In the Media

MEDIA CONTACT

Jackie Jusko

Cell: 216-374-0945

jjusko@buildcommonwealth.org

To drive maximum progress on making wealth possible for all, Commonwealth complements our innovation and partnerships by shaping relevant public and private conversations in the media. Amplifying our work in national, mainstream, and trade outlets is critical to informing and inspiring business, fintech, and policy leaders to act, and ultimately to achieving our vision of systemic change. Browse our latest articles here.

From better benefits to higher pay, employers are upping the ante on talent

Commonwealth’s Timothy Flacke addresses financial health strategies that HR and benefits professionals act on to improve the financial security of employees.

5 of the biggest benefits trends coming this year

Commonwealth’s Timothy Flacke weighed in on the benefits outlook for this year, including a focus on short-term financial security.

Debunking 4 emergency savings myths held by RPAs

Commonwealth’s Nick Maynard shares insights from a survey of RPAs aimed at understanding their perception of emergency savings and shares four commonly held misconceptions in a piece co-authored with Chris Bailey of NMG Consulting.

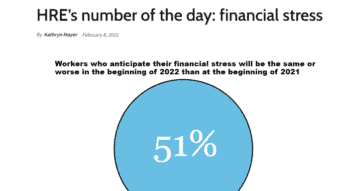

HRE’s number of the day: financial stress

Commonwealth’s Timothy Flacke weighed in on COVID-19’s affect on employees’ financial health and the role of HR leaders.

Biggest financial health opportunity? Focusing on short-term help

Commonwealth’s Timothy Flacke shared insights on the innovations happening in the financial health industry, and the relatively easy (and often underutilized) strategies that HR and benefits professionals can embrace to help employees with their day to day financial security.

Debt refinancing increasingly an option for households, expert explains

Commonwealth’s Timothy Flacke shared insights increasing household savable funds through debt refinancing, including its implications for lenders. Tim discussed the results of a pilot program that Commonwealth conducted on the impact of debt refinancing on low- and moderate-income households.

Consumer Reports will give financial apps same scrutiny it gives appliances

Commonwealth’s Timothy Flacke weighed in on a new program from Consumer Reports, in partnership with Flourish Ventures, that will research, test and compare consumer finance apps.

Truist announces purpose-driven approach to checking account experience

Truist Financial Corporation, one of Commonwealth’s partners in BlackRock’s Emergency Savings Initiative, announced a new approach to overdraft fees and checking accounts driven by customer feedback. They cited their work with Commonwealth via BlackRock’s Emergency Savings Initiative as part of…

FAs ‘Must Keep an Open Mind’ When Prospecting People of Color

Commonwealth’s Timothy Flacke shared insights on how the investment ecosystem can better serve underrepresented populations.

Why Atlanta is setting up savings accounts for kindergartners

Commonwealth Co-Founder and Executive Director Timothy Flacke shared insights on the importance of child savings vehicles in family’s long-term financial security.

‘Emergency Savings’ Stipend Boosts Volunteering Benefit

NPT shared the results of Commonwealth’s experiment with Shared Harvest tying volunteer efforts to an emergency savings stipend, and its possible implications for corporate philanthropy programs.

Working Americans are in a savings crisis — and employers can help

Commonwealth Co-Founder and Executive Director Timothy Flacke shares details on the opportunity employers have to advance emergency savings and financial security for low- and moderate-income workers.