The American jobs crisis continues to escalate at an alarming rate. Nearly 1 million people filed for first-time unemployment benefits on a seasonally adjusted basis in the US in just the first week of 2021. Based on these early signs, tax refunds that low-income families receive this year are more important than ever.

Every year, low-income working families count on the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) in their refund to provide a vital cash infusion to their households. However, widespread unemployment threatened EITC and CTC eligibility in 2020.

Our research found that tax refunds are at risk of decreasing up to 80 percent compared to 2019, as reported by MarketWatch. For reference, annual tax refunds for low-income earners can exceed $5,000, according to the Center for Budget and Policy Priorities. This year, some families could receive only $1,000. If you’re a low-income earner, the difference of thousands of dollars could escalate into an emergency. At the very least, it could worsen an already precarious financial situation.

How you can help low-income families

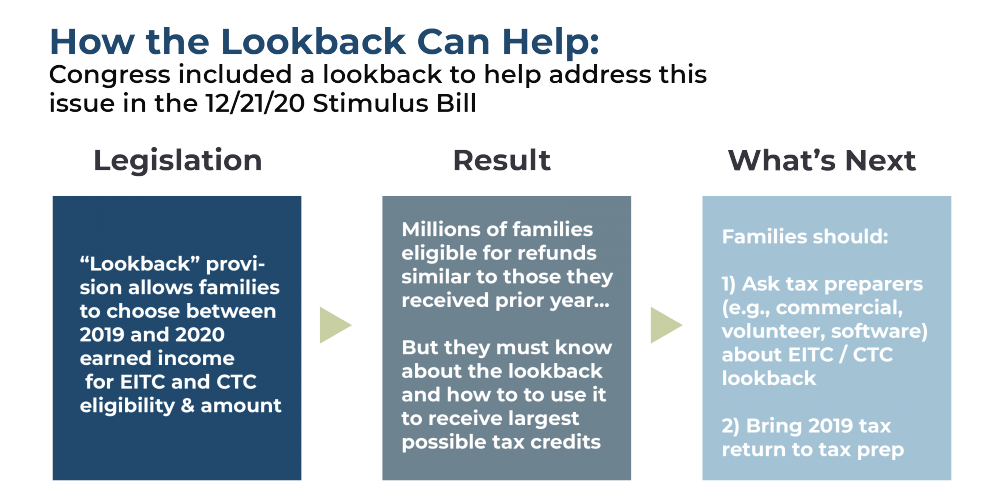

Fortunately, Congress included a “lookback provision” in the relief package that passed December 21st. The provision allows filers to choose between their 2019 and 2020 earned income to calculate key tax credits to boost their 2020 tax return. It is now up to organizations that serve and support working families to ensure this policy translates to household impact, which they can do by raising awareness of the policy and explaining important steps that tax filers need to take to reap the benefits of it.

Direct service organizations, think tanks, tax prep providers, technology platforms, and government officials should ensure low-income families, especially the most vulnerable, receive the largest possible tax refund in 2021. Applying the lookback provision will help ensure millions of low-income working families who experienced income loss in 2020 receive the tax refunds they rely on and continue to be eligible for vital refundable tax credits such as Earned Income Tax Credit (EITC) and Child Tax Credit.

Who is at risk?

For many low-income families, tax refunds are vital. Commonwealth’s tax-related work has taught us many families anticipate and count on tax refunds—often the single largest lump sum of money a family will see all year—as an opportunity to pay down debt, build up savings, and make deferred purchases. According to our analysis, households at risk of reduced refunds include:

- Those who were unemployed for much of 2020

- Households who expected to make up to $25,000 before the pandemic

- Households with children

- Families of color, who disproportionately benefit from the EITC

Our efforts to support awareness and take action in support of populations living on lower incomes will continue throughout tax season and beyond. You can follow that work, developed in partnership with SaverLife and Neighborhood Trust Financial Partners, at TaxTimeCrisis.org.

The complexity of tax season in 2021 presents other serious challenges. For example, in hope of getting their much-needed refund sooner, filers may file quickly and neglect to check if their 2019 income would yield larger tax credits. We need to make sure that tax filers, whether in their living room or at a tax site, are prepared with last year’s return.

While lookback provisions aren’t new, the scope of this year’s provision is unprecedented in light of massive unemployment and a prolonged financial crisis. To yield the highest possible return for people who need it most, everyone that serves low-income tax filers will need to have up-to-date, clear information to ensure every person eligible benefits from the lookback. Organizations that reach tax filers, from tax professionals to direct service nonprofits, are encouraged to participate in Commonwealth’s upcoming webinar to equip themselves to best help their clients.

Join Commonwealth for Tax Time 2021: What we know about the lookback and how organizations can act on it to support low-income families, a follow-up to our November tax time webinar moderated by Jason Ewas, Senior Policy Manager at Commonwealth, along with Nina Olson, Executive Director of the Center for Taxpayer Rights, Annelise Grimm, Associate Program Director at Code for America, and Alan Gentle, from the City of Boston’s Office of Financial Empowerment. The webinar will provide updates on the lookback provision and its implications on low-income Americans. We will also outline how organizations can help ensure that every eligible household maximizes their refund including how to leverage our toolkit to communicate about the lookback to tax filers, how to access additional resources, and how to advocate to ensure effective policy implementation.

Date and time: Thursday, January 28 @ 3pm EST