There are many factors leading to the extremely tight, stretched budgets of people living on low to moderate incomes (LMI). How can people begin to save or build wealth when they do not have the available funds to do so? To enable financial security, and ultimately wealth creation, we must find ways for all people to have more “slack” in their budgets.

With little to no financial “slack,” or extra room in their budgets, people living on lower incomes often do not have the ability to set money aside, build wealth, or experience financial stability. In the last year, Commonwealth has explored ways to combat this challenge. We researched whether it would be possible, and effective, to reduce people’s expenses as a means of creating more slack in their budgets and increasing “savable funds,” i.e. funds available for savings.

Our research identified promising possibilities to reduce payment-related expenses that people living on LMI commonly incur. Innovations in how bills are paid–such as personalized micropayments–may facilitate the timely, full payment of high-priority expenses by lower-income customers, decreasing late fees and other financial consequences incurred. Doing so could lead to more budget slack, greater financial security, and ultimately increased confidence and resiliency.

Expense Prioritization as a Budgeting Tool

In order to build financial security and opportunity, people need to be able to make in-full, on-time bill payments. However, doing so can be especially challenging for those who experience financial volatility and are continuously under pressure to align inconsistent income with planned and unplanned expenses.

“Week by week is a better way to think about [my budget] because of the extra income I may or may not have that week.” — Individual interviewed by Commonwealth

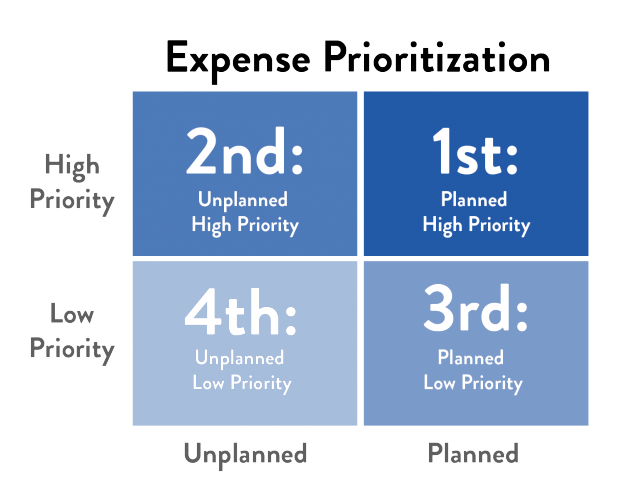

Our research revealed that, when faced with a set of bills, people with low income and high debt levels practice strategic bill payment as a tactical budgeting tool. This prioritization framework, based on careful consideration of the consequences associated with late or missed payment and the flexibility associated with the bill, is used to help limit the most severe short-term consequences. Without financial slack to allow an alternate bill prioritization strategy, these decisions can have an immense impact on people’s financial lives, causing stress and limiting their ability to save or build wealth.

“[…] lights and gas you can kind of play with–you can ask for financial help, but the cable phone bill and car insurance, they have to be paid or you’re just gonna be cut off.” — Individual interviewed by Commonwealth on how they prioritize bills

High-Priority Expenses

These are expenses with the least flexibility and the most acute short-term effects for incomplete or late payment. A late housing payment, for example, could result in eviction and threats to family welfare, as well as potential ripple effects of job loss, mental duress, increased debt, and depleted savings. Daycare costs and mobile phone bills are of high priority for similar reasons. When unplanned expenses with serious short-term consequences arise, they are the next to be prioritized.

Low-Priority Expenses

Lower-priority bills may include payments towards credit card bills or insurance costs, as they come with more payment flexibility and the short-term effects of late or missed payments for these bills are considered minor. However, any delay in payment can have significant long-term consequences for consumers living on LMI, such as increased debt, credit score declines, and other potentially derailing outcomes.

Payment Innovations to Reduce Expenses

Given the potential for far-reaching consequences of late or incomplete bill payments, innovations to facilitate the payment of bills in full and on time can not only reduce related expenses, such as overdraft fees, but contribute to overall greater financial security.

The Potential Benefits of Micropayments

Based on initial user research and design iterations, we have identified an opportunity to innovate around bill payments with personalized micropayments–flexible bill payment options that divide lump-sum monthly payments into more manageable amounts, tailored to the variable income stream and risk tolerance of lower-income households. This solution could be of mutual benefit to certain types of service providers and their customers. Housing rental property managers, for example, face high fixed costs and rely on full customer retention for revenue. A flexible micropayment option enabling in-full, on-time rent payments could help improve property managers’ revenue consistency and minimize account maintenance costs.

“I like to break my payments down to make it feel like I’m paying it all the time… It’s adjusted to me so it kind of feels personal.” — Individual interviewed by Commonwealth

The Unseen Impact of Reduced Expenses

Amplifying the impact of personal micropayments further, successful payments with volatile income streams may foster confidence in people living on lower incomes, and ultimately have a positive cumulative effect on their payment behavior and financial stability. Through on-time payments of high-priority, planned expenses, consumers will avoid late fees, rely less on credit, and increase their ability to save, improving financial security and building wealth.

Next Steps on Increasing Savable Funds

Our research around building more slack in people’s budgets is part of the ongoing project Making Wealth Common: Extending Financial Opportunity. In the next year, we will continue to explore how expense reduction solutions, such as micropayments, can lead to more money being available for savings and building financial security. Looking forward, our project goals are twofold:

- To ease the burden on lower-income customers to pay their high-priority expenses on-time and in-full.

- To support lower-income people in adopting a bill prioritization strategy that reduces both short- and long-term financial consequences of late payments.

Additionally, we will further investigate the potential psychological effects people may experience as a result of reduced expenses, including if there is a perception of having more money that can be saved. This knowledge will inform the future design and dissemination of relevant innovations and will be key to ultimately enabling increased access to savable funds and supporting financial security.

Follow Commonwealth for our future research and design insights around payments innovation and creating more slack to enable people to build more savings and wealth. To learn more about this work, please contact Becca Smith at info@buildcommonwealth.org.

The Making Wealth Common: Extending Financial Opportunity project is made possible thanks to the generous support of the MetLife Foundation.