Our Research

Commonwealth conducts original qualitative and quantitative research with financially vulnerable people—including Black, Latinx, and women-led households who disproportionately experience financial insecurity. We also interview industry experts and academics. We take what we learn and translate findings into actionable insights and practical solutions designed to change systems to work better for financially vulnerable people. We work with community groups, employers, financial services firms, fintechs, policymakers, and workplace solution providers to design and test real-world, practical solutions that not only work for individuals and families, but are also scalable and address the business needs of our partners.

We share the results of our work to provide you with innovative ideas, practical insights, and the tools you need to act. Explore our publications below.

Preparing for Care

Unpaid elder caregiving is a growing reality for millions of American households, yet many people step into caregiving roles without the financial preparation or support they need. Preparing for Care: Financial Insights for Future Caregivers, Employers & Providers examines how…

Building an Emergency Savings Program That Works

This case study with The Fresh Market shares lessons from testing two emergency savings solutions—one digital and one in-person—while also offering access in the retirement plan to the SECURE 2.0 Act’s $1,000 emergency withdrawal provision—providing employers with practical guidance to…

Driving Impact

Discover how a major healthcare employer, in partnership with Commonwealth as part of BlackRock’s Emergency Savings Initiative, achieved record engagement with a workplace emergency savings program while supporting retirement plan participation.

Earning Trust with Every Interaction

Conversational AI has enabled financial services providers to support customers 24/7 at a scale that would be impossible with live agents, and has become a ubiquitous part of the digital banking landscape. Yet significant opportunities remain for this technology to…

Transforming Workplace Benefits into an Engine for Financial Health

This new national report draws on a survey of over 2,000 workers earning low-to-moderate incomes (LMI) across key industries to understand their financial priorities, access to workplace benefits, and the opportunity for employers to improve financial outcomes through intentional benefit…

Unlocking Opportunity

U.S. Bank and Commonwealth teamed up in a bold, cross-sector partnership to help clients turn tax refunds and bonuses into lasting savings. Using behavioral science and a test-and-learn approach, the pilot introduced a simple pre-commitment feature that encouraged saving at…

Understanding Today’s Retail Investor

Part of The Investor Diaries project and supported by the BlackRock Foundation, this groundbreaking report uncovers what’s fueling a powerful movement in the investment landscape: the rise of retail investing among people living on low-to-moderate incomes (LMI).

Intentional Employee Benefits That Support Retirement Savings for Workers Living on Low to Moderate Incomes

This brief explores six promising workplace financial benefits—workplace savings, student loan retirement matches, education savings, healthcare savings, employee equity, and tax time supports—that protect and strengthen retirement savings for workers living on low to moderate incomes. Supported by JPMorganChase, this…

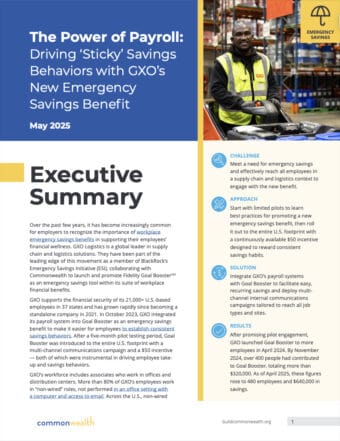

The Power of Payroll

Over the past few years, it has become increasingly common for employers to recognize the importance of workplace emergency savings benefits in supporting their employees’ financial wellness. GXO is a global leader in supply chain and logistics solutions. They have…

How AutoNation Brought a Multi-Solution Emergency Savings Benefit Program Access to 24,000 Employees

AutoNation approached Commonwealth to understand how to support employee financial security through emergency savings benefits and investments in financial health. As part of BlackRock’s Emergency Savings Initiative (ESI), AutoNation, Voya, Commonwealth collaborated to identify, launch, and drive engagement with an…