Emergency Savings Solutions

Employees are increasingly looking for support from their employers to help build a financial safety net that extends beyond their retirement plan. More than half of all adults in the U.S. experience the financial stress of little to no emergency savings. In fact, 37% of Americans do not have $400 in liquid savings. The numbers are even lower for Black and women-led households earning low-to-moderate income (LMI), with 72% and 58% having less than $400 in liquid savings, respectively.

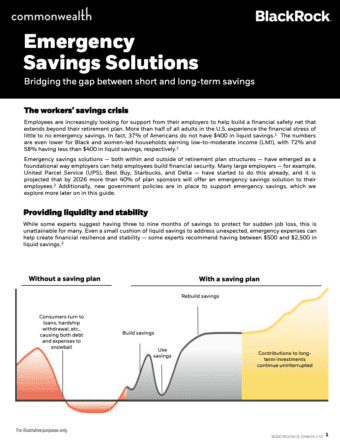

Emergency savings solutions—both within and outside of retirement plan structures — have emerged as a foundational way employers can help employees build financial security. Many large employers—for example, United Parcel Service (UPS), Best Buy, Starbucks, and Delta have started to do this already, and it is projected that by 2026 more than 40% of plan sponsors will offer an emergency savings solution to their employees. Additionally, new government policies are in place to support emergency savings, which we explore more later on in this guide.