The use of software to automate business and financial processes is one the most significant transformations of the information age. While much of the development in this area has focused on making organizations more efficient by streamlining internal processes, the consumer-facing side of financial automation has also had a major impact on the financial lives of millions of households. The ability to set up automatic savings deposits and bill payments has saved time and facilitated the growth of emergency savings for households living on low and moderate incomes (LMI). Now a new generation of apps, such as Otomo, are incorporating more advanced artificial intelligence (AI) processes into consumer-facing financial automation, which allows them to provide adaptive guidance that responds in real time to customers’ cash flows, values, and activities.

Commonwealth recently partnered with Otomo and Michigan State University Federal Credit Union (MSUFCU) to gain insight into how households living on LMI perceive AI-driven financial automation apps, and how these apps might best serve these households. This research is a part of Commonwealth’s Emerging Tech for All (ETA) initiative, with support from JPMorgan Chase & Co., which aims to ensure that the needs, wants, and aspirations of people living on lower incomes are understood and integrated into the design of emerging financial technologies. We gain insight into these perspectives by partnering with financial organizations, fintechs, and platform providers who implement emerging technologies to research the needs and wants of customers living on LMI.

For our first ETA report, we surveyed 1,200 individuals living on LMI in the United States and revealed a marked increase in the use of digital banking, financial apps, and chatbots during the COVID-19 pandemic. This report was followed by a field test in partnership with Boost.ai that provided insight into how households living on LMI perceive conversational AI chatbots in banking. Key takeaways from these projects for the inclusive design of emerging technologies are brought together in our Toolkit for Designing Emerging Technologies.

For our research with Otomo and MSUFCU, we surveyed 377 MSUFCU members with household incomes under $80,000 to better understand their attitudes toward saving money with the aid of automated finance apps. The benefits of automated saving are well established in earlier research from Commonwealth and JPMorgan Chase. The ETA research presented here builds on this earlier work by examining how more advanced AI features in automated savings like adaptive budgeting and recommendations based on customer values are perceived by people living on LMI. It also provides an updated snapshot of this demographic’s attitudes toward automated savings and financial apps, which our earlier survey work shows have shifted in the direction of greater usage and comfort since the COVID-19 pandemic.

Four primary takeaways emerged from this work:

- Connecting with customers’ values, in addition to their finances, provides opportunities for deeper engagement.

- A desire for assistance with budgeting is well-matched to the capabilities of automated finance apps

- Customers are interested in using apps to save, and perceive goal setting as an important part of the process.

- Trust remains a significant barrier to engagement with financial apps.

These insights are discussed in more detail below:

Connecting with customers’ values, in addition to their finances, provides opportunities for deeper engagement

While participants had security concerns about sharing their financial data with apps, they were much more open to the idea of sharing information about their personal goals and values. Connecting with customers at a personal level and incorporating their individual preferences into automated finance software not only allows for higher quality recommendations, but can also make customers more comfortable with the idea of sharing information as they see the benefits of personalization.

Recent research suggests that the benefits of automated savings vary depending on the presence or development of a “savings mindset.” While embedding generic messaging intended to develop this mindset in automated savings apps can help with this, AI-driven messaging and suggestions that adapt in real-time to customers’ shared values and financial flows can increase engagement to make the process of building this mindset through automated savings apps even more effective.

A desire for assistance with budgeting is well-matched to the capabilities of automated finance apps

Focusing primarily on functions related to savings and wealth building, we asked respondents to select a single area in which they felt a financial app could be most valuable for them. The results indicate that assistance with budgeting is seen as the function with the greatest potential value by a significant margin, suggesting that the kind of adaptive support provided by AI-driven automated finance is well suited to the needs of households living on LMI.

In which of the following areas do you think a financial app could be most valuable for you? (single choice)

The interest in apps that assist with budgeting is significant because this is one of the activities that newer AI-driven automated finance apps are better suited to assist with than traditional savings automation. This is because, unlike traditional autosave functions, budgeting often requires ongoing adaptation and prediction based on changes in income and expenses. This additional budgeting support can complement automated savings features and increase uptake of automated savings for people living on LMI.

The opportunity for technology like this to meet the needs of households living on LMI is supported by high levels of interest in some of the key features such an app might have:

- Auto-budgeting with recommended discretionary spending amounts was rated as important by 78% of respondents.

- The ability to select and update specific savings goals was rated as important by 74% of respondents.

- The ability to have savings deposits pause automatically based on account balances was rated as important by 89% of respondents.

Customers are interested in using apps to save, and perceive goal-setting as an important part of the process

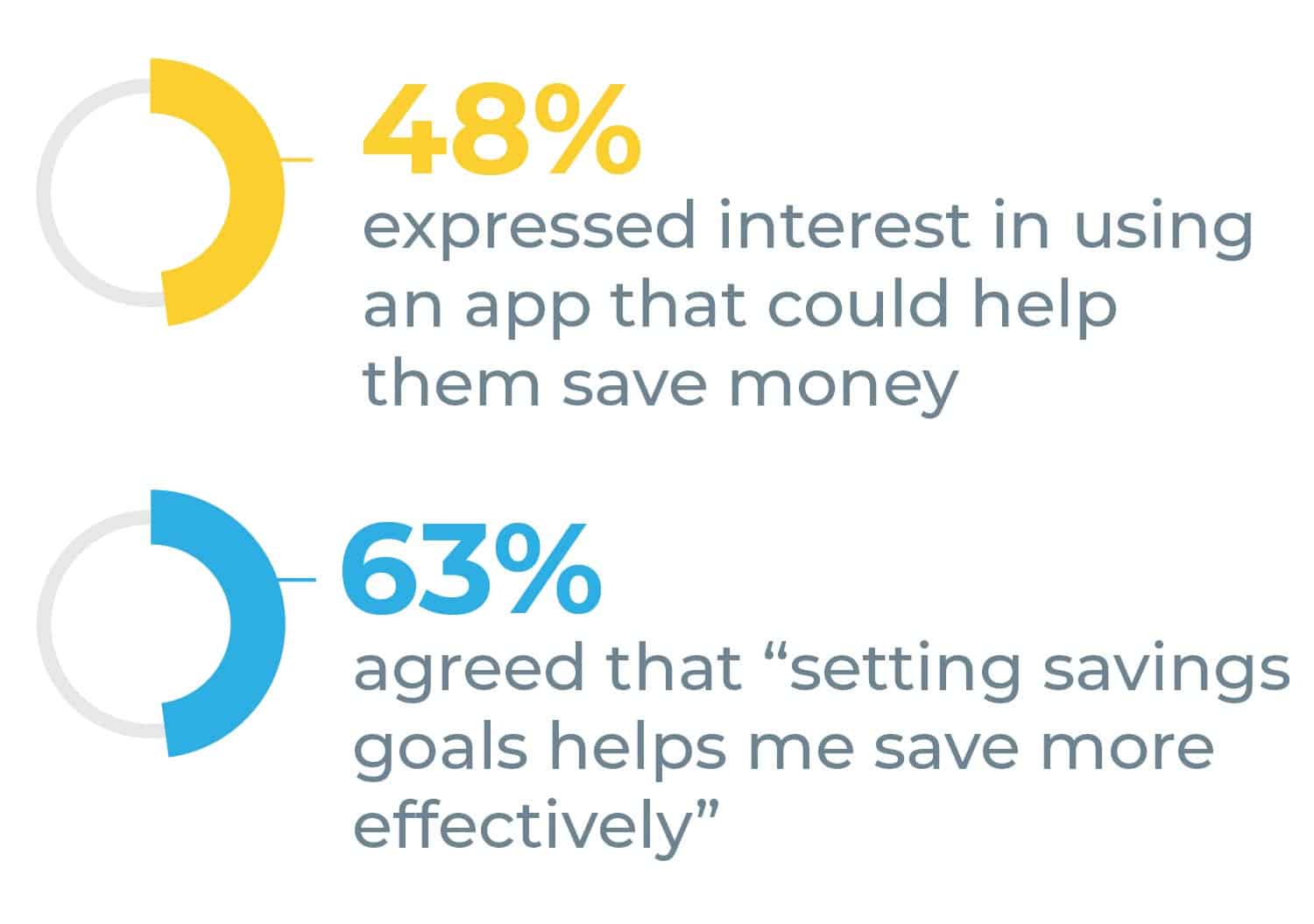

About 30% of respondents had used financial apps to help them save money before. At the same time, 48% expressed interest in using an app that could help them save money and 63% agreed that “setting savings goals helps me save more effectively.” This interest remained high when asked more specifically about an app that could “help you automate deposits into your savings goals with artificial intelligence, based on your budget and expenses for the month,” with 45% of respondents expressing interest. This data suggests that there is significant room for growth in usage of AI-driven savings apps to close the gap between those who are interested in them and those who have actually used them.

Trust remains a significant barrier to engagement with financial apps

The clearest barrier to growth that emerged from survey and interview data was trust in data privacy and security. Just one third of survey respondents said that they would be comfortable sharing information about their bank balance and transaction history with a financial app. In interviews and open response survey items, concerns about the privacy and security of data shared with financial apps was a recurring theme. Uncertainty about how AI processes work only added to these concerns.

These findings are consistent with our earlier research on conversational AI, which identified a widespread lack of trust in the privacy and security of information shared with financial chatbots. Taken as a whole, our research on emerging technology suggests that a lack of trust in data security remains a significant barrier to broader uptake of emerging technologies by customers living on LMI. One key avenue to building this trust is for primary financial service providers to offer personal financial management apps directly to customers. One recent survey suggests that 75% of customers would prefer to use personal financial management tools directly from their bank rather than from a third party.

Next Steps

Overall, these results provide preliminary support for the idea that new AI-driven automated finance can provide a significant opportunity to support the financial security of households living on LMI. At the same time, as with other emerging technologies, trust remains a significant barrier to more widespread use.

Commonwealth plans to continue to build on this research as a part of our Emerging Tech for All initiative by partnering with financial institutions and fintechs to conduct larger field tests to investigate how households living on LMI can benefit most from emerging technologies like automated finance and conversational AI. Based on this research we will continue to update our Toolkit for Designing Emerging Technologies to help product designers ensure new financial technology is inclusive. Stay tuned on our website and sign up for our newsletter to receive updates on this research. If you are interested in partnering with Commonwealth to advance this impactful work together, reach out to Charles de la Cruz at info@buildcommonwealth.org.

This research and associated work was completed with the support of JPMorgan Chase & Co. The views and opinions expressed in this blog are those of the authors and do not necessarily reflect the views and opinions of these supporters or their affiliates