Toolkit: Unlocking Investor Identity

Introduction

Participants received funding in national study

In seed funding per person

Months of national research with beginner investors

Made possible by the generous support of the Nasdaq Foundation, with a special thanks to our field test investing platform partners Ellevest, Public, and Stash.

Cultivating an investor identity—a feeling of belonging in the investing space—is a critical but overlooked strategy to successfully attract, activate, and retain beginner investors who are living on low to moderate incomes (LMI). Investment providers that successfully address the systemic barriers to investor identity will capture one of the fastest-growing demographics joining online investing while supporting the wealth-building goals of an underserved market segment. People with low to moderate incomes were four times more likely to transfer funds to investment accounts in 2023 compared to 2015, according to a recent study.

Commonwealth research shows nearly two-thirds of women earning LMI expressed interest in investing, but just over one-third were doing so. For prospective investors earning LMI who are financially stable and primed to join the investing community, traveling the “last mile” to begin investing can be daunting if the user experience does not feel like it is designed with them in mind.

Our research shows that providing a sense of belonging, learning, agency, confidence, and connection for beginner investors earning LMI can foster an investor identity and make the process of starting less intimidating and more welcoming. Investing platforms and industry providers that address barriers to investor identity will acquire a loyal client base early in their investing journey, resulting in both top-line growth and reduced client attrition costs.

The Toolkit is part of the Transforming Investor Identity research project made possible by the generous support of the Nasdaq Foundation. This toolkit was informed by 863 beginner investors, who each received $150 in seed funding to invest at one of three retail platforms (Ellevest, Public, and Stash). Research was conducted over a year and included surveys, qualitative interviews, and platform data analysis.

64% of beginner LMI investors in the US earn between $50,000-$79,000

How to Use This Toolkit

This toolkit is designed with the practitioner in mind. It can be used by marketing, product, customer success, growth, and strategy managers who would like to better understand beginner investors earning LMI and pursue interventions specific to them.

The solutions included vary in level of effort from incremental, “low-hanging fruit” to new strategic initiatives. All of our recommendations are based on research conducted as part of a national study, collaborations with fintech platform partners, and extensive user feedback sessions. This work reveals exciting insights into how investment platforms can motivate the decision-making of beginner LMI investors who are eager to activate their investor identity.

The content is organized in sections corresponding to each stage of the consumer journey (attract, activate, and retain). We include ideas, tactical tips, and a downloadable checklist for reference.

Each section is structured like this:

- Customer Journey Phase – Key insights on how investors earning LMI evaluate if their investor identity needs are met during the attraction, activation, and retention stages.

- Challenge A summary of the pain points specific to beginner investors earning LMI, highlighting the opportunities that exist to convert and commit beginner investors.

- Solution Recommendations on how to approach the opportunities presented by investor identity challenges.

- Action Specific tactics tied to one or more solutions, that address investor identity barriers through levers targeting motivation, anxieties, and aspirations.

Download Our Investor Identity Toolkit Checklist

A Framework for Investor Identity

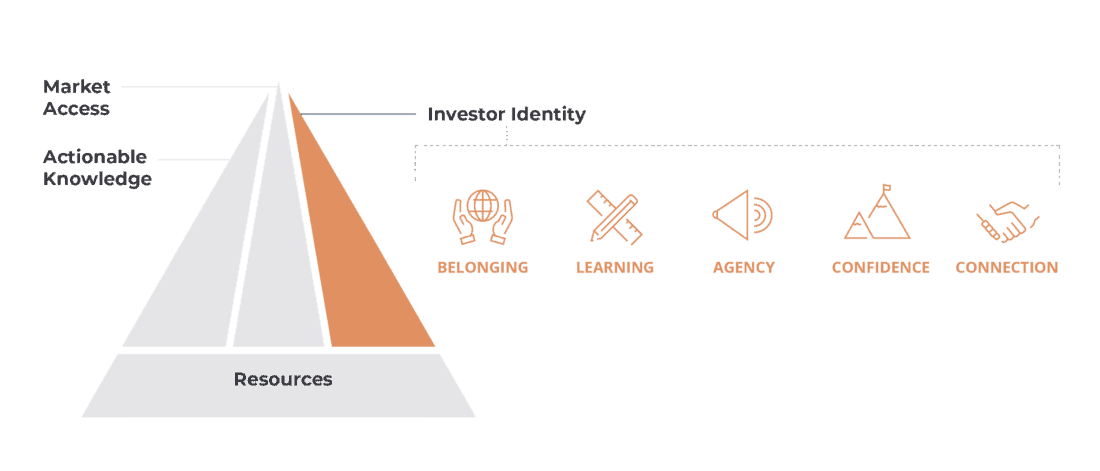

More than a feel-good state, investor identity describes a set of related attitudes and experiences that motivate beginner investors to start and continue their wealth-building journey.

Through the Transforming Investor Identity research project, we identified five components that make up an individual’s investor identity. (Read more about the research and framework here). Findings from this year-long study reveal compelling opportunities for reaching prospective investors who will start with small balances but have untapped potential to grow alongside their investment platform.

Key Findings

Impact of a Stronger Investor Identity

- Strong investor identity is associated with greater investor satisfaction, leading to increased engagement and referrals.

- Participants with a stronger investor identity at the end of the study plan to continue investing and are more likely to add deposits.

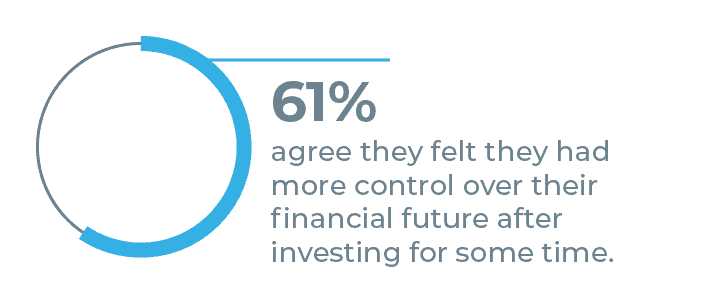

- Participants with a stronger investor identity felt more control in navigating uncertainty in their investments.

- Perceptions of how much investment capital is needed to be considered an investor shifted, from 28% to 36%, over the course of the study to include investments of $100 or less.

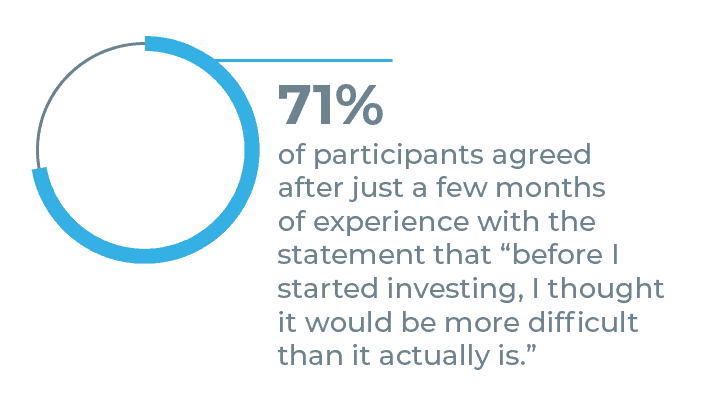

- 71% of participants agreed that investing turned out to be easier than they had initially thought.

Contributors to Developing an Investor Identity

- The growth in investor identity accelerated after the initial six months of investing compared to the first six months, reflecting the time needed for early learnings to begin to “click.”

- Representation matters; 73% of participants who felt represented by imagery of people who look and resonate with their self-identity, also reported a sense of belonging within the investing community, compared to just 44% of those who did not feel represented.

- Connecting with others improves the investing experience; however, the connection needs to feel both safe and reassuring.

- Emergency savings have a greater impact for retention. It is more important than income when investors decide to close their investment accounts.

The Investor Identity components are woven throughout the Toolkit’s recommendations to unlock opportunities and address core barriers for beginner, smaller-balance investors.

Research Insight

Participants with a stronger investor identity plan to continue investing and recommend investing to friends.

Download Our Report: Transforming Investor Identity Research Report

Investor Identity through the Customer Journey

Our in-depth research on investor identity, specifically for beginner investors earning LMI, revealed different barriers and opportunities for investment platforms to cultivate an investor identity across the customer journey. Investment platforms can pull various levers at the Attract, Activate, and Retain stages to tap into the tremendous potential to expand the marketplace by targeting people earning LMI who have a latent investor identity.

Attract

- People earning LMI and with an interest in wealth-building are eager to participate in capital markets. Uncertainty of whether they will feel like they belong or, worse, feel rejected in the investing community can be a deterrent.

- Addressing investor identity barriers can disproportionately benefit underserved demographics. Encouraging them to start investing, at whatever level, is the most effective way to change preconceptions of who can be an investor.

Activate

- Activation is the pivotal stage when smaller-balance investors either commit to their wealth-building journey or confirm their presumption that they do not belong.

- Investor identity strengthens and accelerates once early experiences start to “click” after six months of investing.

Retain

- The ability to maintain financial stability is necessary for the successful cultivation of investor identity.

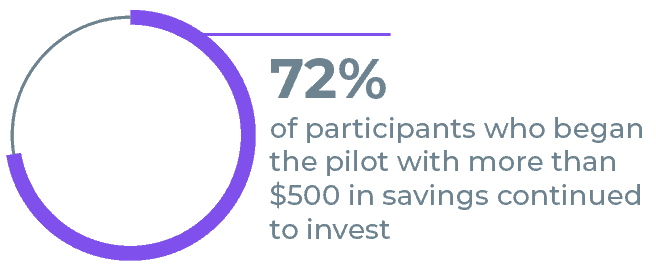

- Emergency savings matter more than income to predict the retention of beginner investors (as little as $500), and investing platforms are well-situated to provide helpful resources.

I feel like over the course of the [study], I {sic} don’t feel as stupid.

You don’t have to have all this knowledge about investing, you don’t have to have a bunch of money to do it.

And I feel like my anxiety surrounding it diminished over the past months with the investing experience.”– Late 30s, Black Woman

Attract

Prospective investors earning LMI are eager to begin their wealth-building journey. For them, becoming a part of the broader investment community is not only a financial decision but also a symbolic step towards economic advancement. However, this enthusiasm can be offset by their discomfort with uncertainty and presumptions of what they should know or how much in assets they should have before beginning to invest.

Investment platforms can also misinterpret beginner investors’ hesitancy and assume it is related to not earning enough income or a lack of interest in capital markets. The reality is that prospective investors living on LMI who have financial stability are looking for investing opportunities that feel comfortable and are right for them.

I felt really good that among all my friends and everybody that I know, I’m the one who’s starting early, I’m the one who’s a trendsetter here and I have a clear vision of the future that I’m building for myself. And I’m kind of happy that at least I know that I’m going to be above average in the future.”

– Early 20s, Black Man

Challenge: Small Starting Balances & Intimidating Context

- Beginner investors with small balances worry about uncertainty of returns and feelings of inadequacy. 45% of participants said risk prevented them from previously investing. Beginner investors enter investing spaces with a guarded approach. Investors earning LMI experience the opportunity costs more acutely as they often have more immediate financial needs, which leads to understandable anxiety about protecting what they have.

- Prospective LMI investors are looking for signs that they belong. These investors may not be as familiar with financial and investing terms, which can erroneously signal to them that they do not know enough or have enough to get started. Moreover, cultural and socioeconomic dimensions are at play and include an internalized skepticism of capital markets. As such, they have a need for support and reassurance throughout their decision-making process as they are onboarded.

Solution: Guidance and Reassurance

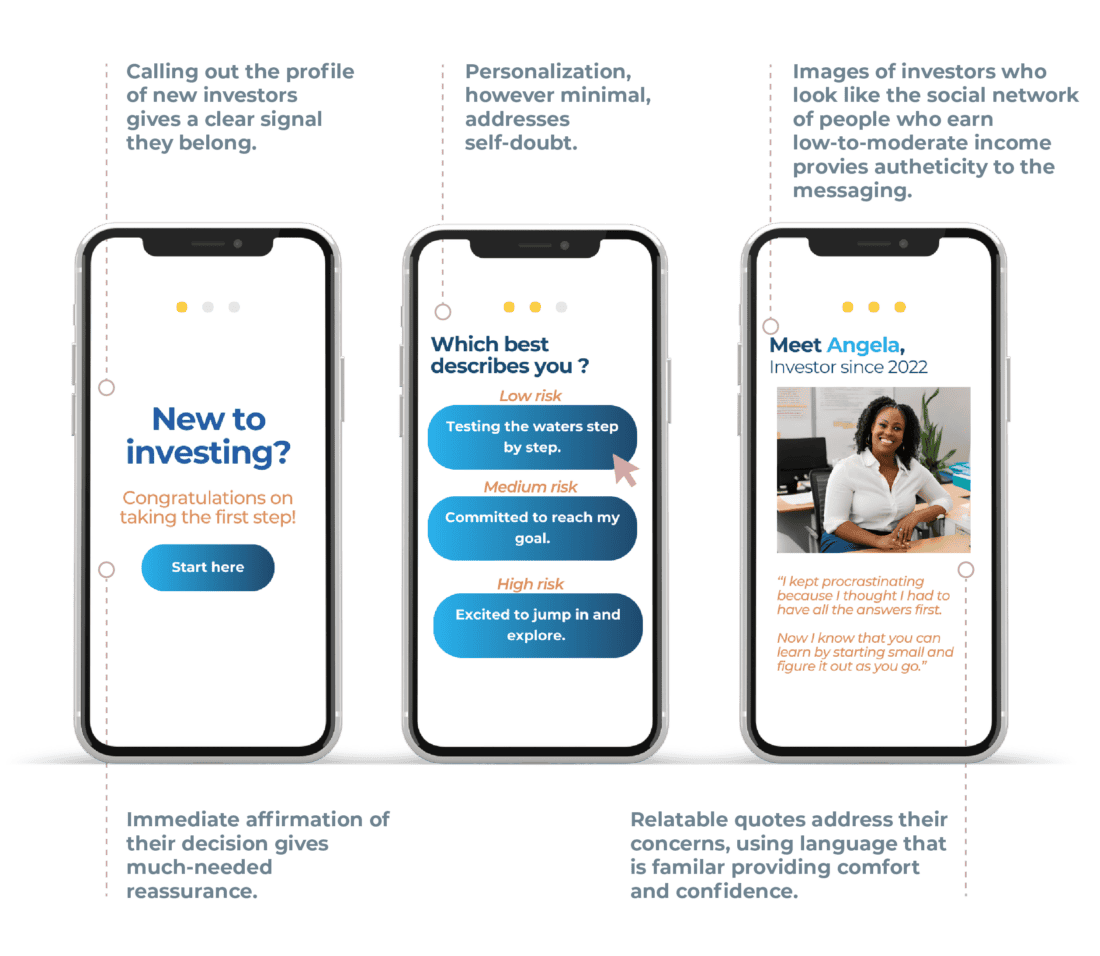

- Use an encouraging tone to counterbalance the intimidating nature of investing. For prospective investors who have lower investor identities, explicitly welcoming them through the attraction and acquisition process helps overcome their self-doubts of whether they have enough money or level of experience to start.

- Show how investors earning LMI who start with small balances are also part of the investing community and are thriving. Participants reacted positively to marketing and user experience (UX) mock-ups that addressed their profiles directly (e.g., “beginner investor” and “smaller-balance investor”) and celebrated the milestone of making the decision to start investing.

- Offer step-by-step reassurance to LMI investors as they make investment decisions. At every step of the sign-up process, beginner investors from LMI backgrounds question their own judgment and need encouraging feedback. Streamlining the decision-making process helps beginner investors climb their learning curve with more self-assuredness by demystifying the seemingly complex process into small decisions that build into investment strategies.

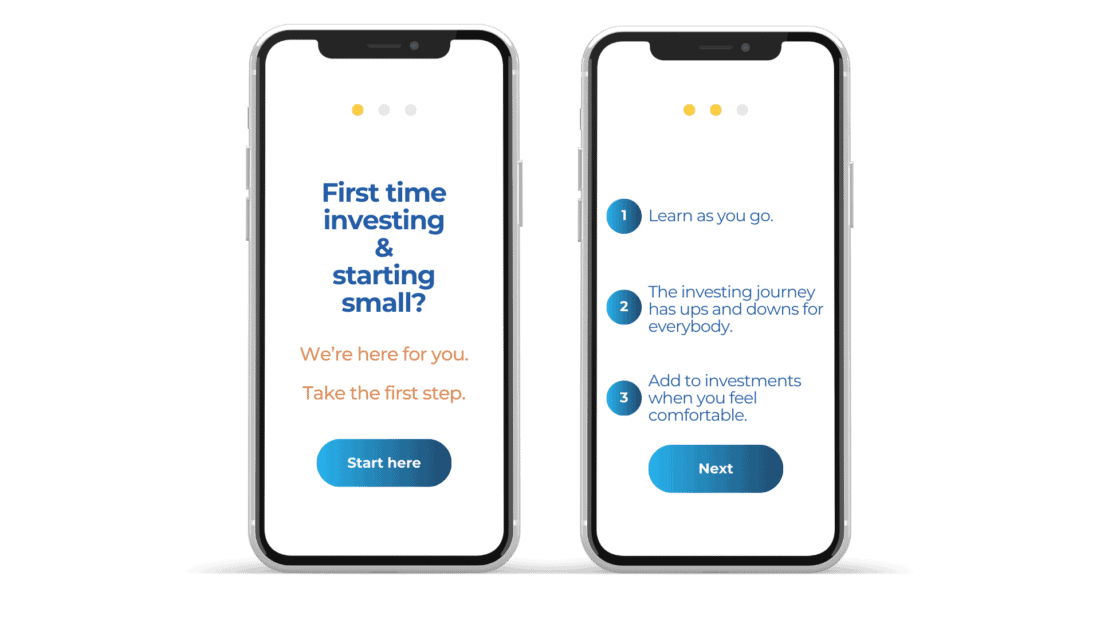

Action: Reframe, Normalize, & Simplify

- Reframe small balances as optimal for LMI investors to “learn-as-you-go,” emphasizing the value of experiential learning. Active learning is a keystone for identity building and research participants who developed a stronger investor identity were more likely to both increase their investment deposits and recommend investing to friends.

- Provide relatable analogies. All beginners, including those new to investing, feel relieved when they realize their anxieties are the same jitters experienced by everyone else when they start something new. Initiating the activity is an effective way to learn how to navigate the activity and starting small mitigates risks. “You can learn about swimming in the classroom but you only learn how to swim by getting in the pool.”

- Normalize the emotional journey of investing. Let beginner, smaller-balance investors know there are stages to the investing journey experienced universally. Incorporating this messaging during onboarding, throughout FAQs and in newsletters, internalizes the point.

Initially, there is excitement starting the experience, followed by optimism, then anxiety as either there are few gains or slight losses. More often than not, the moment passes either because the portfolio recovered or a rebalancing decision was made. Once the uncertainty passes there is renewed excitement, and the emotional journey starts again. With time and hands-on experience, the discomfort felt initially will diminish.

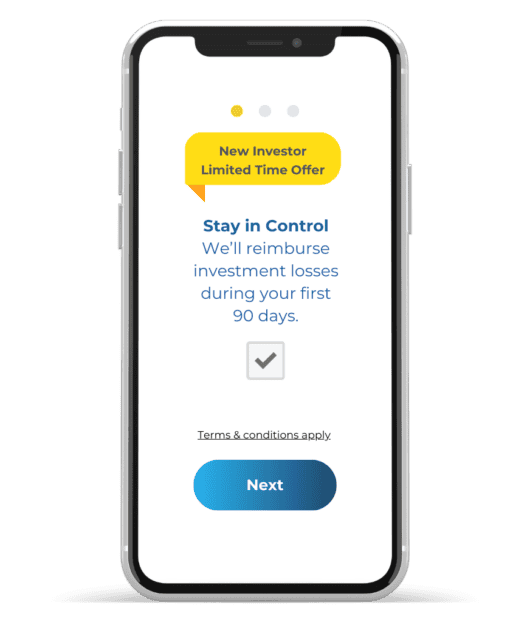

- Mitigate the sting of first-time losses. Consider a type of loss-recovery plan during the first three months of investing. Field tests of a loss reimbursement feature received overwhelmingly positive feedback from study participants. Reimbursing beginner investors up to a nominal amount (e.g., $20) in losses for a limited time overcomes the initial aversion to uncertainty. Investment platforms can consider this part of their customer acquisition cost (CAC), similar to incentives given when starting a new account.

- Reduce the perceived gravity of the initial investment decisions. Investors living on LMI overestimate the permanence of their investing decisions, especially early on. They will delay starting their journey or drop out of the acquisition process due to decision paralysis. Step-by-step guidance (rather than text-heavy educational resources) can address this. Something as simple as asking for their risk tolerance within a simplified interface provides a feeling of being walked through the process.

You’re not as dumb as you think you are about it and it’s easier than you think to get into it. They give you resources and you figure out your comfort level and keep learning.”

– Early 50s, Black Woman

I would have started the journey faster. It took me about a month and a half to two months to start [after receiving the seed funding] to make my first investment choice since I was unsure of what I was doing.”

– Late 40s, Black Woman

Activate

Activation is the most consequential step in the customer lifecycle journey for beginner, smaller-balance investors. Activation means converting a subscribing customer into one who is building a regular investment habit and is more likely to commit to a long-term horizon.

Identifying and building the investor identity and sense of belonging of investors living on LMI is foundational to activation. Beginner investors—across demographics—look for indicators that they do or do not belong. To investors earning LMI, commonly used graphs and financial jargon can be perceived as indicators that they do not belong. Small adjustments to user interface copy and visuals and a simplified user experience can go a long way to meet beginner investors at their starting point.

Research Insight

Perceptions of investing begin to shift during the activation phase as early foundational experiences start to “click.” During this pivotal period, beginner investors begin to have expanded views on who belongs in the investing community, including those who start with smaller balances and less experience.

Challenge: Isolation & Disengagement

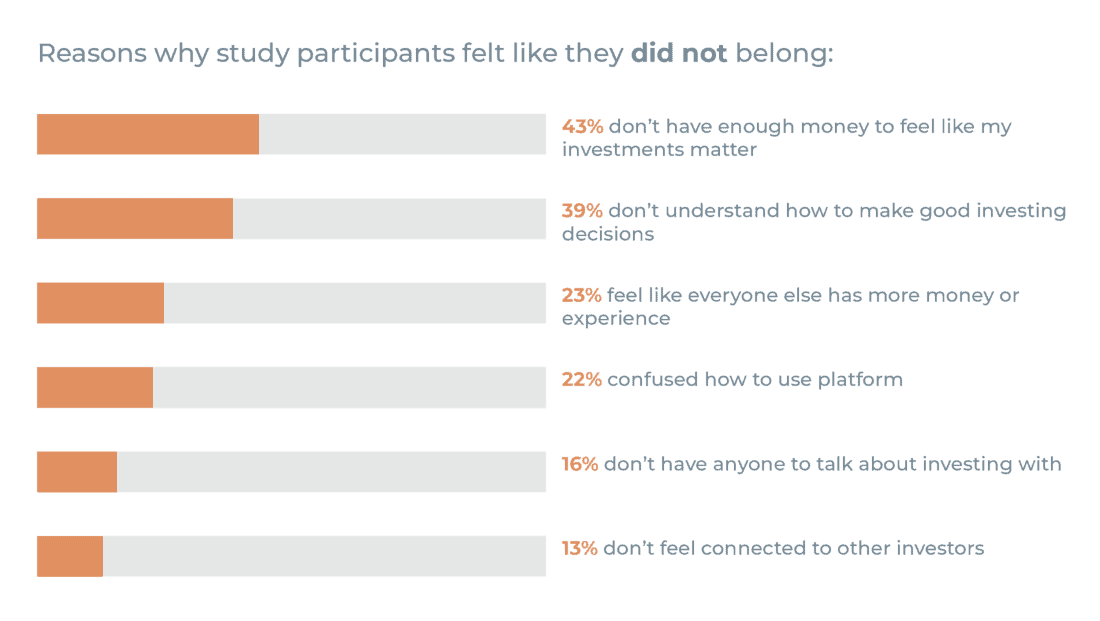

- Investors living on LMI start their investing journey on unsure footing. Participants expressed an isolating experience in their first few months. During this time they felt disconnected, and uncomfortable within the investing community. In short, they described a feeling that they do not belong.

- Investors start with an exciting curiosity that dissipates if they cannot engage further with their investments. Participants expressed a strong desire to explore investment opportunities after they started investing but did not know where to start or how to narrow the scope. When investors do not have access to instructional guidance or need to look up terminology in order to understand tools provided, they stop engaging.

- Smaller-balance investors do not have reliable access to sources of encouragement and guidance. Many beginner investors do not have social networks within which to share their journey and when seeking this network online, they risk feeling inadequate and discouraged.

Research Insight

White participants, compared to Black participants, were 2x more likely to go to family and friends for investing information.

Solution: Connection Within Judgment-Free Spaces

- Create dedicated spaces for beginner investors to interact. This will encourage participants to engage freely and send a strong signal of support and acceptance. Beyond one-to-one connections, broadening the language and images used during the activation phase helps include LMI profiles.

- Define milestones that are specific to a smaller-balance portfolio. Reminding beginner investors living on LMI of their progress and what they’ve learned along the way can validate their experience and activate their investor identity. This helps address the recurring self-doubt of “am I doing it wrong?” In particular, guidance from fellow smaller-balance investors resonates most and fuels their sense of belonging.

Tips participants would give to someone like them who is starting out:

Do not over analyze at the beginning, we are looking at the long term benefits.”

– Under 21, Black Man

Update yourself with the trends and news, but don’t get too attached to it. It will work great at times and sometimes it won’t, but do not lose hope.”

– Early 30s, Latinx Man

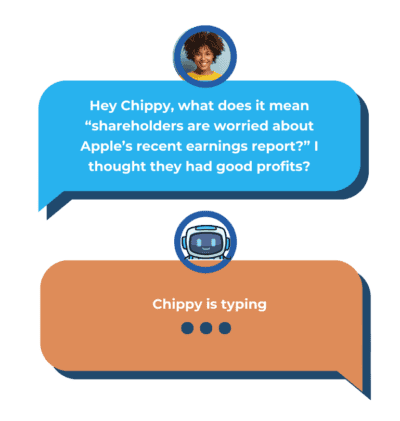

- Provide simplified guidance to help beginner investors begin exploring. Beginner investors avoid activities that could lead to embarrassment or feelings of inadequacy. Artificial intelligence (AI) tools and chatbots can be particularly helpful. Users express feeling less self-conscious interacting with AI tools compared with anonymous online communities or with live chat. Deepening a practical understanding of investing and encouraging exploration helps beginner, smaller-balance investors contextualize their portfolio in a relatable way.

Action: Celebrate, Demystify & Defy Expectations

- Showcase a wide range of smaller-balance investor profiles. This serves as a counterbalance to the perception of what an investor should look like. Spotlight stories of investors with similar profiles, including administrative workers, retail managers, and working parents, can address concerns and give practical tips in a way that resonates. Comparing the similarity of concerns across all beginner investors is reassuring for those living on LMI who assume their feelings of isolation are unique.

- Highlight early wins and recognize beginner LMI investors as trailblazers. Pointing out milestones along the journey of a beginner, smaller-balance investor helps them build momentum and resolve nagging self-doubts. Milestones can be specific to their investments and their experience, e.g., dividend distributions, quarterly earnings, first 30, 90, and 180 days. Redirect their focus from performance to patience, and provide examples that speak directly to their sense of belonging and recognize their achievement of forging a wealth-building path for themselves.

- Implement knowledgeable, judgment-free tools. AI tools (chatbots or search) present a particularly compelling solution for beginner investors. Investors living on LMI assume their questions are too basic (even when they are not) and prefer asking a non-judgmental chatbot, especially if they can do so in plain language and receive responses in simple terms.

- Beginner investors appreciate personalization features that feel customized to their decision-making process, e.g., risk tolerance, financial goals, and financial stability.

- One-on-one judgment-free spaces can encourage questions that seem too small, obvious or simple on another (more public) channel.

- Narrowing the scope of AI chat and search and providing them as tools for beginner investors removes a barrier to the development of their investor identity.

- Ask for and reward referrals to signal LMI profiles are valuable to the platform’s growth. Doing so can serve to encourage positive social interactions, thereby increasing investor identity. Just over half of participants (54%) reported speaking to someone about investing at least monthly. Of those, 67% said they felt like they belonged in the investing community, which is double the rate of belonging compared to people who did not connect regularly with someone about investing. Incentivizing referrals helps beginner investors activate their investor identity by encouraging them to engage in conversations about investing within their own social circle.

- Offer discovery tools that help investors explore without feeling overwhelmed. Providing step-by-step instructions in a conversational tone opens the door for beginner investors to walk through after their initial funding. Beginner investors want to better understand capital markets but don’t know how to go about it. Giving them ways to make equity investments personal, like exploring sectors they are interested in or companies in their home state, can quickly demystify their experience, bridging the gap between a stock ticker and the sneakers in their closet. As investment platforms plan their AI product roadmaps, building personalization features for investors earning LMI can yield strong activation from this demographic.

One thing that did excite me was when a notification about a dividend occurred of what I invested in.”

– Early 30s, Black Woman

Most confidence was when I bought some blue chip stocks, like the tech companies. I could tell that over time they’re actually making me money and even though maybe sometimes on the daily percentage, I might see that it fell by 2% today or 1% the other day. Overall, I could see the growth and I could tell that this is really going somewhere.”

– Under 21, Black Man

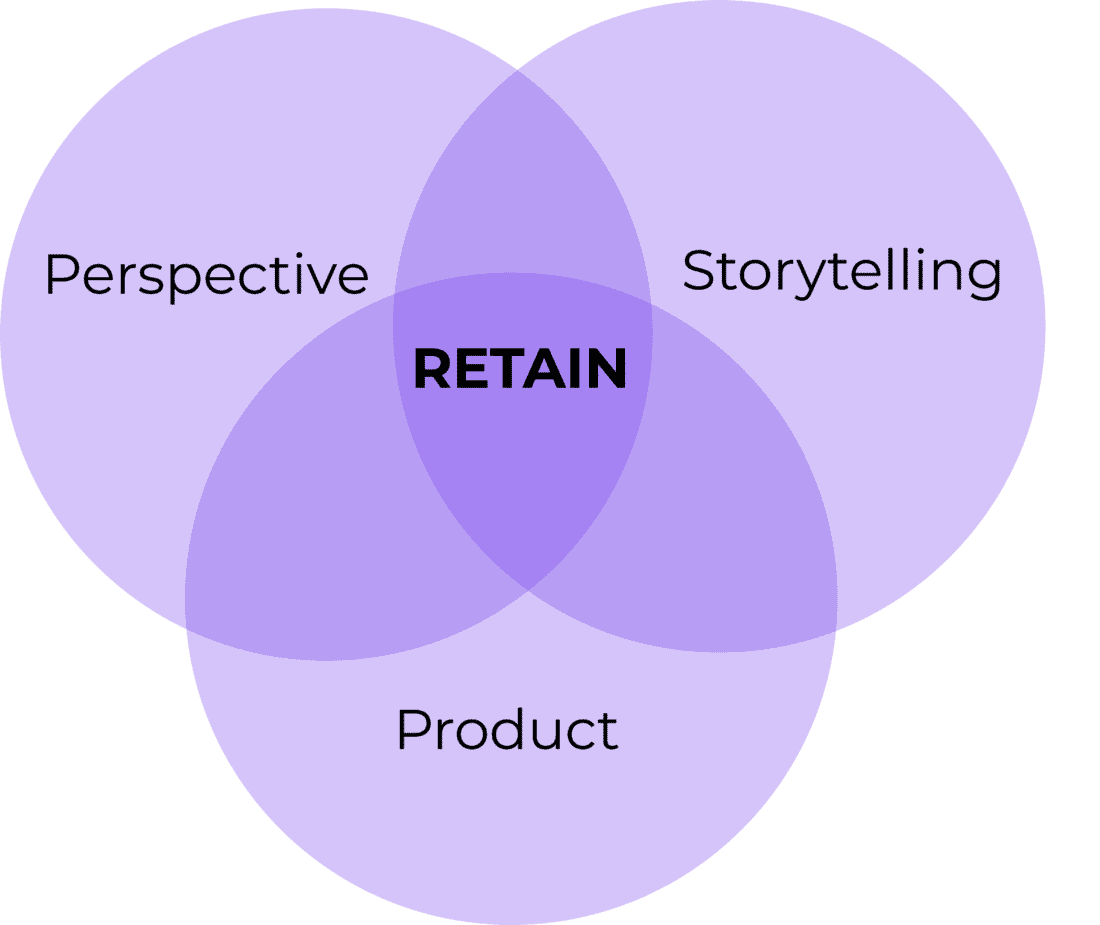

Retain

Beginner investors are eager to see a payoff and feel validated for their decision to start investing. For investors earning LMI, this can be difficult as their portfolio may not see much growth due to their small initial balance. Beginner investors are more susceptible to the emotional ups and downs as investments gain and lose value over time. Helping increase emotional resilience in beginner, smaller-balance investors can yield significant dividends in the reduction of attrition costs.

When investors living on LMI decide to leave an investing platform, it is likely the result of an extraneous circumstance, such as a financial emergency or the delayed outcome of not having been successfully activated. This includes investors who make an initial seed deposit to start investing and make other attempts to engage further but cannot find accessible footholds designed for beginners with small balances. Discouraged, they decide investing is not for them and withdraw their funds.

Challenge: Financial Instability & Discouragement

- Investors living on LMI may experience more instances of financial instability, prompting them to question the opportunity cost of their investment. The benefits of compounding gains over a long period of time take a back seat to immediate needs and anxieties. Specifically, investors who lack emergency savings are at a greater risk of stopping investing. Based on our research of participants who withdrew funds, there was no correlation to level of income but instead a strong correlation to amount of personal savings.

- Beginner investors feel isolated when they experience investment losses or slow gains. Without the ability to discuss the experience with others, they may assume the disappointing performance is an indictment of their decision-making as opposed to market fluctuations. At the beginning of the research study, 70% of participants had two or fewer people with whom they felt they could discuss investing. With the right support, beginner investors can be better prepared to anticipate this as part of the experience, rather than get caught off guard. Otherwise they will think the effort is not worthwhile and may withdraw their funds.

I currently feel like I’m doing it on my own. I don’t really have a group of people around me that I can talk about this stuff with. [People that] actually know what I’m talking about because they’re actively participating.”

– Early 50s, Black Woman

Solution: Practical Tools from Trusted Sources

- Tap into the power of storytelling by showcasing similar investor profiles to inspire and encourage. Relatable experiences from trusted sources can effectively build confidence and develop a sense of agency. Beginner investors search for proof points that can provide visibility into a journey that is not only successful but one they can follow.

- Partner with or provide tools, resources, and products that can address financial stability. For example, emergency savings offerings are becoming widely adopted and can be particularly helpful for investors earning LMI. This can validate the financial stability needs of investors, sending a reassuring signal of belonging. Commonwealth has extensive work and research demonstrating best practices for helping people build sufficient emergency savings. (Learn more about emergency savings.)

- Zoom out and give perspective to the investing experience. Provide beginner investors framing for the continual nature of investing. Showing what the most recent gain or loss looks like compared to the last five or 10 years provides a helpful perspective on how to think about investment horizons.

Action: Focus on Commitment-Building Interventions

- Use accessible voices that acknowledge the emotional moments of investing. Using plain language from a friendly source can humanize the experience for LMI investors. Journey metaphors with defined end goals and smaller-balance growth strategies can be effective. Collaborating with individuals (e.g., social media influencers) and organizations already established in marginalized communities, who can speak to these tactics and the emotional volatility of investing can be influential for beginner investors.

- Encourage the adoption of tools that can support financial stability. A way for people to build emergency savings alongside investing can provide alternate financial means and lessen the stress of near-term portfolio performance. This gives smaller-balance investments more runway to demonstrate their value for beginner investors living with LMI.

- Provide periodic performance comparisons across sectors and over time. Participants expressed a desire to be reassured with data, in addition to tone and messaging. Visual graphics and relatable analogy can help shift perspectives from short-term to longer-term. For example, “When you own a home, you don’t buy and sell every time there is an increase or decrease in value. Think of your portfolio the same way.” Or, give fact-based context by showing the last quarter’s performance as a slight blip in an index fund or stock market’s 10-year history.

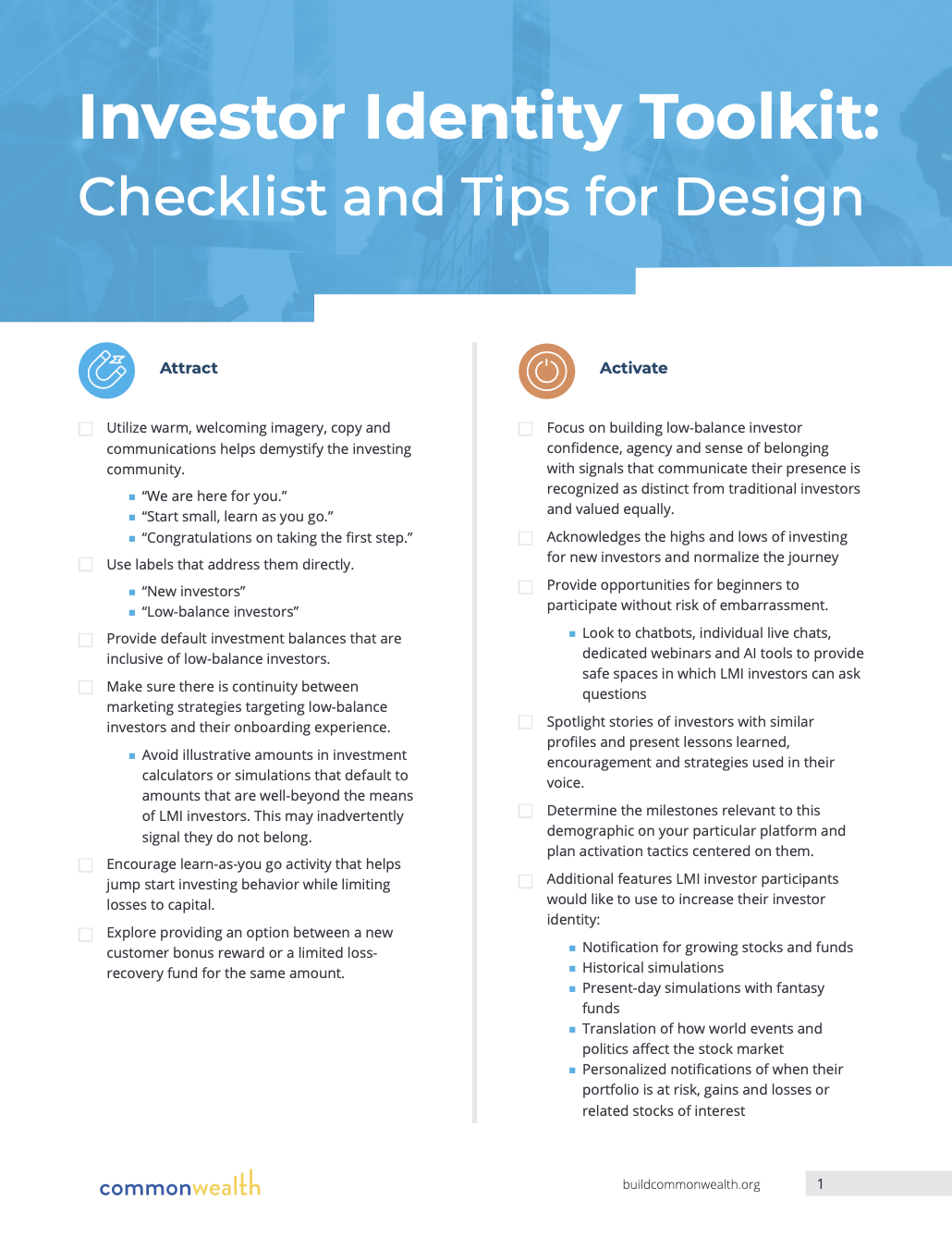

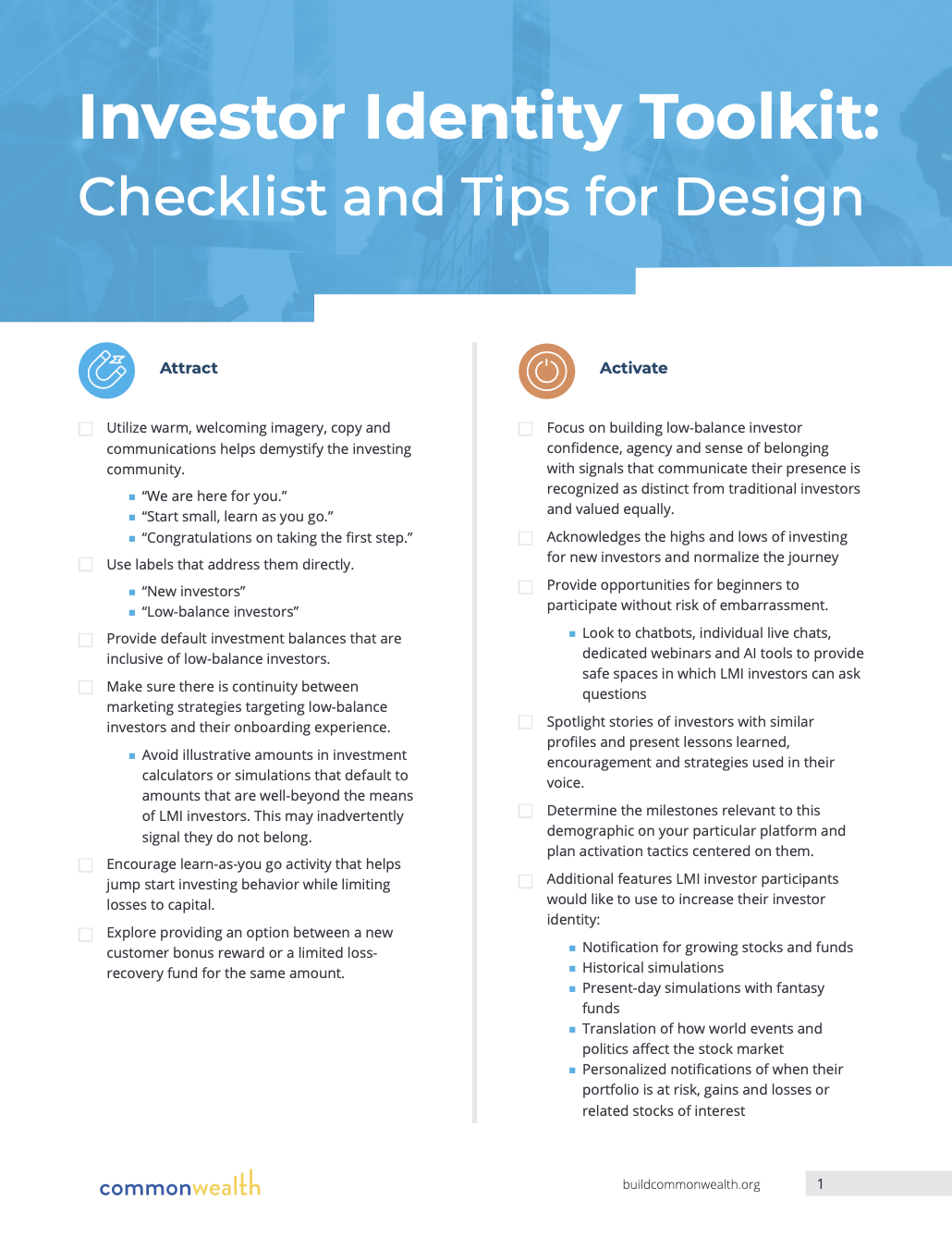

Investor Identity Toolkit: Checklist

Developing an investor identity is especially important for groups that have historically been excluded from investing and other wealth-building opportunities and who often start with a sense that these opportunities are not designed for them. Informed actions and strategies that investment providers can implement to better support this growing client base include:

- When they evaluate how to enter the investing ecosystem

- Whether they decide to start, and

- How long they stay

This downloadable checklist summarizes key takeaways from each customer journey phase and can be used as a guide for practitioners to explore and implement practices to better attract, activate and retain beginner, smaller-balance investors.

Additional Resources

Research that contributed to this toolkit:

Transforming Investor Identity: Early Research Insights from a National Pilot Project

Opportunities to Build Social Support for Beginner Investors

Invest Forward: Closing the Investing Gap for Black and Latinx Low- to Moderate-Income Women

A Framework for Inclusive Investing: Driving Stock Market Participation to Close the Wealth Gap for Women of Color

Additional relevant research from other sources

- Nasdaq Foundation New Investor Initiative Hub

- Design for Belonging: How to Build Inclusion and Collaboration in Your Communities, Susie Wise

- Intention-Action Gap Framework, Decision Lab

Disclaimer: The information provided is for general informational purposes only and should not be considered personal financial planning, tax, rollover, or financial advice. The information provided should be used at your own risk.