Meeting the Needs of a Diverse Workforce

Designing an Emergency Savings Program

Originally published in Benefits Quarterly Vol. 40, Second Quarter 2024

The demand for workplace emergency savings programs is growing as stakeholders—including financial institutions, investors, employers and employees—increasingly agree that employers have a critical role to play in delivering solutions for employee financial well-being.1 An emergency savings benefit can play a key part in building a firm financial foundation for workers to first gain financial security and eventually expand into wealth-building benefits like retirement and health savings accounts (HSAs).

While employers are motivated to find a financial wellness benefit that includes an emergency savings program, finding and launching a new benefit from a burgeoning field of options can be daunting. The passage of the SECURE 2.0 Act of 2022 has opened new opportunities for retirement-linked emergency savings, but employers can also start exploring out-of-plan programs, which existing benefits vendors often offer.

This article will discuss the emergency savings landscape in the United States and describe a collaboration between specialty grocery retailer The Fresh Market, Inc., and two nonprofit organizations to improve emergency savings among the company’s workforce of 10,000.

The Emergency Savings Landscape

Presently, employers encounter some hurdles in approaching an emergency savings benefit, including the scarcity of high-quality, well-designed products and an industry that defines emergency savings too widely. Mainstream financial education has raised consumer familiarity with the three-six-nine-month savings benchmark to absorb income shocks. However, with many people in the U.S. struggling to save $400 for an emergency expense, it may be necessary to focus instead on a build-use-rebuild model of emergency savings to account for expense shocks.2

At a Glance

- The demand for workplace emergency savings programs is growing, but finding and launching a new benefit can be a daunting task for employers.

- The Fresh Market, Inc., a specialty grocery retailer with a workforce of 10,000, began exploring an emergency savings benefit in 2022. The company has had early success with campaigns encouraging the use of direct and split deposits of their paychecks.

- Employers wanting to develop an inclusive emergency savings benefit should make sure to gather data on employee needs and preferences, use multichannel communications, and offer incentives to increase enrollment and participation.

Instead of focusing on a large emergency fund designed to respond to an income shock, The Fresh Market and Commonwealth wanted a focus on a model for responding to expense shocks. For example, a build-use-rebuild model is effective in meeting the unexpected demands of a flat tire or urgent care bill. One of the challenges to this approach is the design of traditional savings accounts, which can be difficult to access and are not intended for low balances that move up and down as they are built, used and rebuilt. In addition, many products have hidden fees or minimum balances that hinder the liquidity or immediate access needed in an emergency expense situation.

With the passage of SECURE 2.0, which included The Emergency Savings Act, Congress recognized the critical role that emergency savings play in improving worker financial security. The Act provided options for retirement-linked emergency savings offerings, including automatic enrollment into a savings program. Yet critical implementation questions remain for retirement recordkeepers and benefits leaders, including ensuring inclusivity for employees with low to moderate incomes.

The workplace emergency savings landscape is evolving.3 Some high-quality savings providers have designed products around the principle of high-liquidity savings, with key features including no fees or minimum balances and automatic deposits to enable employees to build a financial cushion for short-term emergencies.4 A savings cushion can unlock a pathway to long-term asset growth by increasing the financial wellness of employees, allowing them to contribute to asset growth through retirement savings. In addition, the initial savings can start at small, manageable amounts like $5-$10 per week or $10-$20 per biweekly pay period to help employees build the emergency savings habit through recurring payroll deductions.

The Fresh Market

In response to the growing demand for financial benefits, The Fresh Market embarked on an exploratory emergency savings benefit journey in 2022. The Greensboro, North Carolina–based company partnered with national nonprofit Commonwealth, as part of investment firm BlackRock’s Emergency Savings Initiative (ESI). The ESI is a philanthropic commitment designed to enhance access to high-quality emergency savings solutions for people living on low and moderate incomes and has helped generate more than $2 billion in new liquid savings for ten million people.

The emergency savings benefits offered to suit the needs of The Fresh Market’s diverse workforce were designed to eventually lead to increased participation in other key benefits, such as retirement.

The Fresh Market’s journey to develop this suite of emergency savings benefits started with understanding the unique needs of its workforce through research. The company then uncovered the key features of a successful multichannel marketing campaign, leading to a better understanding of the role that incentives can play in driving benefits participation. These pieces have become key guideposts for The Fresh Market in designing and implementing emergency savings programs early this year.

To understand how to assess the workplace emergency savings landscape, The Fresh Market needed to understand the diverse needs of its workforce, such as how and when they save through consumer research and pilot demonstrations with existing benefits—like direct deposit and split deposit functionalities in payroll—to lay a foundation for a future tailored emergency savings program, with an optimized marketing plan.

Understanding the Workforce

Employers can start planning for their emergency savings benefits by examining quantitative and qualitative data to understand the needs of their unique workforce. Payroll behavior can be telling; for example, are there significant demographic gaps around whether employees are utilizing direct and split deposit actions?

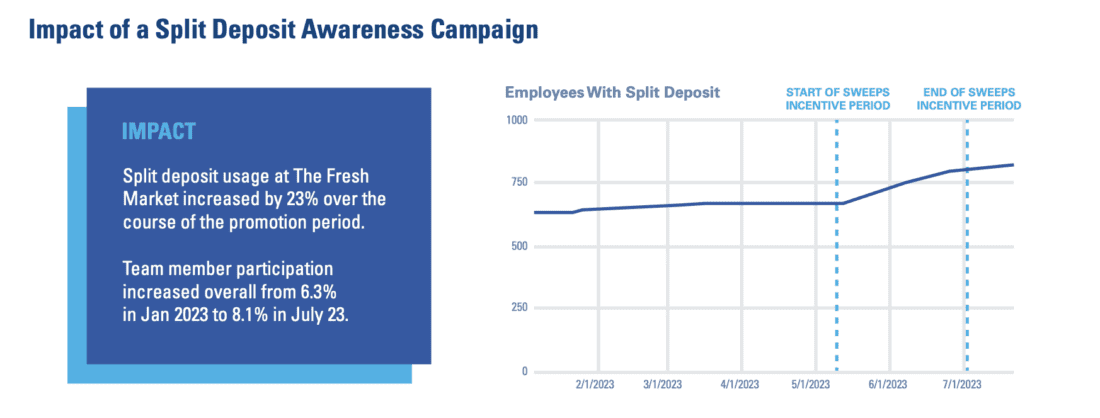

Initial payroll data analysis found that roughly 10% of The Fresh Market’s team members did not have direct deposit set up via payroll. Analysis also found that corporate team members (not at a store location) were three times more likely than retail team members working in stores to use split deposit—setting up a paycheck to automatically “split” by a percentage or set dollar amount to be deposited across multiple accounts on payday. Workers who use direct and split deposit behavior save at higher rates than those who do not have them enabled.5 This presented an early opportunity for the company to drive savings before implementing a new benefit and to test its internal marketing and communication strategies, taking care to target in-store team members, who represent more than 95% of the company’s workforce.

Dynamic Communications

Using this early data insight, Commonwealth and The Fresh Market decided to test internal communications channels and raise awareness of the benefits of direct deposit with a split deposit marketing campaign. The goal was to encourage savings behaviors by marketing automatic savings through split deposit.

The multichannel and multiweek campaign used email, monthly benefits newsletters, human resources information system (HRIS) application notifications, in-person store huddles, a retail sector messaging application and the deployment of in-store fliers. Deploying in-store materials and phone-based app notifications was a critical component in targeting retail team members, who may have less consistent access and attention for email communications. This campaign laid the groundwork for discerning the effectiveness of different modes of benefits communications and built up a common understanding of how direct and split deposits can support savings behaviors among team members.

To contextualize the payroll data, the company deployed qualitative research in the form of a short survey and in-depth interviews to complement the quantitative data and better understand communications preferences.

Active Listening to Employee Needs The Fresh Market also included emergency savings questions in its annual benefits survey to learn what team members prioritized when considering current or future benefits. Unsurprisingly, financial wellness came out as a top priority among team members. When asked about an emergency savings benefit:

- 55% of the respondents were interested and gave feedback on the type of features they would want to see.

- 38% expressed interest by wanting more information.

- Only 8% said they were not interested.

These insights gave a valuable picture of what to look for in an emergency savings vendor and solution.

To dive deeper, Commonwealth conducted 11 in-depth interviews with a diverse set of team members, gathering insights to support The Fresh Market in identifying a high-quality emergency savings benefit. The research goals were to understand team member behaviors and financial priorities and how they prefer to receive benefits communications.

Following are the key findings of the consumer research and the opportunities identified.

- Repositioning emergency savings as “build, use, re-build” where small savings matters: Team members associate savings with the concept of high savings balances that would provide a cushion in case of a job loss and, thus, find it unattainable.

- Most desired features: Liquidity (i.e., immediate access), no minimum balance, digital access and interest-earning accounts all ranked highly in desirability by team members.

- Communications preferences: Email plus in-store posters, fliers and other printables are key channels.

- Preferred incentive models: Team members were most interested in a high volume of small-dollar incentives to increase access to funds for the most participants.

These insights created a road map for identifying an emergency savings product and how to connect best with team members to increase enrollment once an emergency solutions product is identified.

Incentives Matter

With the consumer research insights in hand, The Fresh Market deployed a second split deposit campaign—this time with a goal to increase direct deposit and split deposit numbers among team members. For this campaign, the company increased the number of emails, lengthened the promotional period and, most importantly, added an incentive in the form of a sweepstakes.

A sweepstakes can be a relatively simple and budget-friendly incentive structure that an employer can deploy to drive positive behavior. The Split to Win! Sweepstakes was a one-time drawing of 100 prizes of $50 each, in the form of a virtual gift card delivered via email. Eligibility for an entry, limited to one entry per team member, was defined by having at least one recorded split deposit via the payroll application during the promotion period.

As shown in the figure, the sweepstakes proved a success: The Fresh Market saw a 23% increase in split deposit users over the promotion period, particularly among full-time team members, and they maintained that increase beyond the promotional period. This sweepstakes experiment demonstrated the potential of a small-dollar incentive.

Conclusion

While recent policy measures like SECURE 2.0 may open up new opportunities for emergency savings in the coming years, employers do not have to wait on retirement recordkeepers to build a high-quality in-plan solution. There are opportunities available today to deploy emergency savings solutions through current benefits, payroll, and banking vendors and partners.

Employer strategies derived thus far in the collaboration between The Fresh Market and Commonwealth ESI include the following.

1. Understand Your Workforce

Gather quantitative and qualitative data on employees to ensure that you are finding the right solution to meet their unique needs. Do this through consumer research with surveys, focus groups and in-depth interviews.

2. Use Dynamic, Multichannel Communications

Dynamic, multichannel communications lead to higher enrollment and participation in a benefits program. Employees indicate that their company should be contacting them more with benefits information.6 Effective employee outreach includes increasing ongoing communications, in-person printables like posters and flyers, and searching for key intervention moments around open enrollment, merit increases and tax time.

3. Incentives Matter

Incentives—even small ones—demonstrate employer commitment to employee wellness and increase participation in a benefits program.2

With the success of its initial program, The Fresh Market plans to test two different emergency savings products for employees this year as part of the ESI. These three-month pilots, provided by current vendors of The Fresh Market, will deploy with a multichannel communication campaign, a diverse range of incentives and a data-tracking plan to measure their impact.

Paula Legendre Stop, CEBS, is the director of total rewards for The Fresh Market, Inc., and is responsible for the company benefit and compensation programs. She received her Professional of Human Resources (PHR) designation in 2005. In 2016, Legendre Stop earned her Certified Employee Benefit Specialist (CEBS) designation and in 2019 and 2020 earned the Fellowship designation. She is vice president of the board of the North Carolina Business Coalition on Health. Legendre Stop holds a bachelor’s degree in French and international business from the University of Tennessee and a master’s degree in business administration from the University of North Carolina at Greensboro.

Nick Maynard is an expert on savings innovation with more than 15 years building, piloting and scaling innovations to improve the lives of financially vulnerable Americans. In his role as senior vice president at Commonwealth, he currently leads efforts deploying proven savings solutions at scale with employers, financial services firms, financial technology partners and gig platforms. Maynard holds master’s degrees in business administration and public policy from Harvard University. He also holds a bachelor’s degree in engineering and operations research from Princeton University. To learn more about Commonwealth’s work on emergency savings, check out the numerous employer case studies at buildcommonwealth.org.

- The Pivotal Role of Investors in Worker Financial Security Report. June 28, 2021. Commonwealth.

- “How to Design Emergency Savings Solutions to Increase Sign Up.” July 18, 2021. Commonwealth.

- BlackRock Emergency Savings Initiative Impact and Learnings Report. June 9, 2023. BlackRock.

- Emergency Savings Features That Work for Employees Earning Low to Moderate Incomes. August 17, 2022. Commonwealth.

- Split Deposit. June 29, 2020. National Automated Clearing House Association (NACHA).

- Supra note 4.