Inclusive product design is a crucial lever for improving financial security and opportunity for people traditionally left out of the financial system. In this blog post, we define inclusive financial product design as a process that ensures the needs, wants, and aspirations of people living on low to moderate incomes (LMI) — disproportionately Black, Latinx, and women-led households — are integrated into financial products.

Today, as new fintech companies — especially those participating in FinTech Sandbox — obtain funding, develop their product roadmap, and find product-market fit, Commonwealth has developed this Inclusive Product Design toolkit to support research and product development processes that advance a more equitable financial system.

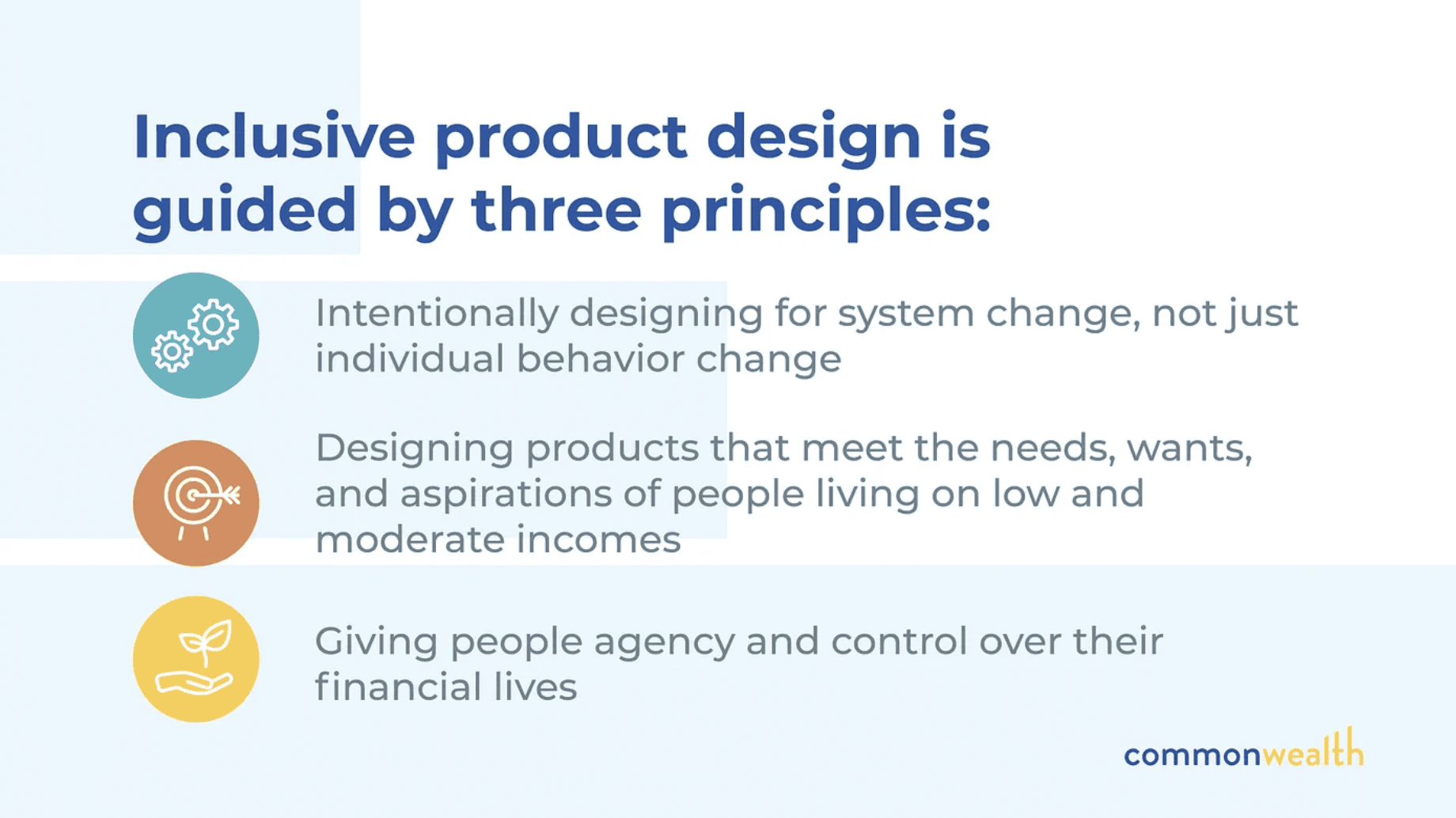

In practice, it is guided by the following three principles:

- Intentionally designing for system change, not just individual behavior change

- Designing products that meet the needs, wants, and aspirations of people living on low and moderate incomes

- Giving people agency and control over their financial lives

An Inclusive Product Design Case Study with Emergency Savings

Inclusive product design has proven real-world results. Commonwealth’s work to scale access to emergency savings shows how the design framework has helped implement solutions that have supported 10 million people earning LMI save more than $2 billion in liquid cash savings.

In 2019, Commonwealth joined BlackRock’s Emergency Savings Initiative(ESI) to tackle that crisis in short-term savings faced by people in the U.S. earning LMI. America is in an emergency savings crisis: nearly four out of 10people can’t easily access $400 in cash — that increases to nearly 60% of households making under $60,000 who struggle to come up with $400 for an unexpected expense.

As a leading expert within BlackRock’s ESI, Commonwealth has followed a systems change approach to solving this emergency savings problem. Following the first principle in the Inclusive Product Design toolkit, Commonwealth looked for infrastructure systems where embedded emergency savings solutions would impact not just individual behavior but many people. ADP — the nation’s largest provider of payroll services, reaching one in six workers in the U.S. — exemplifies this in offering a high-quality emergency savings option through its Wisely® card* and myWisely® mobile app**. Through BlackRock’s ESI, Commonwealth and ADP collaborated to learn more about the emergency savings needs of both employees and employers, translating the learnings into enhanced high-quality savings features available to all Wisely® cardholders, offered through the myWisely® mobile app.

Research is another critical part of following the Inclusive Product Design framework. In the partnership with ADP, Commonwealth collaborated on research and identified four ways ADP’s myWisely app*** could meet the emergency savings needs of their consumers: 1) Multiple, customizable savings envelopes**** 2) Automated payday transfers to savings; 3) Customized scheduling of savings transfers; and 4) Gamification to turn cash rewards**** from card use into savings. Prior Commonwealth researchshowed that for people earning LMI, emergency savings solutions should be fully liquid, have no fees, and offer the ability for an individual to determine when and how the funds are used.

Incorporating features improvements to the app resulted in an increase in total savings from $199 million to $1.55 billion, a 3.5x increase in monthly average new users of the savings envelopes^, and 2.7x growth in net savings inflows (savings less withdrawals).^^ The surges in uptake and utilization show the power of product design that is responsive to consumer needs and aspirations.

More details about ADP’s case study, as well as other partner case studies that leverage the Inclusive Product Design principles, are included in a new impact report, BlackRock’s Emergency Savings Initiative: Impact and Learnings (2019–2022).

An Opportunity for Fintechs to Prioritize the Needs of People Earning LMI

Emergency savings is one critical step in the journey to financial security for people earning LMI. As Commonwealth’s work with BlackRock’s ESI has demonstrated, using inclusive product design to build and scale products can have a profound impact and create real-world results.

Having an inclusive focus is an area of opportunity for fintech companies and where they can lead the way for the broader industry. Another recent brief from Commonwealth captured provider perspectives from financial service incumbents. The report uncovered that a focus on the needs and financial security of households living on LMI is not a priority for many traditional financial service providers.

Inclusive product design can be used to address all parts of the financial lives of people earning LMI, whether that is borrowing a home loan, saving for education or retirement, or managing credit and debt. The key is that their needs, wants, and aspirations are centered from the start — never ignored or tacked on as an afterthought.

While the focus of the design principles is on people earning LMI, it is essential to recognize that income is highly intersectional with race, ethnicity, and gender equity issues as well — which means using the principles is not just solving for income equity, but can potentially multi-solve for many different parts of the financial security journey across many populations.

We hope product designers, founders, and others involved in fintech product development, consider using inclusive product design as they move forward with their offerings.

To learn more about inclusive product design principles and use them in your organization’s product development work, download our toolkit here.

Join Commonwealth’s mailing list to stay current with our latest research, partner case studies, and news.

About Commonwealth

Commonwealth is a national nonprofit building financial security and opportunity for people earning low and moderate income through innovation and partnerships. Black, Latinx, and women-led households disproportionately experience financial insecurity due in large part to longstanding, systemic racism and gender discrimination. Addressing these issues is critical to Commonwealth’s work of making wealth possible for all. For nearly two decades, Commonwealth has designed effective innovations, products, and policies enabling over 2 million people to save nearly $8 billion. Commonwealth understands that broad changes require market players to act. That’s why we collaborate with consumers, the financial services industry, employers, policymakers, and mission-driven organizations. The solutions we build are grounded in real life, based on our deep understanding of people who are financially vulnerable and how businesses can best serve them. To learn more, visit us at www.buildcommonwealth.org.

About BlackRock’s Emergency Savings Initiative

BlackRock announced a $50 million philanthropic commitment to help millions of people living on low to moderate incomes gain access to and increase usage of proven savings strategies and tools — ultimately helping them establish an important safety net. The size and scale of the savings problem requires the knowledge and expertise of established industry experts that are recognized leaders in savings research and interventions on an individual and corporate level. Led by its Social Impact team, BlackRock is partnering with innovative industry experts Common Cents Lab, Commonwealth, and the Financial Health Network to give the initiative a comprehensive and multilayered approach to address the savings crisis. Learn more at www.savingsproject.org

* The Wisely Pay Visa® is issued by Fifth Third Bank, N.A., Member FDIC or Pathward, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. The Wisely Pay Mastercard® is issued by Fifth Third Bank, N.A., Member FDIC or Pathward, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. The Wisely Direct Mastercard is issued by Fifth Third Bank, N.A., Member FDIC. ADP is a registered ISO of Fifth Third Bank, N.A., or Pathward, N.A. The Wisely Pay Visa card can be used everywhere Visa debit cards are accepted. Visa and the Visa logo are registered trademarks of Visa International Service Association. The Wisely Pay Mastercard and Wisely Direct Mastercard can be used where debit Mastercard is accepted. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

** Standard text message fees and data rates may apply.Amounts transferred to your savings envelope will no longer appear in your available balance. You can transfer money from your savings envelope back to your available balance at any time using the myWisely app mobile app.

*** See footnote **

****Amounts transferred to your savings envelope will no longer appear in your available balance. You can transfer money from your savings envelope back to your available balance at any time using the myWisely app mobile app.

^ See footnote ***

^^ See footnote ***