Retirement Plan Advisors’ and Sponsors’ Role in Driving Workplace Emergency Savings

In partnership with Commonwealth, and other like-minded nonprofits, BlackRock’s Emergency Savings Initiative (ESI) has reached more than 10 million Americans and built over $2 billion in new liquid savings. Engaging retirement plan advisors (RPAs) to help employers navigate new provisions, understand the policies, and implement solutions is vital to expanding that reach.

The resources on this page, including the downloadable presentation and flyer, are designed to support RPAs as they work with employers to implement high-quality emergency savings solutions.

37% of Americans don’t have $400 in liquid savings. That percentage increases for women to 58% and for Black households to 72%.1

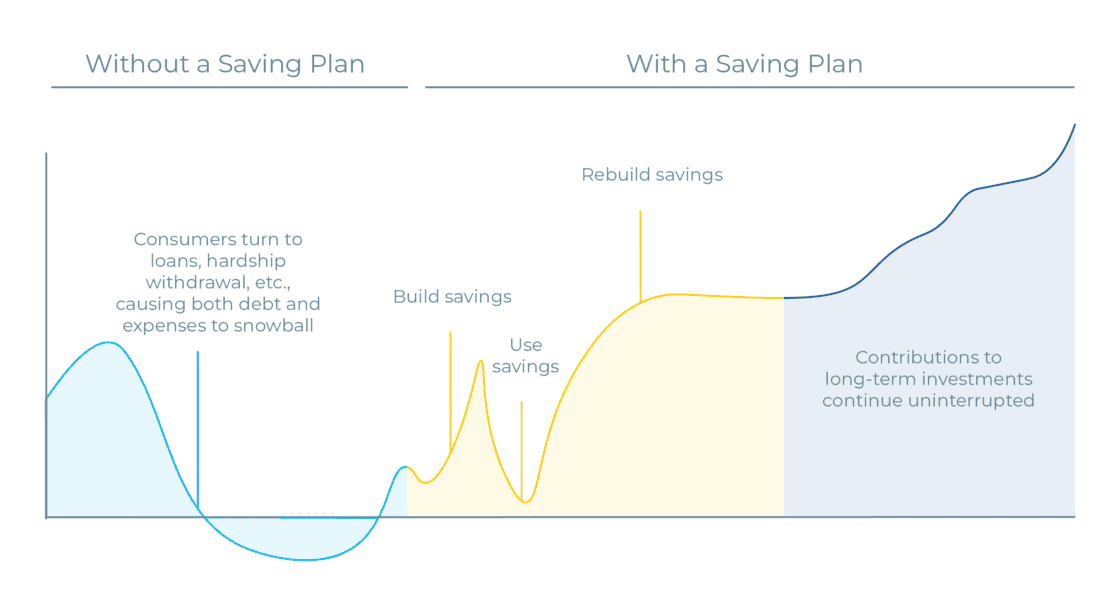

Where there’s a short-term financial stability problem, long-term financial stability challenges aren’t far behind. Blackrock’s Emergency Savings Initiative found that workers with inadequate emergency funds are 13 times more likely to take a hardship withdrawal from their 401(k)s. The good news is, that 72% of workers say they would participate in an emergency savings program2, and workers with emergency savings are 70% more likely to contribute to their employer-sponsored retirement plan.3

Retirement Plan Advisors can be proactive and positive in helping employers adopt workplace emergency savings solutions. This role includes providing advice and guidance on the following components of an emergency savings account:

- In-plan and out-of-plan solutions, and what employers may want to consider when selecting one or the other: Does it matter that participants have immediate liquidity? That it’s connected to a retirement plan? That it is eligible for auto-enrollment?

- Incentive structures, including rewards and matching: 87% of workers say they would participate in an emergency savings program if an employer match is offered.4

- Awareness and engagement strategies, such as targeted communications and peer-to-peer messaging.

- Demographic data in terms of understanding factors such as the frequency of hardship withdrawals and retirement participation.

- Two new Secure 2.0 provisions regarding emergency withdrawals and an in-plan emergency savings program.

Advisors and sponsors can play an important role in that last bullet, helping plan sponsors navigate these new provisions, understand the policies, and implement their solutions.

85% of defined contribution (DC) plan consultants believe that the adoption of in-plan emergency savings programs will increase in the next 3 years,5 so expect more employers to express interest. This is an opportunity to build meaningful relationships with employers in various stages of adopting a solution.

We also review case studies from two large employers implementing emergency savings programs. UPS, for example, found that employees were 2x as likely to increase contributions to their retirement account if participating in the emergency savings program, and ADP saw a 3.5x increase in the monthly average number of new users.

Many other large employers—Best Buy, Starbucks, and Delta, for example—have also introduced emergency savings programs, and it is projected that by 2026 more than 40% of plan employers will offer one to their employees.2

“Emergency savings is important because it helps our people prepare for their financial wellness,” said UPS Global Retirement Strategy and U.S Benefits Director B.J. Dorfman. “We just want to make it easier for people to save for those emergencies.⁶”

1 Federal Reserve, Report on the Economic Well-being of U.S Households, 2022

2 Commonwealth, “Incentives to Increase Emergency Savings Enrollment”, 2023

3 Commonwealth and DCIIA, “Emergency Savings Features that Work for Employees Earning Low to Moderate Incomes”, 2022

4 “AARP Public Policy Institute, “Saving at Work for a Rainy Day. Results from a National Survey of Employees”, 2018

5 T. Rowe Price 2023 Defined Contribution Consultant Research Study

6 “Securing Americans’ Financial Future”, uploaded by Commonwealth, 2023, www.youtube.com/watch?v=aiUTgDXpDvs(opens in a new tab)

This material is provided for educational purposes only and should not be construed as research. The information presented is not a complete analysis of the global retirement landscape. The opinions expressed herein are subject to change at any time due to changes in the market, the economic or regulatory environment or for other reasons.

The material does not constitute investment, legal, tax or other advice and is not to be relied on in making an investment or other decision.

This material does not constitute a recommendation by BlackRock, or an offer to sell, or a solicitation of any offer to buy or sell any securities, product or service. The information is not intended to provide investment advice. BlackRock does not guarantee the suitability or potential value of any particular investment.

Investing involves risk, including possible loss of principal.

Asset allocation models and diversification do not promise any level of performance or guarantee against loss of principal.

FOR INSTITUTIONAL OR FINANCIAL PROFESSIONAL USE ONLY.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK is a trademark of BlackRock or its affiliates. All other trademarks are those of their respective owners.