Commonwealth 2027Enabling 10 Million Families to Build $15 Billion

Building Financial Security & Wealth for Low-to-Moderate Income (LMI) Households

Make the workplace an engine of financial security & wealth

Democratize capital market investing through solutions in partnership

Unlock wealth opportunities through AI and emerging tech

Building Financial Security, Enabling Wealth, Transforming Households

Vision 2027

Commonwealth is committed to creating financial security and wealth for all. By 2027, our strategic plan will enable 10 million families to build $15 billion in wealth through systemic workplace, financial, and tech solutions.

Financial insecurity and wealth gaps remain widespread, sparking concern and deeply harmful consequences for households, communities, employers, and the economy. We ensure that the needs and aspirations of LMI people are understood, visible, introduced early into relevant conversations, and integrated into solutions.

Let’s build the future together.

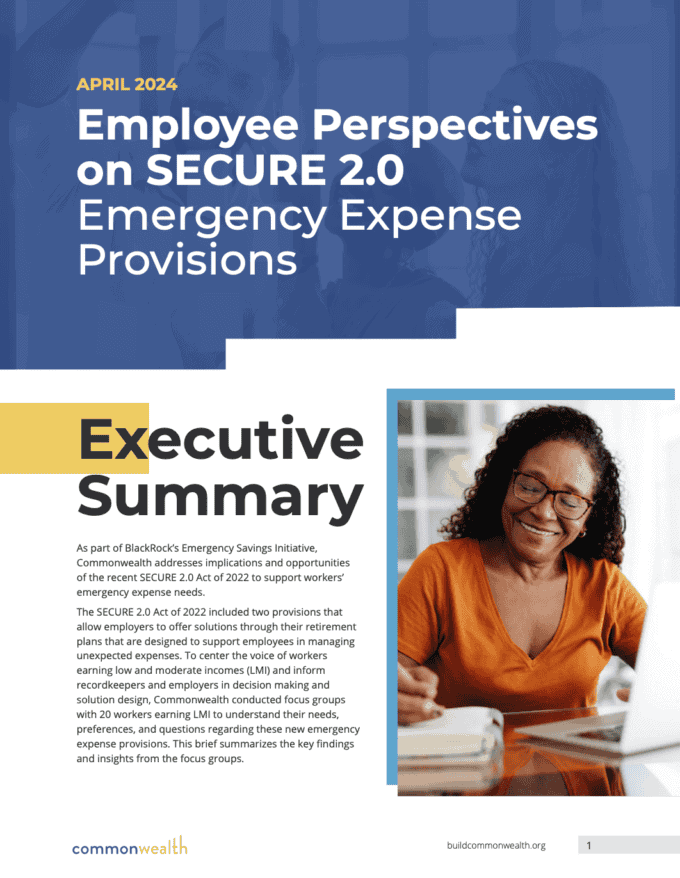

Workplace Financial Benefits

Financial security should be a given for all working people, and employers have a unique opportunity to help make this a reality. Wages are critical but insufficient alone. By offering emergency savings and other programs, debt repayment support, and better tax incentives, employers can empower employees to achieve greater financial stability.

I have a lot more confidence in my financial foundation knowing that I have money elsewhere.”

Autonation Employee

Employee Perspectives on SECURE 2.0: Emergency Expense Provisions

Read more on our Workplace Financial Benefits initiatives

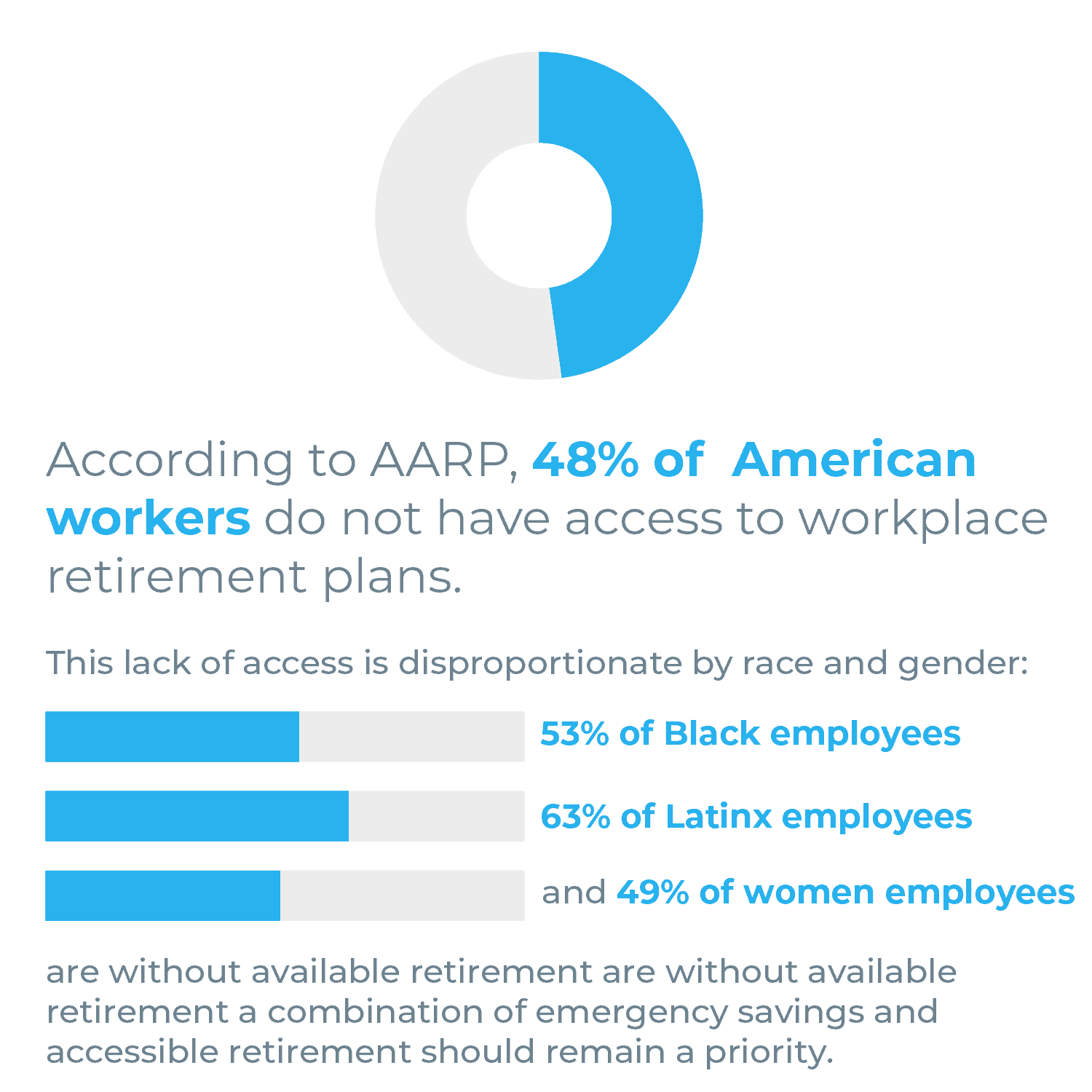

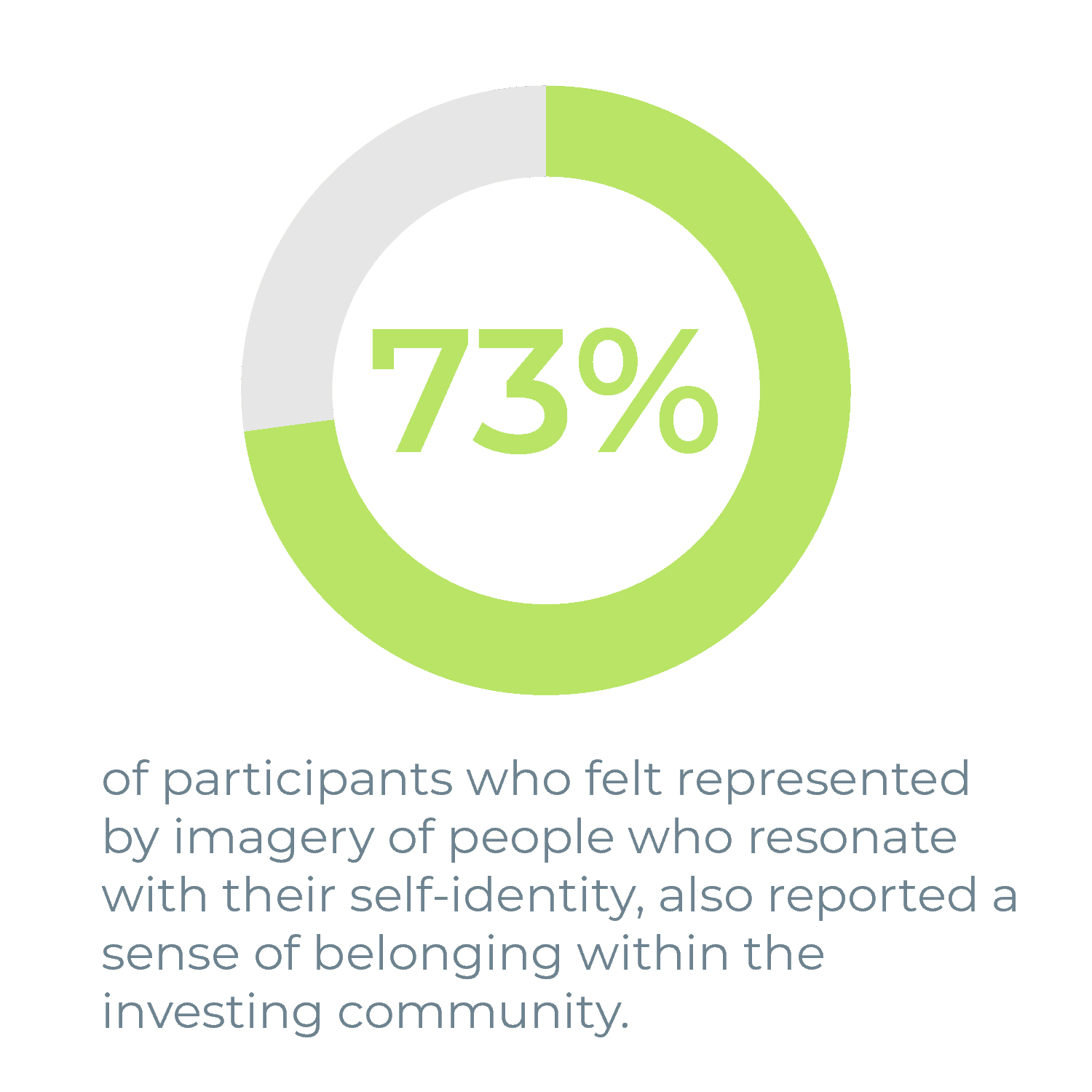

Inclusive Investing

Too few working people to build wealth through capital markets underscores the need for systemic change. Creating more inclusive platforms, products, and services enables people with modest incomes build wealth.

It started off with just making those recurring investments, starting off at, you know, from $5 to $10, $50 to $100 a paycheck and like ramping up.”

Christian, investor diaries participant

Transforming Investor Identity Report

Read more on our Inclusive Investing initiatives

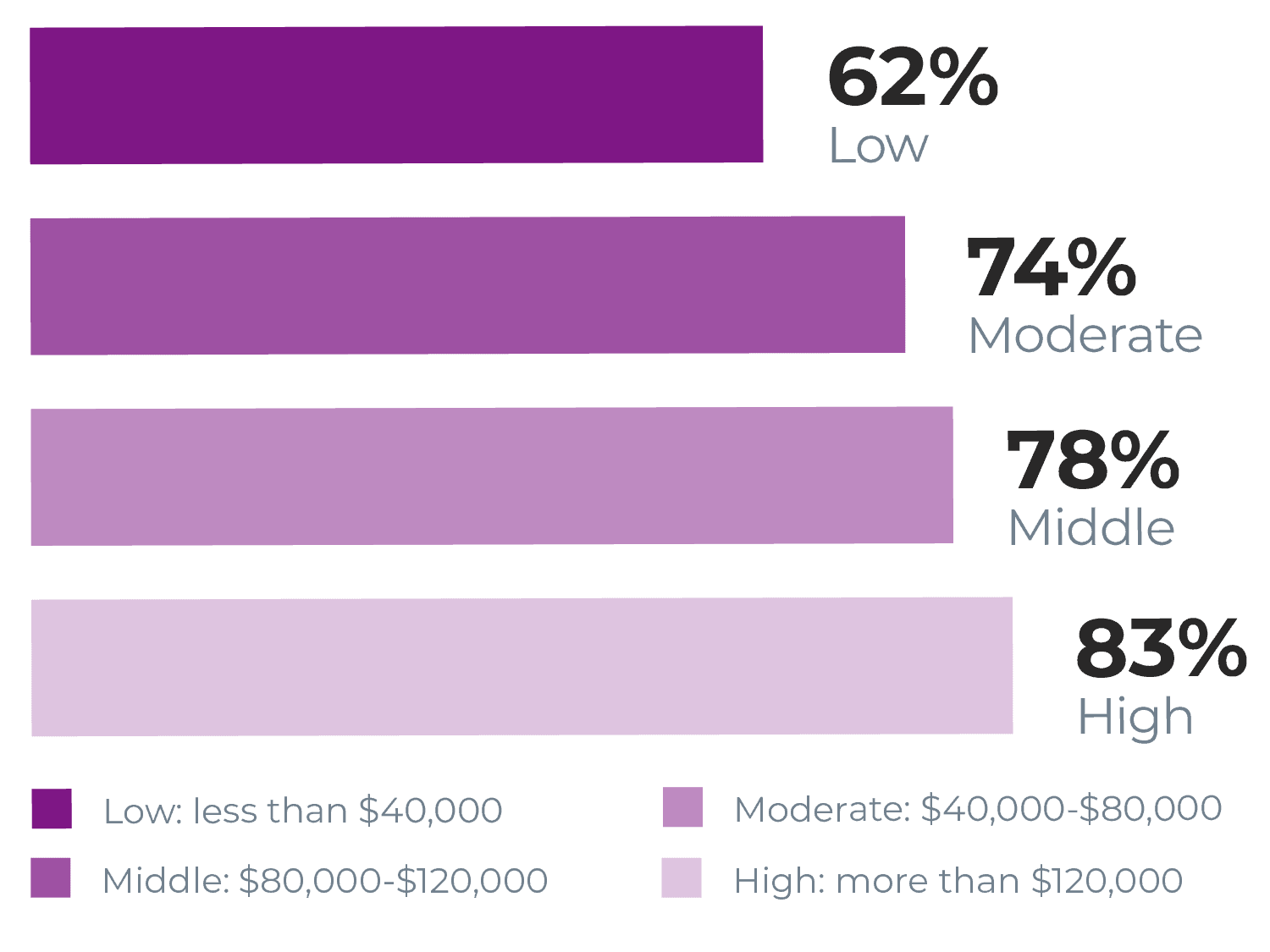

Financial AI

Realizing the full potential of financial technology as a democratizing force means addressing the unique needs of all audiences, including those with low-to-moderate incomes.

The findings suggest there is a significant relationship between individuals’ financial situations and their specific concerns and preferences regarding financial technologies such as chatbots and virtual assistants.”

From our report, Emerging Technology for All:Conversational AI’s Pivotal Role in Improving Financial Security and Opportunity

A Pivotal Juncture For Financial AI

Comfort with digital banking, by income level

Read more on our Financial AI initiatives

Reshaping Financial Systems

Through action-oriented innovation, Commonwealth is reshaping the financial industry to better serve individuals with low-to-moderate incomes. We do this by collaborating with partners, policymakers, and employers on integrated solutions that transform communities and strengthen the economy by:

Expanding possibility

Collaborating with industry leaders to launch cutting-edge financial tools, security benefits, and transformative technologies.

Expanding access

Utilizing public, private, and social networks to deliver these solutions to more people.

Expanding impact

Driving widespread adoption to create lasting change in financial security and wealth-building.

Our Partners and Supporters