The emergence of new technologies has a major impact on financial security and opportunity at every level of society. Too often, however, the design of new technologies does not take into account the needs of and potential benefits for households living on low and moderate incomes (LMI). As a result, new technologies may end up deepening inequity by focusing only on the needs of people with greater financial resources.

Commonwealth’s Emerging Tech for All (ETA) initiative aims to ensure that, as the next generation of emerging technologies develops, the needs, wants, and aspirations of people living on lower incomes are understood and integrated into the design of new financial technologies. We are shedding light on these perspectives by partnering with financial organizations, fintechs, and platform providers who implement emerging technologies to research the needs and wants of customers living on LMI.

Our first ETA report surveyed 1,200 individuals living on LMI in the United States and revealed a marked increase in the use of digital banking, financial apps, and chatbots during the COVID-19 pandemic. The growth of digital banking and related technologies like chatbots and automated financial management provides an opportunity to learn about how customers living on LMI can benefit from them and how financial actors can design products that meet these consumers’ needs and preferences.

Building on the trends identified in that survey, Commonwealth recently conducted a field test in partnership with conversational AI provider Boost.ai and Michigan State University Federal Credit Union (MSUFCU). MSUFCU introduced their chatbot Fran in 2019; after her re-release at the end of 2021, we surveyed and interviewed a sample of credit union customers living on LMI, oversampling for Black customers, to better understand how people use chatbots, what they want from them, and what concerns remain that might act as barriers to use. While a lack of access to local bank branches disproportionately affects lower income communities, financial chatbots may offer a key path to ensuring equitable access to financial services for populations without easy access to a physical bank branch.

In this first field test, we’ve identified three areas where chatbots can be designed for maximum accessibility and value for customers living on LMI:

- Chatbots should be designed to complement support from human agents, not entirely replace it

- Chatbots should be action-oriented and able to execute tasks, not just provide information

- Chatbots can overcome widespread security concerns and build trust by being transparent about security and data storage practices

Each of these insights is discussed in more detail below.

Chatbots should complement human agents, not replace them

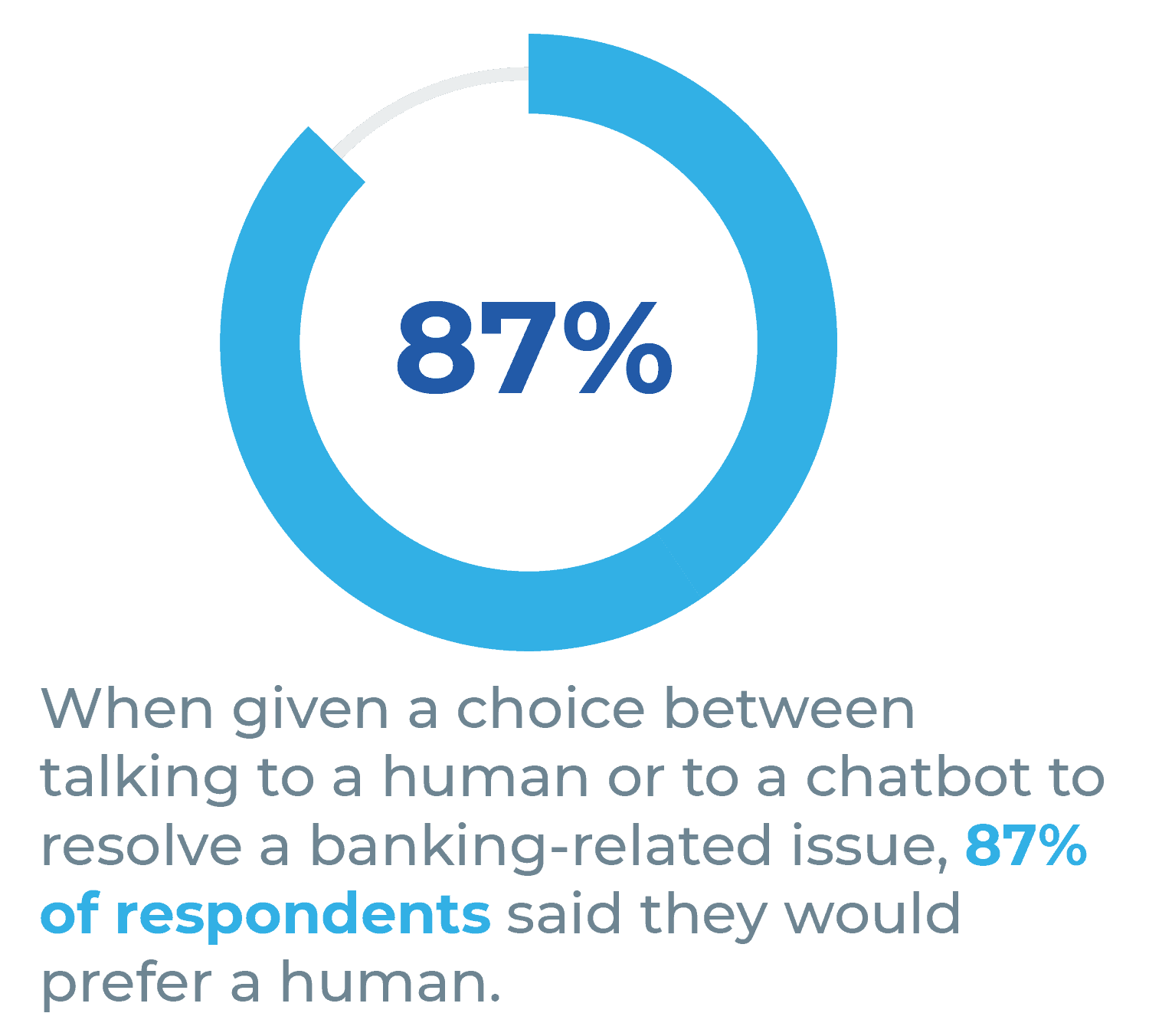

While use of and comfort with chatbots has increased significantly since the pandemic, participants retain a strong preference for interacting with a real person–especially for more complicated issues. When given a choice between talking to a human or to a chatbot to resolve a banking-related issue, 87% of respondents said they would prefer a human. When asked to select their highest priority chatbot features from a list, the most frequent choice was the ability to connect to a human agent (75% selected this). At the same time, when participants were asked to choose between a chatbot or a human for more specific use cases, the chatbot came out ahead for several straightforward tasks like reporting a card stolen or sending payments. These cases are discussed in the next section.

Interview discussions revealed that participants often become frustrated when a chatbot is unable to accurately identify or answer their questions and that, over time, these experiences can discourage them from using chatbots at all. Making it easy to move from a chatbot conversation to a live agent can improve openness to financial chatbots by creating a pathway to solutions rather than a potential dead end.

Financial chatbots should be action-oriented, not just informational

Although chatbots are perhaps most commonly thought of as sources of information that can provide guidance or recommendations, our research suggests that the ability to complete basic transactions through a chatbot interface has significant appeal. While only 8% of respondents would prefer a chatbot to a human for resolving a banking-related issue and 13% would prefer a chatbot for receiving financial advice, 36% of respondents said they would rather talk to a chatbot than a human to send payments or complete banking transactions. This is reflected in MSUFCU’s firm-wide chatbot usage data, which finds that in the last quarter of 2022, the chatbot intent most frequently accessed by members was transferring money to other financial institutions.

When asked about potential situations in which a chatbot might be useful, interview participants consistently noted a desire to be able to complete simple actions like reporting a lost card or arranging payments to others. At the same time, they were more hesitant to use a chatbot for tasks that involved more complex questions or judgments such as asking for a fee to be waived or making investment decisions. These trends point toward the potential benefits of more fully integrating online banking actions into chatbot interfaces so that they function not just as information sources, but as virtual bank tellers. This function is especially important given the decline in access to local bank branches, which disproportionately affects lower-income communities.

When asked about potential situations in which a chatbot might be useful, interview participants consistently noted a desire to be able to complete simple actions like reporting a lost card or arranging payments to others.

Trust remains a significant barrier to chatbot utilization

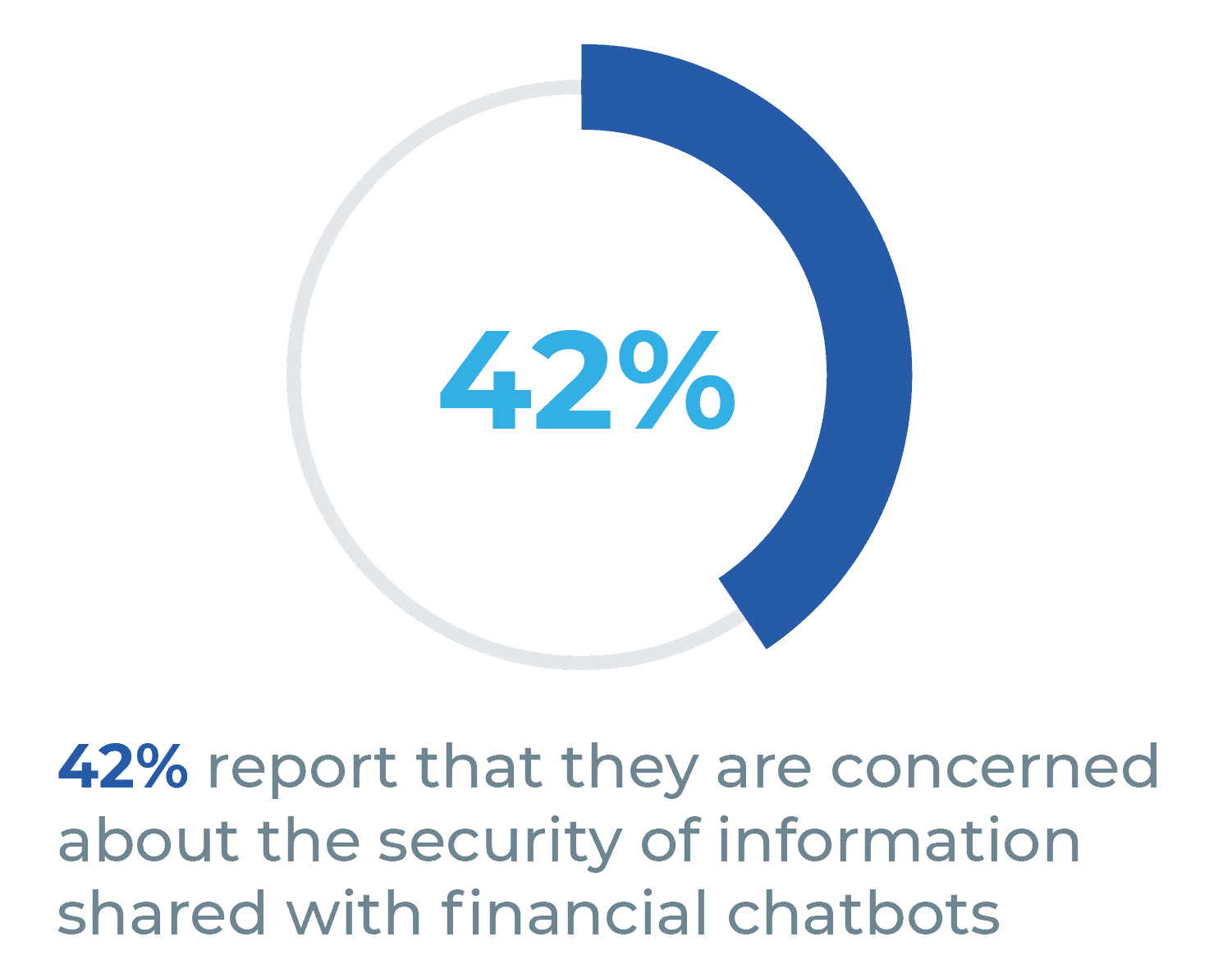

While only 17% of respondents report that they would not feel comfortable using a chatbot, a lack of trust in the effectiveness of chatbots and in the security of data shared with them remains a significant barrier to broader use. While 41% agree that they would trust a chatbot to provide correct answers to financial questions, only 28% trust them to provide effective solutions to specific financial issues they are facing. Additionally, 42% report that they are concerned about the security of information shared with financial chatbots. This lack of trust was reflected in our interviews with participants, many of whom were concerned about the permanent nature of digital records compared with receiving assistance through a phone call.

Trust in chatbots will likely increase as chatbot functionality improves. Participants who had previously negative or unhelpful experiences with chatbots were less likely to trust them in the future. Customers may also trust chatbots more when they are given clear information about what data from the conversation is being stored and by who. Being clear about what data is collected, or giving customers the option to control privacy settings can give them a sense of agency that increases trust in chatbot interactions.

Next steps

The results of this work provide some initial guidelines for thinking about how financial chatbots might be designed to best address the needs of communities living on LMI. Still, there is much work to be done to develop these initial insights into a robust body of research supporting the development of inclusive design in conversational AI. Getting useful data on chatbot usage by specific groups can be challenging because usage is both infrequent and driven by unpredictable financial or life events—very few people use chatbots frequently or regularly. We plan to build on these initial insights with a larger and longer field test that allows us to analyze a large volume of chatbot interaction records to observe how people are using them in real time.

Commonwealth’s Emerging Tech for All initiative is continuing with a second field test focusing on automated digital finance and will be releasing a design toolkit for these technologies in summer 2022. In the next year, we plan to build on these insights with larger pilots that allow us to rigorously test the impact of different design choices. Stay tuned on our website and sign up for our newsletter to receive updates on this research. If you are interested in partnering with Commonwealth to advance this impactful work together, reach out to Charles de la Cruz at info@buildcommonwealth.org.