Introduction

Recent developments in the retail investing space, including the widespread adoption of commission-free trading and better UI on mobile and desktop platforms, have made it easier than ever to become an investor. Despite increased accessibility, significant gaps remain between a widespread desire to invest among households living on low and moderate incomes (LMI)—particularly Black, Latinx, and women-led households—and taking advantage of this key wealth-building opportunity.

To address these challenges, Commonwealth, with support from the Nasdaq Foundation, launched a groundbreaking research program and pilot with fintech partners, including Ellevest, to gain insight into how the development of an investor identity can act as a key enabler for beginner investors to overcome initial feelings of doubt and develop a sense of belonging in the investing community.

In this post, we explore some of the highlights from this critical research and specific areas where Ellevest’s women-focused investing platform is contributing to a more inclusive investing ecosystem. We will also look at some of the ways in which Commonwealth’s research is providing insight into how these choices support beginner investors living on LMI. If you’d like to know more, check out Commonwealth’s full report on this research as well as our toolkit designed to provide actionable guidance for providers looking to help make investing for everyone.

Investor Identity Insights

- Even incremental increases in investor identity are associated with positive action such as investing more funds and recommending investing to friends: Higher investor identity scores were associated with higher ratings of participants’ experience, higher rates of planning to add funds to their investing account, and higher likelihood of recommending investing to friends, indicating that even small increases in identity can have significant impact on investing behaviors. Platforms that are able to cultivate identity effectively for new customers can see direct benefits through increases in deposits and net promoter scores.

- Investor identity “clicks” after 6 months: Overall, average investor identity scores for participants grew during the first year. Most of this increase happened during the second six months of participation, highlighting a dynamic in which early experiences eventually start to “click” and translate into changing perceptions of oneself as an investor over the course of the first year. For providers, this means that the initial phase of laying the foundation for beginner investors should be understood to extend beyond onboarding, with the first six months a critical incubation period when the elements that give rise to investor identity are cultivated.

- Perceptions of investing change during the first year for most participants: 71% of participants agreed that investing turned out to be easier than they had initially thought. The amount of money people thought was needed to be considered an investor declined during the pilot period, indicating a more inclusive understanding of who investors are. For many beginner investors, the biggest hurdle is getting started so that they can see that it is not as difficult as they imagined. Tools like seed funding or other promotions are critical for getting them in the door so that they can develop a more informed understanding of what investing entails.

- Emergency savings matters more than income for retaining beginner investors: Participants who started with less than $500 in emergency savings were 50% more likely to have to withdraw their funds before the program ended than participants who had more than $500 saved. The most common reason cited for withdrawal was financial need. This difference highlights the important role resources play in individual agency as an investor, and the opportunity that exists for integrating low-risk savings products into the investing experience.

Representation matters

Commonwealth’s research identified representation in investing-related advertising and messaging as a key factor in developing a sense of belonging in the investing community. Participants who did not feel represented in these channels reported a lower sense of belonging in the investing community; 73% of participants who felt represented reported that they felt a sense of belonging, compared to just 44% of participants who did not feel represented. Women were half as likely as men to feel represented in investing messaging and advertising. We also found that representation was perceived along a variety of axes, including gender, race, age, and income. These communications are many investors’ first impression of platforms, and can play a large role in the decision to get started.

Ellevest provides a valuable example of what efforts to more explicitly represent women in investing can look like, and its success highlights the draw of this kind of representation for women across the income spectrum. Importantly, Ellevest also demonstrates how representation can go beyond just messaging and advertising by being incorporated directly into product design and branding, increasing the sense of connection for women and other groups. This research highlights opportunities for all providers to reach broader audiences through representation in multiple dimensions, including gender, race, age, and income level, to create a more diverse and inclusive investing community.

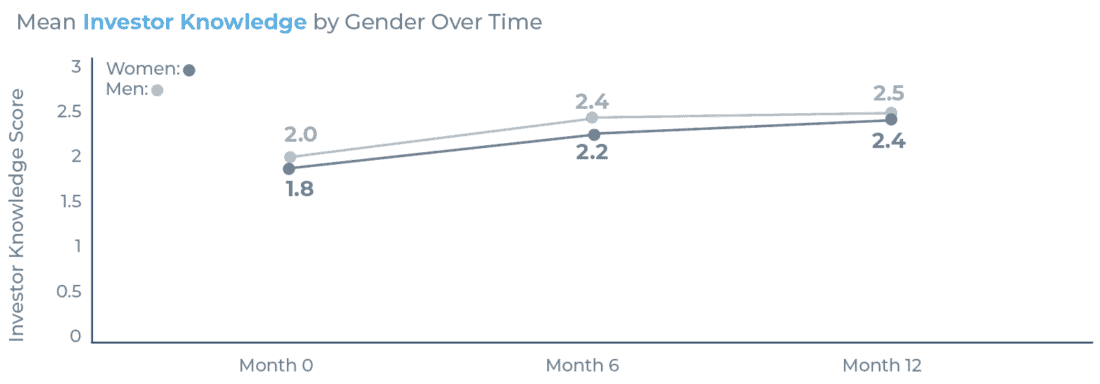

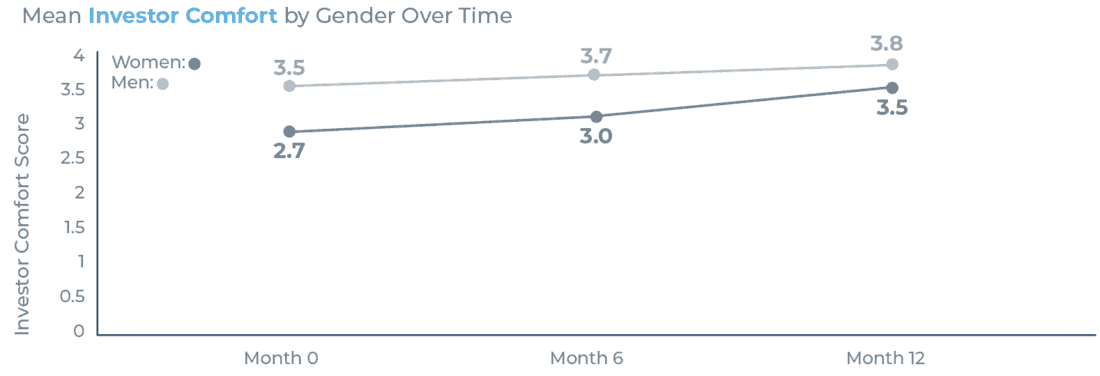

One year of investing experience helps women close gender gaps in investing knowledge and comfort, but men are still more likely to develop higher investor identity scores

Despite starting at a significantly lower baseline, women showed greater gains in self-reported knowledge of and comfort with investing during the first year, closing much of the initial gap with men. This process highlights the ways in which inclusive design can help beginner investors overcome systemic barriers, including embedded attitudes about their own capabilities, empowering women and other underrepresented groups to take full advantage of the wealth-building opportunities afforded by capital markets. Ellevest provides a platform designed to make women feel more comfortable and confident as investors.

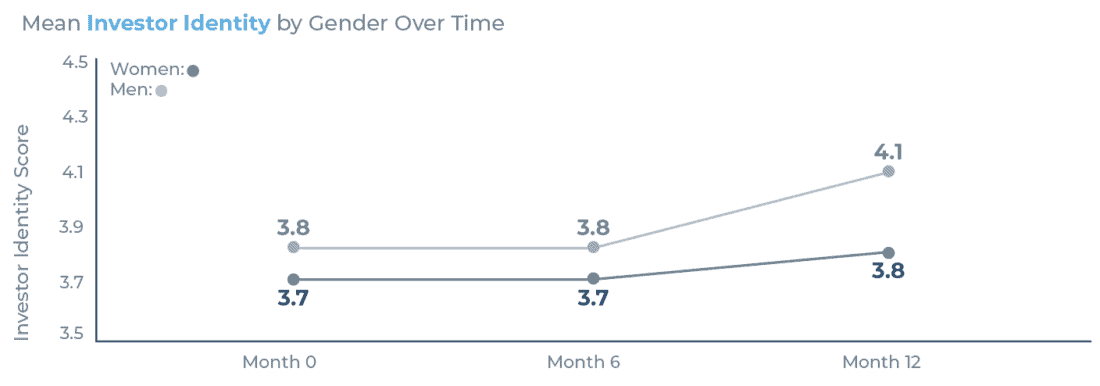

We found that women had lower investor identity scores at the start of the pilot than men, scores that did not grow as quickly despite average scores for both groups increasing. The percentage of participants who saw identity score increases was similar, at 53% for women and 57% for men, so the difference lies primarily in the magnitude of growth. This difference highlights the fact that identity is about more than feeling knowledgeable or comfortable making investing decisions; it is also influenced by social and systemic factors, such as representation, that may lead women to feel more out of place in the investing system than men even when they feel similar levels of capability. More explicit support for and representation of women in investing is a key opportunity for providers to contribute to a more inclusive investing system, with Ellevest providing a shining example of what these efforts can look like.

Conclusion

Ellevest has been a champion for inclusive investing both through partnering with Commonwealth on this critical research and designing a platform that welcomes new women investors, including those living on LMI, to take advantage of the wealth-building opportunities afforded by digital retail investing. For a complete analysis of this research, check out our comprehensive final report from the Transforming Investor Identity project. This project is also accompanied by an action-oriented toolkit with practical guidance for providers looking to implement more inclusive design and cultivate investor identity.

This is not intended to be personal financial advice or a product endorsement and is shared for informational and educational purposes only.

If you would like to be involved in this research and in the broader project of building a more inclusive investing system, please reach out to us at info@buildcommonwealth.org.