Originally posted on Public.com.

Public.com partnered with Commonwealth, a non-profit financial innovation lab, to facilitate a seven-month pilot program that would study the possible effects and impact of inclusive technology design on investing outcomes for underrepresented populations.

Today, we’re sharing the results of this comprehensive research study, including findings that show how inclusive design increases confidence and can inherently improve accessibility for underrepresented populations by meeting them where they are and facilitating their growth as investors.

Commonwealth’s mission is to support security and opportunity for people living on low to moderate incomes, specifically through the lens of how platforms and technologies can better serve these populations. Through this program, Commonwealth wanted to observe the role of product design when it comes to improving financial security and opportunity for people traditionally left out of the financial system.

The program provided 241 women of color with seed funding to build a portfolio on the Public.com platform, with community features and in-app context supporting their journeys. With participants’ consent, Commonwealth’s research team observed the behaviors and attitudes of the cohort over a seven-month period in 2021 and 2022 with the goal of understanding how investing platforms can provide opportunities for advancement for market participants at all stages.

The research revealed that investing platforms can support promising outcomes in the areas of empowerment and confidence. Here are a few of the highlights, with the full report available via Commonwealth.

Inclusive design helps build investor comfort and confidence

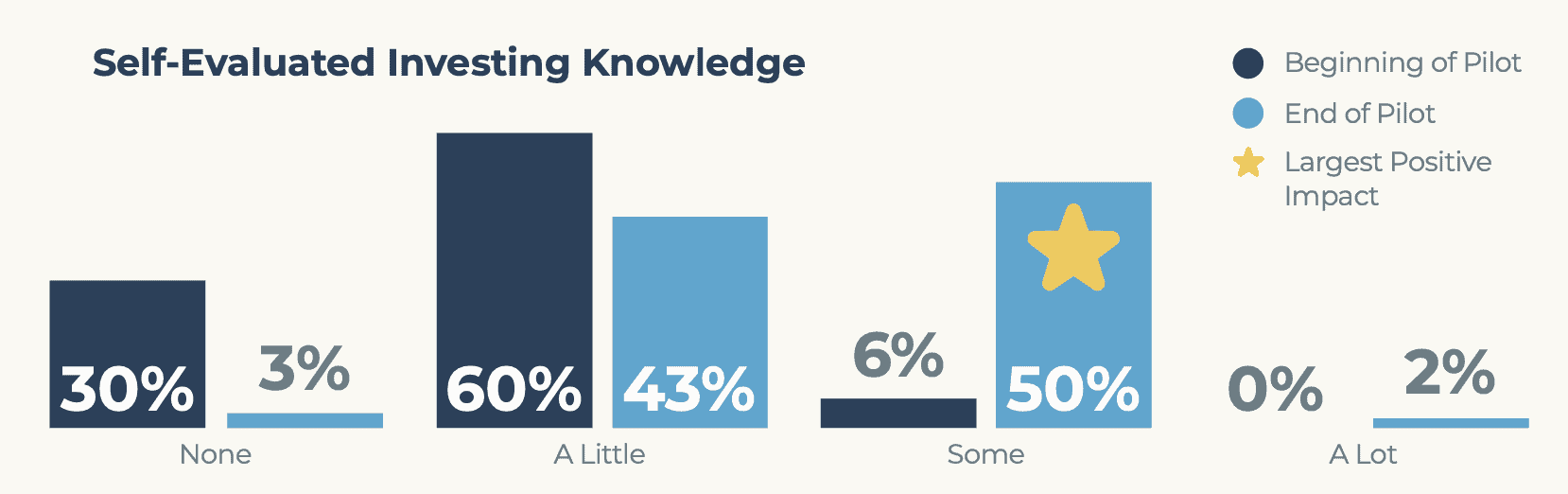

At the end of the pilot, the number of participants who reported that they were more comfortable making investing decisions more than doubled, from 25% at the beginning of the pilot to 65% by the end.

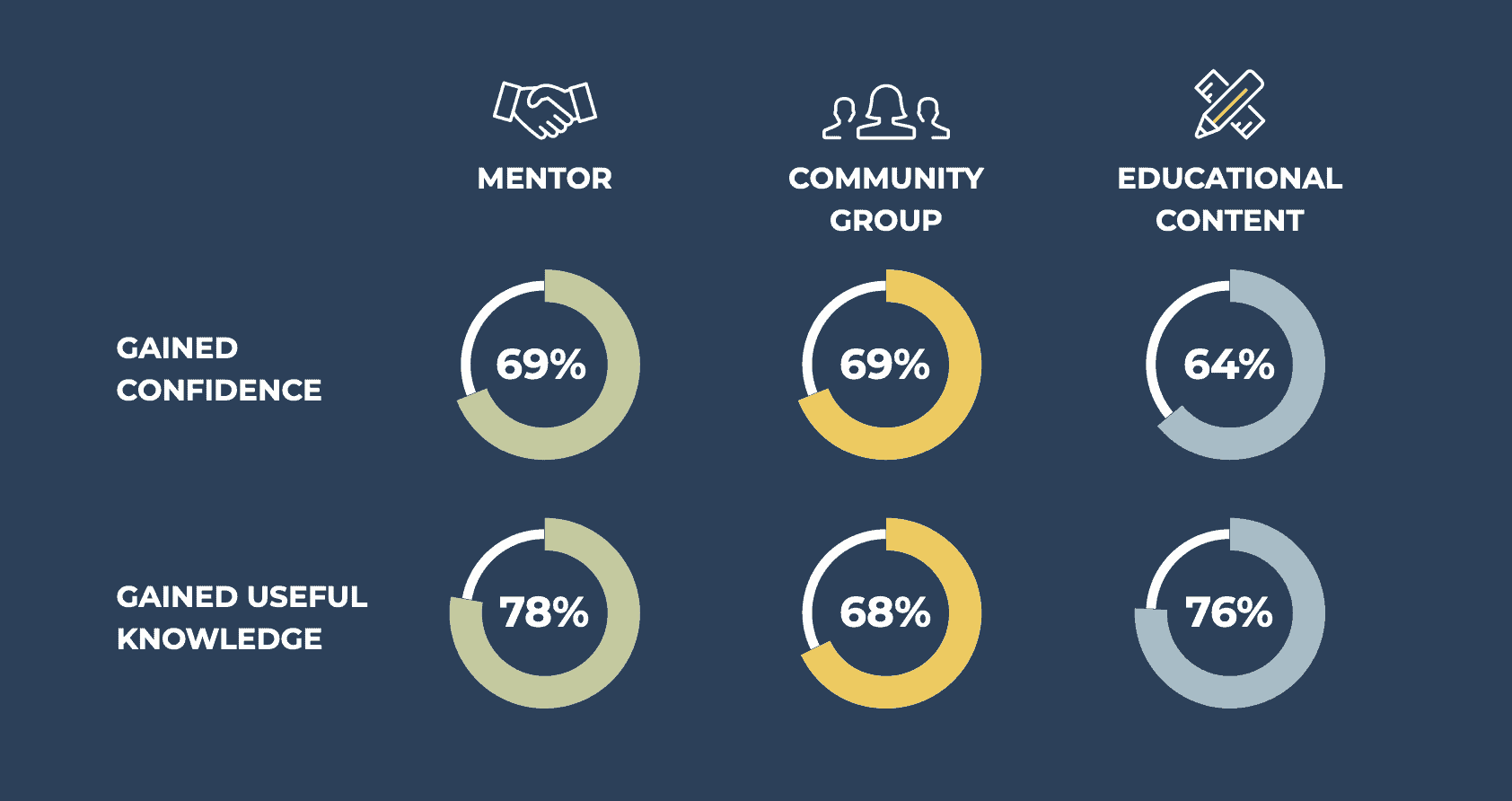

A majority of participants reported that the ability to talk with others on the Public.com platform (including both peers and mentors) made them feel more comfortable with investing (67%) and more confident in their ability to invest effectively (59%).

Active market participation develops investor sophistication

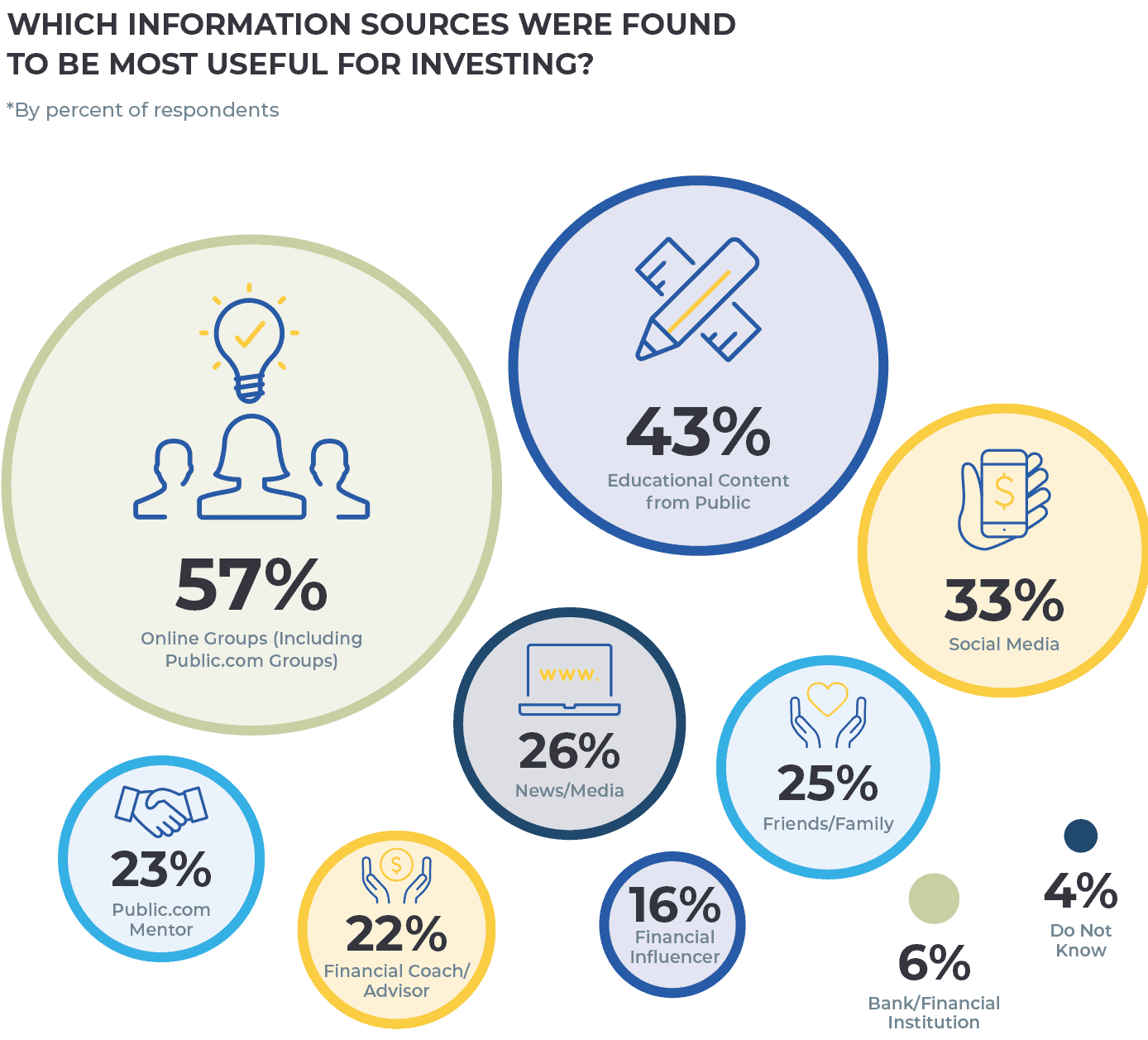

The report also found that having access to actionable knowledge embedded in the investing experience was crucial to removing barriers and shifting investor mindset from viewing market participation as unattainable to seeing it as an active learning opportunity.

Public.com’s platform provides a place for investors to build a portfolio with context, offering in-platform audio shows, skills-based lessons, and community features designed for knowledge exchange and personal development alongside other investors.

The most engaged participants were most likely to diversify over time

Commonwealth tracked diversification using an index that accounted for the number of different assets held, as well as the allocation of the assets within a portfolio. The index ranged from 0 to 1, with 1 representing the highest degree of diversification.

Overall, the average diversification rating for participant portfolios at the end of the pilot was .77; however, the most engaged participants diversified to a much greater degree (.93) by the program’s end. This suggests that engagement with contextual features and community support can support the advancement of specific investing skills in the journey.

The research also suggests that the pilot program effectively laid a foundation for continued development among participants. At the end of the pilot, 88% of participants said they plan to continue investing in the future.

*Open To The Public is a member of FINRA and SIPC. This content is not investment advice. Investing involves the risk of loss.