Addressing Inequity

Financial insecurity is a deep-rooted problem in the United States, with 63% of adults saying they would cover a hypothetical $400 emergency expense exclusively using cash or its equivalent, unchanged from 2022 but down from a high of 68% in 2021. This is indicative of a larger problem in which a majority of individuals in the U.S. (55%) say their financial situation is “only fair” or “poor.” In fact, an average of 60% of individuals living on lower incomes express worry about financial matters (retirement, healthcare, standard of living, housing, children’s education, and credit cards) compared to 47% of those living on middle and 31% of upper incomes.

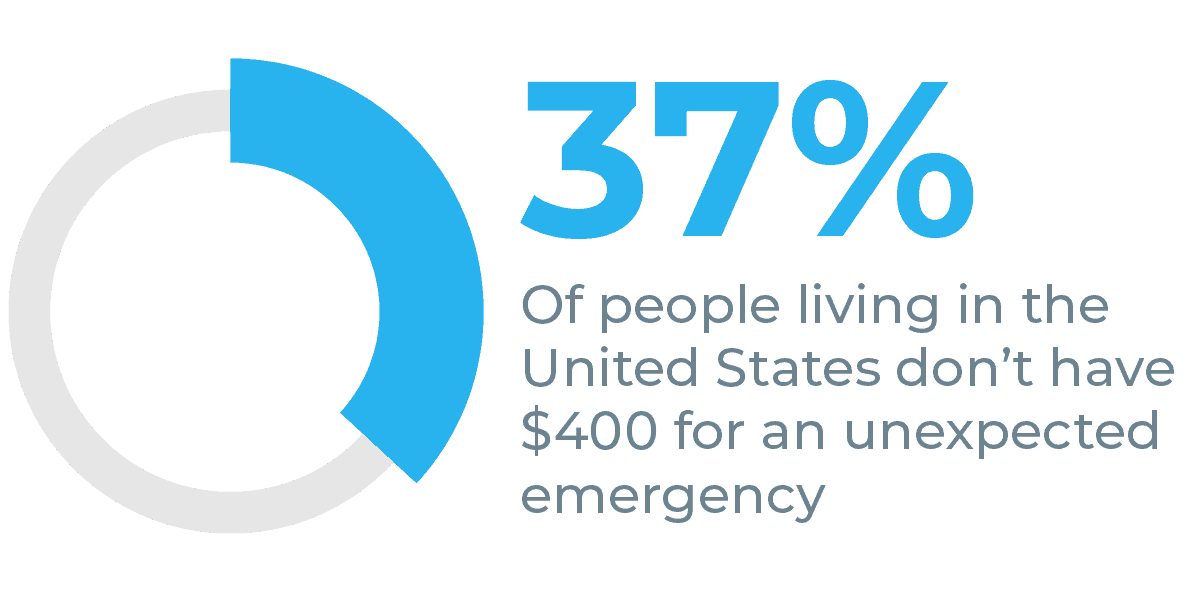

Financial insecurity disproportionately impacts Black, Latin, and women-led households. The Federal Reserve Report on the Economic Well-Being of U.S. Households in 2022- 2023 found that 37% of people surveyed reported they would not be able to cover a $400 expense completely, up 5% from 32% in 2021 and back to 2019 levels. Other studies found that nearly half of women (47%) cannot easily afford a $400 emergency expense, 40% of Black adults, and 35% of Latin adults are close to having difficulties paying their bills –including an emergency expense.

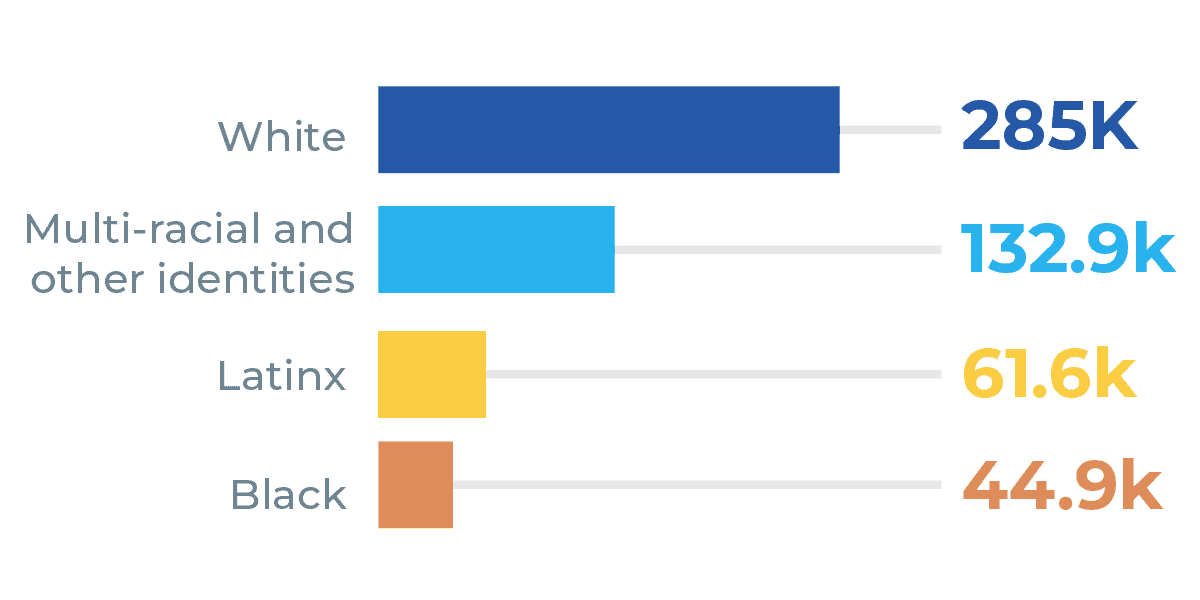

Further, the racial and gender wealth gaps in the U.S. are immense. The wealth of the typical Black family ($44,900) was only about 15% of the typical white family ($285,000); the typical Latin family similarly held only about 20% of the wealth of the typical white family (about $61,600). Black married households have a median net worth of $66,000 while the median for white married households is $260,000.

In 2022, single (never-married) women had $19,200 in inflation-adjusted median household wealth, and men in that group had $28,100. While there has been growth since 2019, single women had only 90 cents in wealth for every dollar held by their male peers. But women of color fare worse, with single (never-married) Black women having just $3,300 and (never-married) Latin women having $5,600 in median wealth, compared to single (never-married) white women who have $31,000. This means that for every dollar of median wealth held by single white men, single Black women, and single Latin women had 8 cents and 14 cents, respectively.

The economic impact of COVID-19 has shone a light on long-standing economic, racial and gender inequities that profoundly impact Americans’ financial security. Many Americans understand this: over 35% percent of surveyed Americans report that their financial stress increased from before COVID-19. Since the pandemic, the racial wealth gap has widened despite an increase in wealth.

The Costs of Inequity

The social, economic and human costs of inequity extend to employers, financial institutions and society as a whole.

According to the PwC 2023 Employee Financial Wellness Survey, 57% of employees indicate financial stress as their primary concern. In the workplace, employees spend an average of 14 hours per week stressing about finances, over half that time (8.2 hours) during working hours. Overall workers lose an average of 7 hours of productivity each week due to financial stress costing employers $183 billion annually. Addressing racial inequity further compounds costs, as well; a study by the RAND Corporation found that it would take $7.5 trillion to halve the Black-White wealth gap, and $15 trillion to eliminate it.

And a majority of workers (74%) want help with their finances, seeking financial guidance when dealing with financial decisions, crises, or life events. PlanAdvisors’ Financial Wellness Survey found that 70% of Americans believe their employers should assist them in achieving financial well-being while J.D. Power notes that 59% of banking customers expect their financial institutions to actively help them improve their financial health. It’s no surprise that U.S. workers are more likely to believe that institutions should be doing more to help.

Racial and Gender Disparities

The data are overwhelmingly clear that the distribution of wealth and financial security is not only an economic or class issue, but a racial and gender one as well. Addressing the harmful impact of systemic racial inequity and gender discrimination on financial security is critical to Commonwealth’s work of making wealth possible for all. We will continue to integrate a focus on race and gender into our work to make wealth possible for everyone, and aspire to be:

Seven in 10 (70%)workers believe their employers should assist them in achieving financial well-being, and 65% state that financial wellness programs are a key factor in job selection.

Qualified Plan Advisors Financial Wellness Survey, 2024

Data-driven

To understand how people of color and women are disproportionately impacted by financial insecurity, we disaggregate research data by race and gender. Further, wherever relevant, our insights and solutions are designed to address the specific financial barriers exacerbated by racial and gender inequities.

Institution- and system-focused

We understand that neither racism, gender discrimination nor financial insecurity can be overcome by individual actions alone; we work to ensure that the institutions and systems that shape the options people have provide the tools and access required to enable people to improve their financial lives.

Partnership-focused

We seek partnerships with organizations that serve underrepresented populations, are led by people of color and women, and/or share our goal to intentionally address racial and gender financial inequity.

Serving targeted populations

In both our research and solutions, our work is focused on those disproportionately impacted by financial insecurity—including those living on less than the median income, Black and Latin households, women-led households, and households with children. Recent examples of this are our work on emergency savings solutions for automotive retail employees and addressing investing barriers for LMI Americans, with a particular emphasis on developing investor identity to help individuals participate in retail investing.

Also focused on ourselves

We believe intentionally building a team with diverse backgrounds and perspectives is essential for our success, and we are committed to continuing to nurture a diverse, committed, skilled, and collaborative staff in its employment practices.