in the pilot, generously supported by Capital One. Students competed in class-wide…

Celebrity Calamity User Interviews

Users of Celebrity Calamity, a Financial Entertainment video game that teaches players about spending and credit card debt, discuss how the game improves their financial capability.

Split Save Win: A Reflection on SaveYourRefund 2014

This paper highlights the approach and successes of Save Your Refund’s second year. The campaign generated a nearly 400% increase in both dollars saved and number of entries while engaging over 75 community tax preparation sites in its efforts. With…

Statement for the Record – United States Committee on Financial Services

D2D cofounder Peter Tufano submitted a Statement for the Record in connection with the July 15, 2014 hearing before the House Committee on Financial Services Subcommittee on Financial Institutions and Consumer Credit. In his statement, Tufano reinforced the importance of…

Save To Win: Michigan 2013

The Michigan Save to Win program completed its fifth year in 2013. This brief contains key highlights and findings from the product as it matures in state, including: 1)The product was offered in 38 credit unions and there were 12,531…

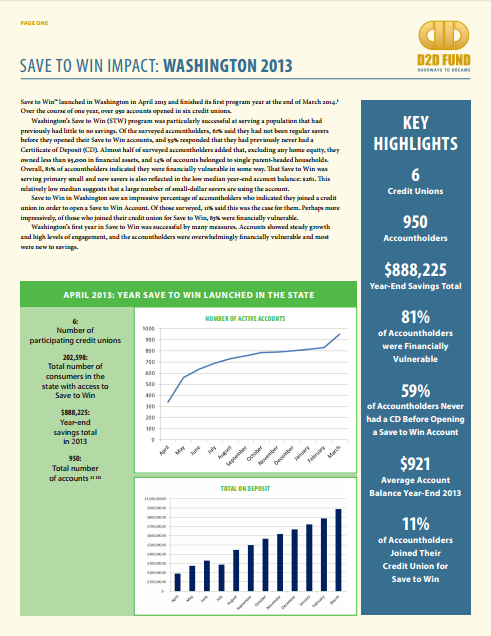

Save to Win: Washington 2013

Save to Win launched in Washington in April 2013 and finished its first full program year in March 2014. This paper contains key highlights and findings from the product's first year in the state, including: 1) 950 accounts opened in…

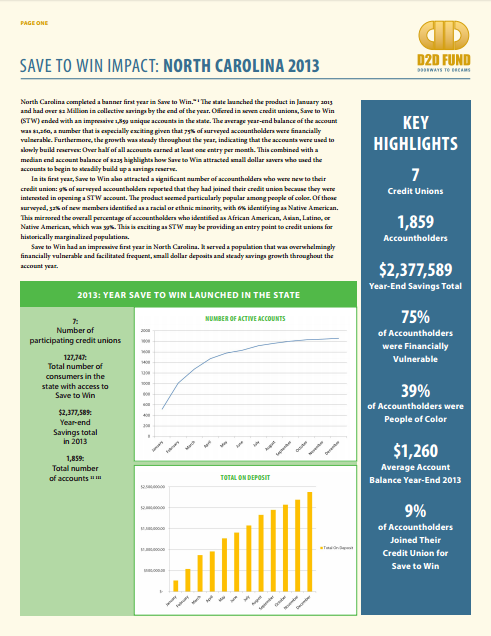

Save To Win: North Carolina 2013

Save to Win launched in North Carolina in 2013. The first year results from North Carolina show an impressive 1,859 accounts opened with $2MM in collective total savings. This brief contains key highlights and findings from the program year, including:…

Save to Win: Nebraska 2013

In 2013, Save to Win entered its second year in Nebraska. Across the state, 215,044 consumers had access to the product in 11 credit unions. This brief contains key highlights and findings from the program year, including: 1) 85% of…

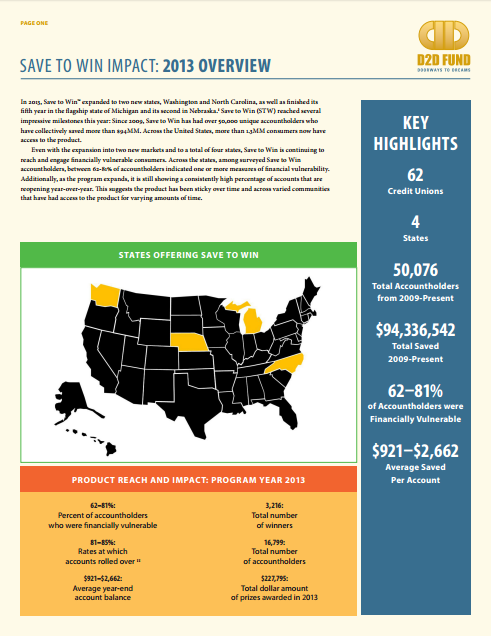

Save To Win 2013

In 2013 Save to Win, the nation's first large-scale prize-linked savings product, expanded to include credit unions in Washington and North Carolina. It also entered its fifth year in Michigan and second in Nebraska. This brief contains full results and…